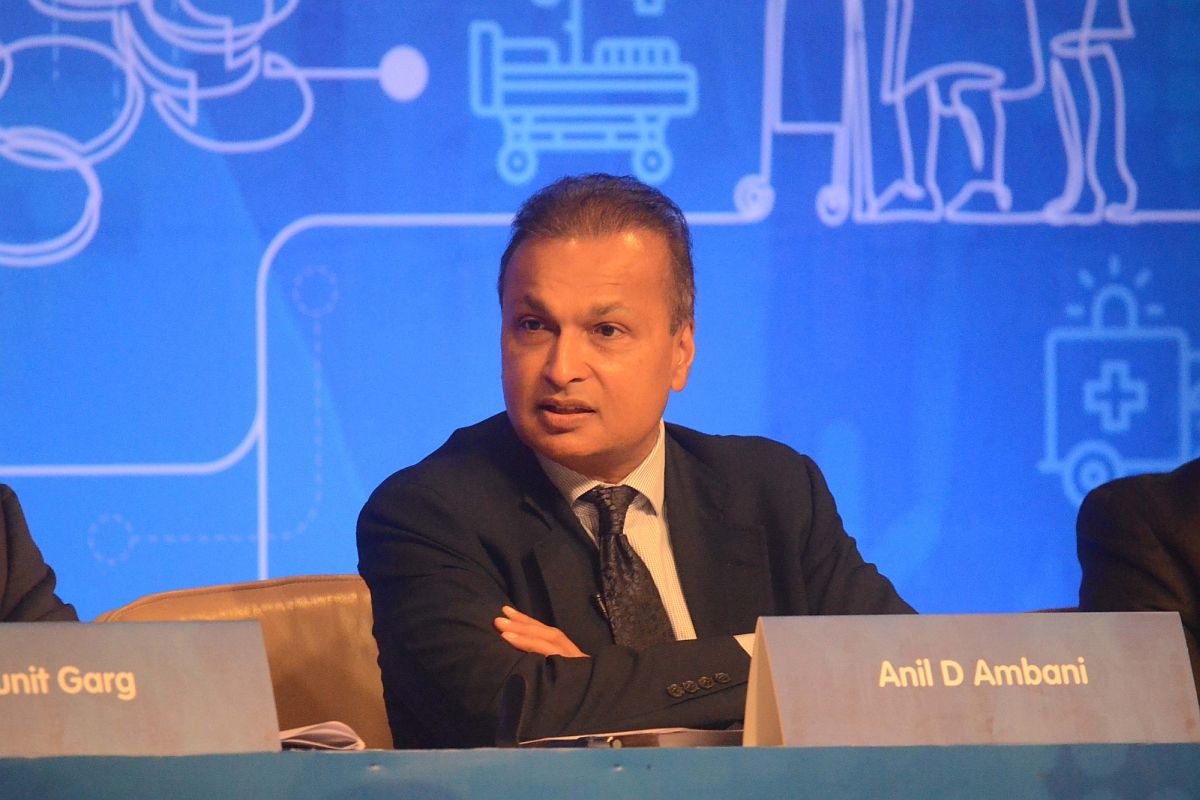

YES Bank case: ED summons Anil Ambani; other borrowers to be called for questioning soon

Ambani's group companies are stated to have taken loans of about Rs 12,800 crore from the bank that turned NPA.

Ambani's group companies are stated to have taken loans of about Rs 12,800 crore from the bank that turned NPA.

Last week, the RBI placed YES Bank under moratorium and capped the withdrawal limit at Rs 50,000 till April 3, due to deteriorating financial health of the bank.

In a tweet, the bank also said that Yes Bank customers can pay their credit card dues and loan obligations from other bank accounts.

The bank granted a Rs 600 crore loan to a company called DoIT owned by Roshni Kapoor, Rakhee Kapoor Tandon, and Radha Kapoor.

The move comes a day after RBI capped the withdrawals from the bank at Rs 50,000 with few exceptions till April 3.

Laying down the restructuring scheme for Yes Bank, Finance Minister Nirmala Sitharaman had on Friday countered criticism by the opposition, saying that the crisis originated under the watch of Congress-led UPA government.

In its draft 'YES Bank Ltd. Reconstruction Scheme, 2020' announced on Friday evening, the RBI said that SBI has expressed willingness to invest in the private lender and that it will bring in 49 per cent equity.

In a draft reconstruction plan for the crisis-ridden Yes Bank, the RBI said that SBI has expressed willingness to invest in the private lender and that it will bring in 49 per cent equity.

Withdrawals from the bank have been capped at Rs 50,000 per depositor with few exceptions till April 3.

Meanwhile, Chief Economic Advisor Krishnamurthy Subramanian on Friday assured all depositors of YES Bank that their funds will remain safe and there is no need to panic.