Xiaomi launches Redmi Note 14 Pro, Redmi Note 14 Pro+

Xiaomi has launched Redmi Note 14 Pro and Redmi Note 14 Pro+ in India on Monday.

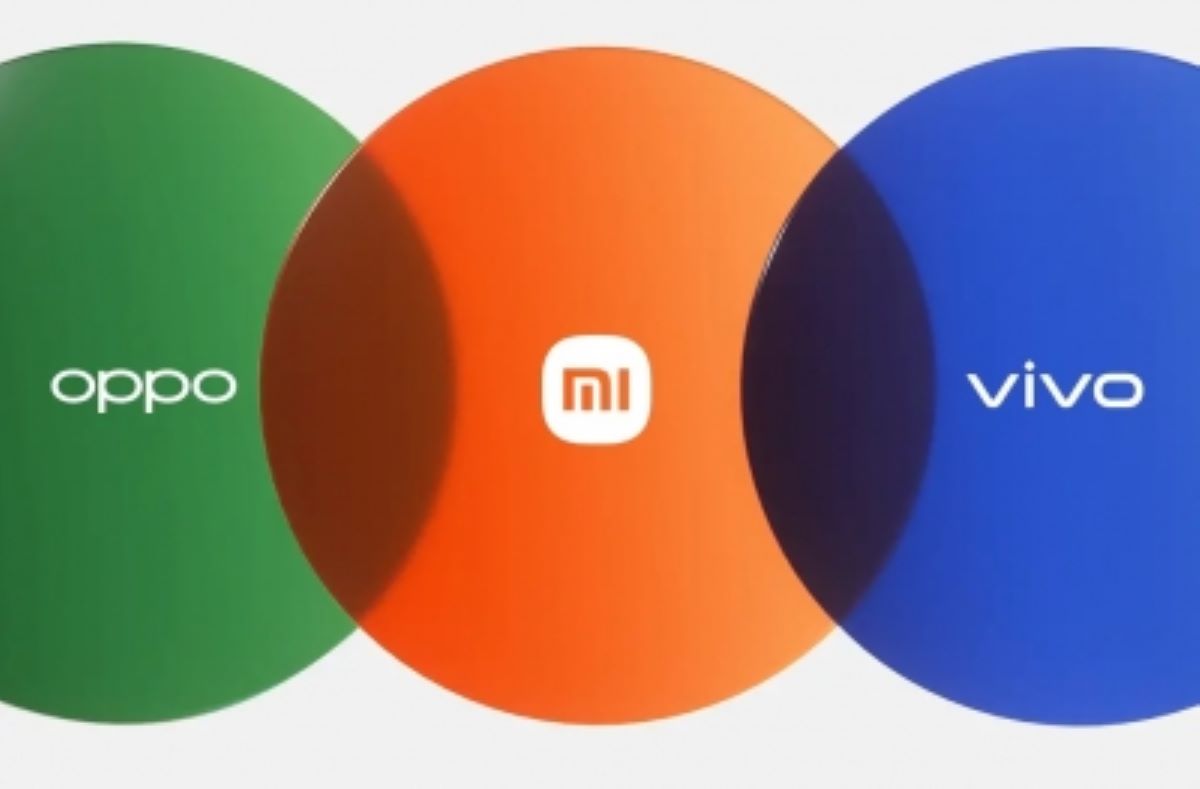

Three Chinese technology brands, OPPO, Vivo and Xiaomi, have joined hands to allow users to transfer data between their devices to take on the growing Apple’s market share in the country, the media reported on Friday.

[Photo:IANS]

Three Chinese technology brands, OPPO, Vivo and Xiaomi, have joined hands to allow users to transfer data between their devices to take on the growing Apple’s market share in the country, the media reported on Friday.

The three smartphone makers announced the pact on their Weibo accounts, saying their users be able to move system and app data “seamlessly to a new handset belonging to any of these brands,” reports South China Morning Post.

Advertisement

In 2019, Oppo, Vivo and Xiaomi set up a wireless transfer protocol that mirrors Apple’s AirDrop function.

Advertisement

Google Drive service is unavailable on handsets sold in the mainland Chinese market and most users in China rely on third-party data transfer apps.

However, Apple iPhone users can directly move data to a new iOS device via the iCloud service or a Bluetooth and Wi-fi connection.

“The new partnership between Xiaomi, Vivo and Oppo, which jointly control nearly half of China’s smartphone market, comes after the country last year saw its steepest fall in smartphone sales in a decade,” the report mentioned.

However, China’s smartphone market recorded a good start to the new year and at the start of 2023, the sales quickly increased week over week to reach above 7 million.

In four out of five weeks, the sales stayed above 6 million, a level seldom reached in 2022 when the pandemic haunted China’s cities from time to time.

The Chinese New Year season also started earlier than usual this year, helping the weekly sales walk out of the trough at the beginning of 2023, reports Counterpoint Research.

Apple remained China’s biggest original equipment manufacturer (OEM) in January in terms of sales share and its sales increased about 6 per cent YoY.

The smartphone market in China has contracted after 2017 in terms of YoY sales growth. Q4 2022 recorded a 15 per cent YoY decline, hitting major OEMs’ confidence and further darkening market prospects.

Advertisement