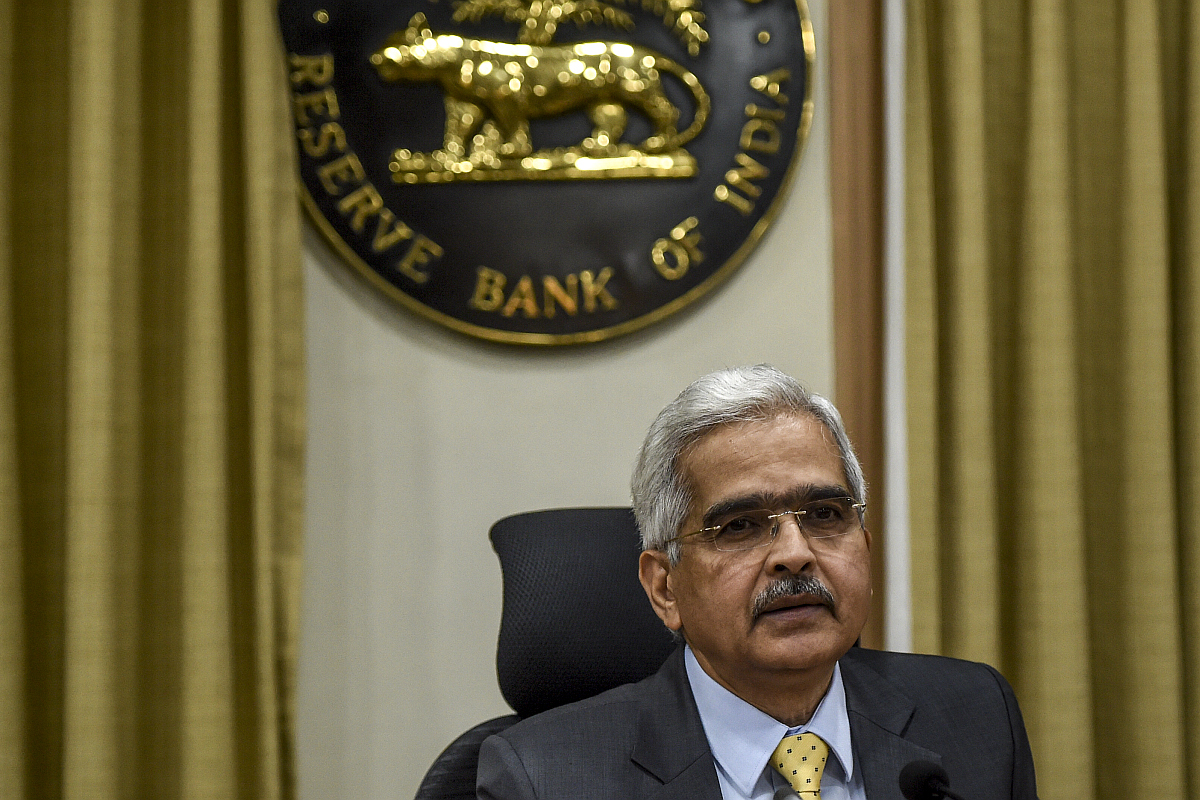

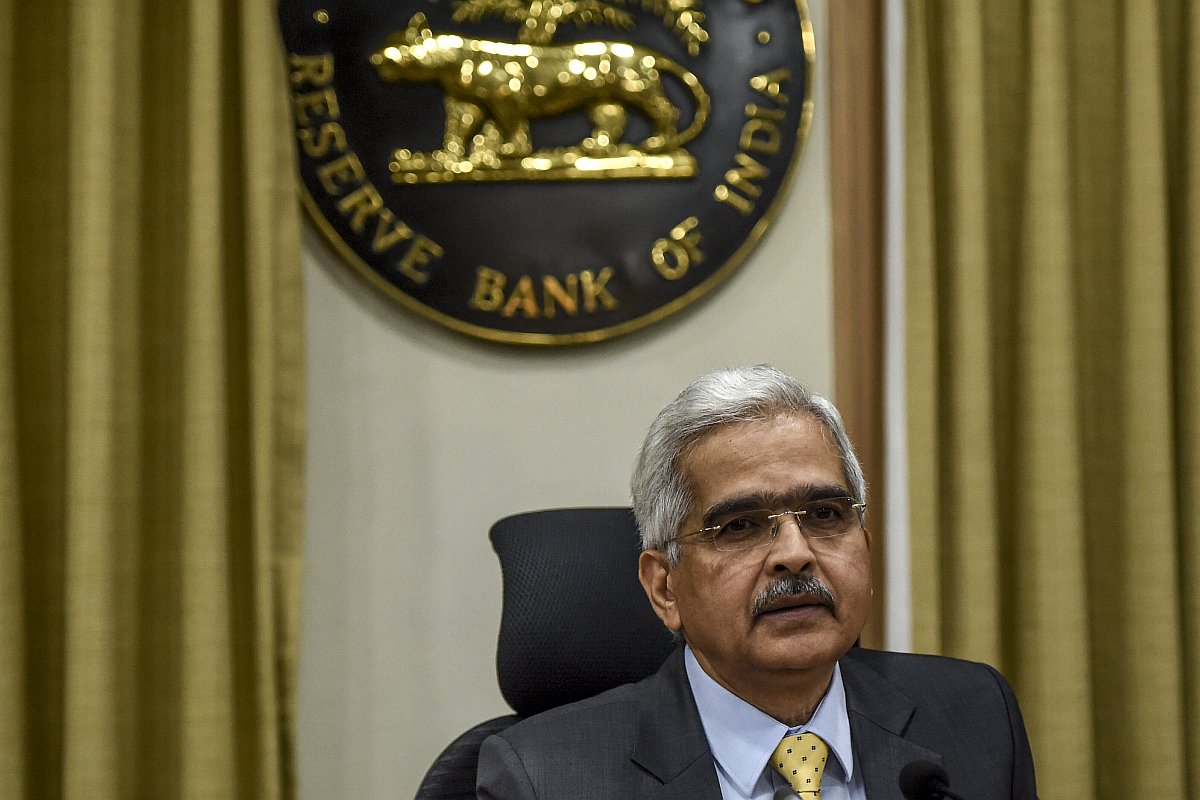

RBI likely to cut repo rate by 25 basis points: SBI report

The Reserve Bank of India (RBI) is likely to cut the repo rate by 25 basis points in its February 2025 policy meeting, which is set to begin on Wednesday, the State Bank of India (SBI) said in a research.