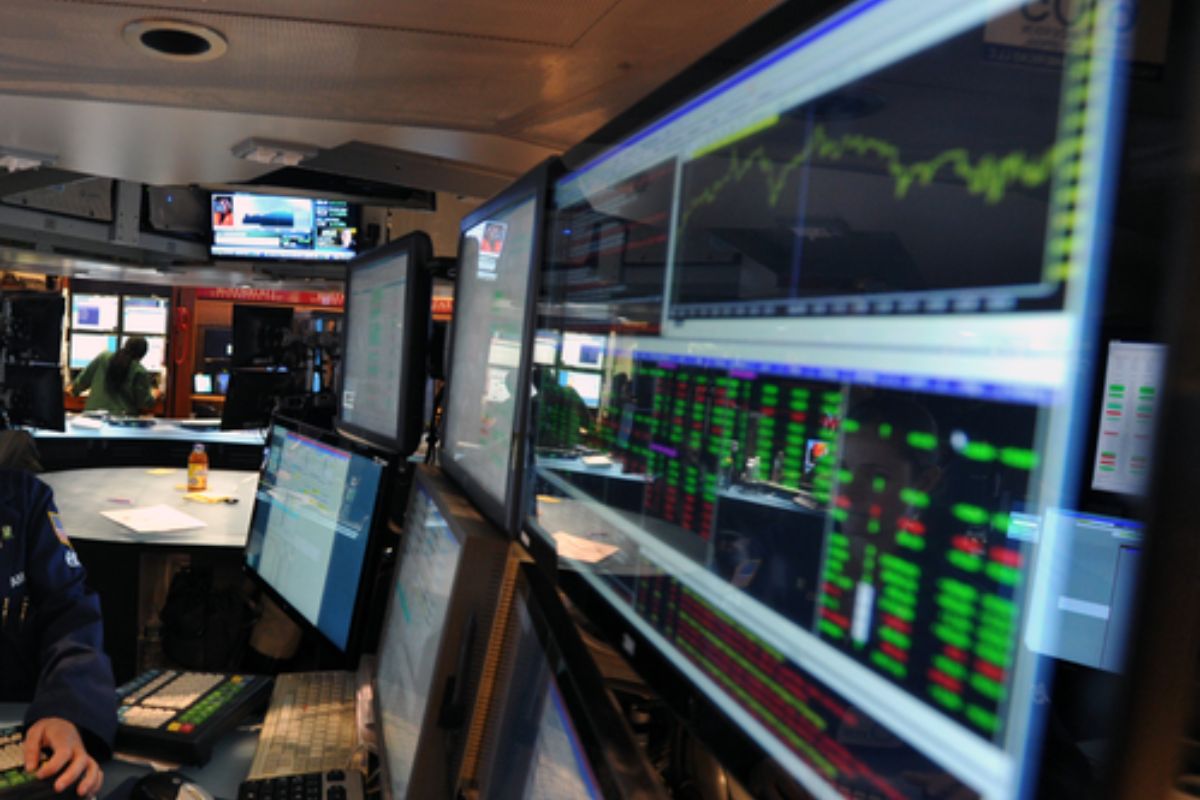

US stocks tumble on inflation data

US stocks tumbled on Tuesday after fresh data revealed that inflation eased somewhat, but stayed stubborn in January.

US stocks tumbled on Tuesday after fresh data revealed that inflation eased somewhat, but stayed stubborn in January.

A spike in yields can put pressure on stocks, since it increases the amount companies spend to cover the interest on their debt, in turn hurting their profit.

Six of the 11 primary S&P 500 sectors ended in the green, with consumer staples up 0.71 percent, outpacing the rest.

Market sentiment also turned sour amid disappointing US jobless claims numbers.

Walmart shares gave up earlier gains to close 2.12 per cent lower despite a better-than-anticipated quarterly profit.

The Walt Disney stock rose 4.44 per cent to close at USD 141.74 apiece after an analyst at Morgan Stanley raised his price target on the stock to USD 160 per share from USD 135 per share.

On the economic front, the U.S. consumer price index for all urban consumers increased 0.1 per cent in May on a seasonally adjusted basis after rising 0.3 per cent in April, the US Department of Labor reported.

There were high hopes that Vice Premier Liu He's trip to Washington on Wednesday for the 11th round of talks would produce a deal to end the trade war which has ravaged the global economy for almost a year.

US stocks rose as Wall Street became more optimistic about potential progress in trade negotiations between Washington and its key trading partners while digesting some key economic data.

The declines brought the S&P 500 to the brink of a "bear market," considered a drop of 20 per cent from its peak.