DPIIT signs MoU with YES BANK, Kyndryl Solutions to bolster startups

The Department for Promotion of Industry and Internal Trade (DPIIT) has signed a Memorandum of Understanding (MoU) with YES BANK to bolster India’s startup ecosystem.

The Department for Promotion of Industry and Internal Trade (DPIIT) has signed a Memorandum of Understanding (MoU) with YES BANK to bolster India’s startup ecosystem.

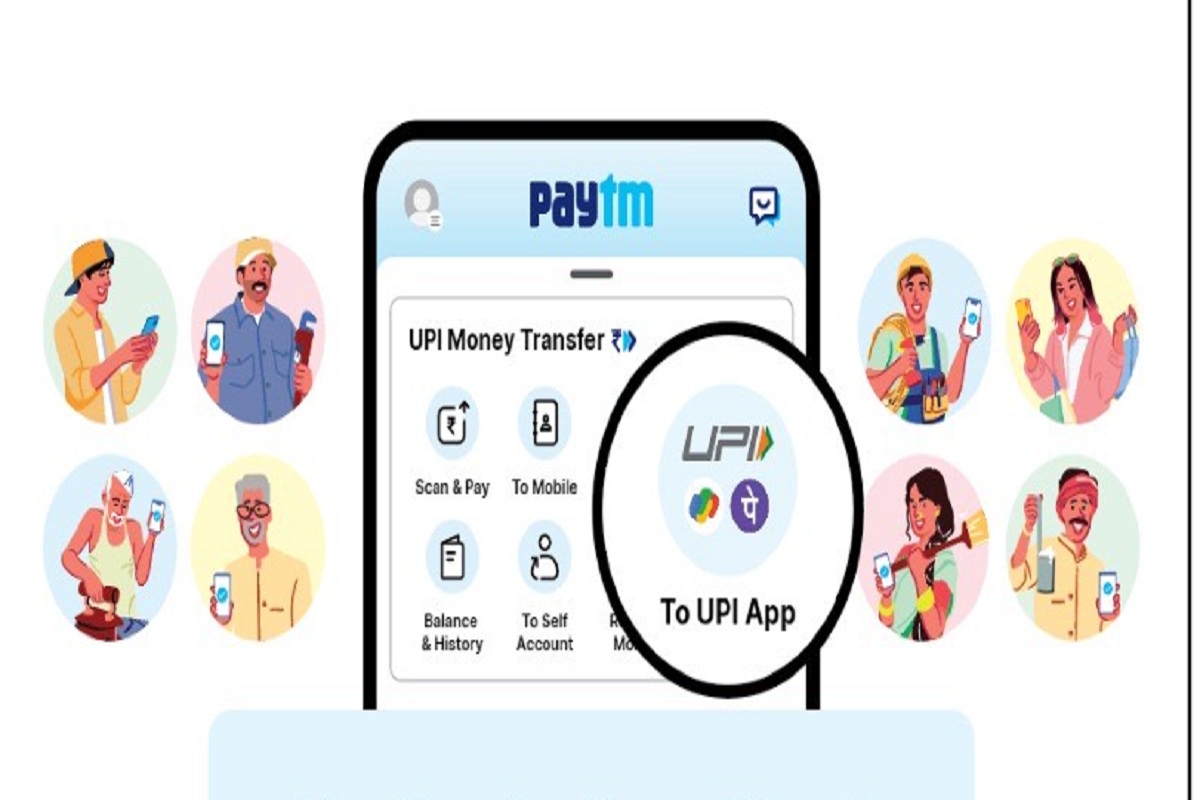

Highlighting the recent development, the Paymt said that the National Payments Corporation of India (NPCI) has granted approval to One97 Communications Limited (OCL) to participate in UPI as a Third-Party Application Provider (TPAP) under multi-bank model.

The apex court also questioned why the Enforcement Directorate (ED) is taking so long to investigate the YES Bank scam pertaining to Rs 3,642-crore.

Stating that the case has ‘rocked the entire banking system’, the Supreme Court on Friday rejected the bail plea of…

The MoU aims at enhancing the startup ecosystem in India by granting them access to a diverse range of resources through YES Bank’s curated startup-focused program - YES Head-Startup.

The bank took constructive possession of the property mortgaged to it on February 10, 2020 for recovery of Rs 548.30 crore.

The bank's total capital adequacy ratio had stood at 8.5 per cent, including the tier-I ratio at 6.5 per cent as of March 31 this year.

The decision can help the bank to raise its Tier-1 core capital ratio of 6.3 per cent to around 10 per cent, the report said.

This move means that its founding promoters Rana Kapoor and Madhu Kapur families and firms linked to them will now become non-promoter shareholders or public shareholders.

On May 30, Yes Bank had informed that it will reclassify its shareholding as the Madhu Kapur group had consented to be categorised as public stake holders.