US bank First Republic’s shares crash more than 46%

Shares in the troubled First Republic Bank crashed more than 46 per cent after reports the San Francisco-based bank may need to raise more funds despite a $ 30 billion rescue last week.

Shares in the troubled First Republic Bank crashed more than 46 per cent after reports the San Francisco-based bank may need to raise more funds despite a $ 30 billion rescue last week.

In India, when a bank fails, innocent depositors lose out, because deposits in banks are insured only up to Rs 5 lakh by the Deposit Insurance and Credit Guarantee Corporation, which means that one would get a maximum of Rs.5 lakh in case of bank failure, that too after many years. Statistically, only 51 per cent of the total bank deposit base is covered by insurance. Looking at the aftermath of recent bank failures, one finds that even after three and a half years, the assets of PMC Bank are yet to be liquidated; depositors initially got only Rs 1,000 per account, and a total of Rs 1 lakh till now

"During the financial crisis, there were investors and owners of systemic large banks that were bailed out," Yellen said.

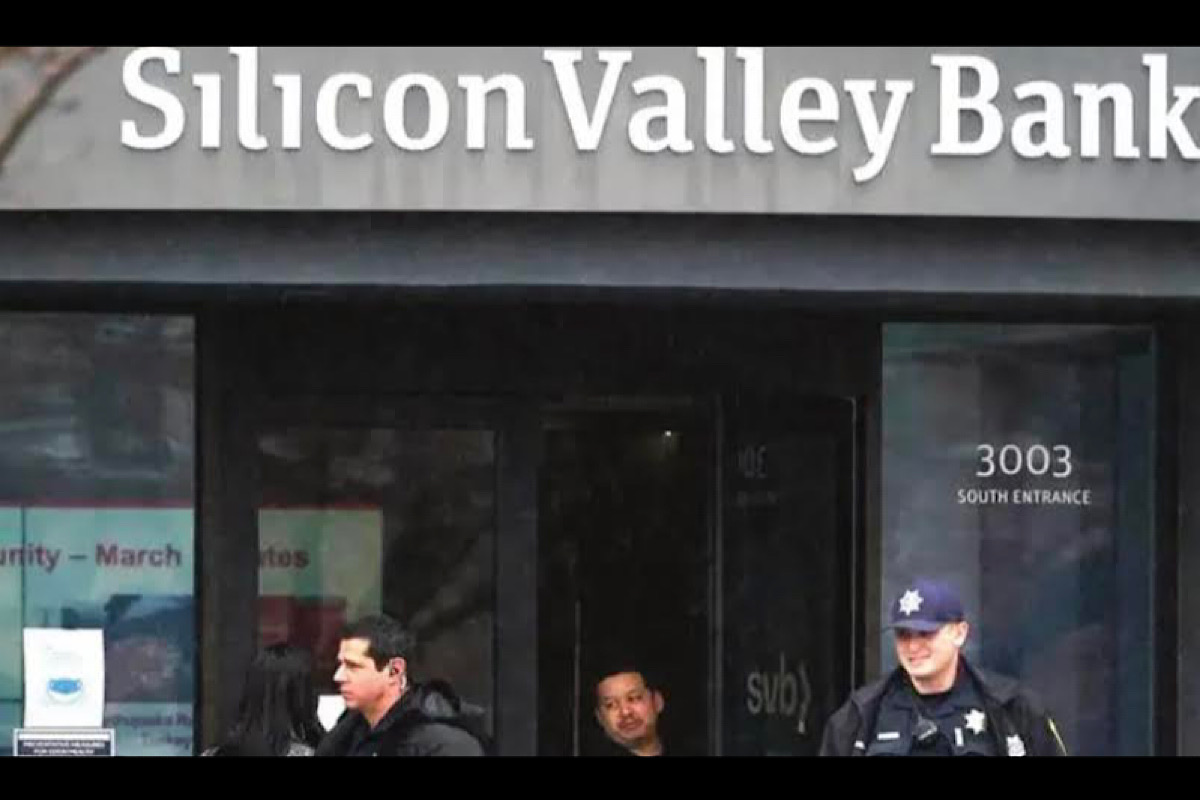

Silicon Valley Bank collapsed after a stunning 48 hours in which a bank run and a capital crisis led to the second-largest failure of a financial institution in US history.