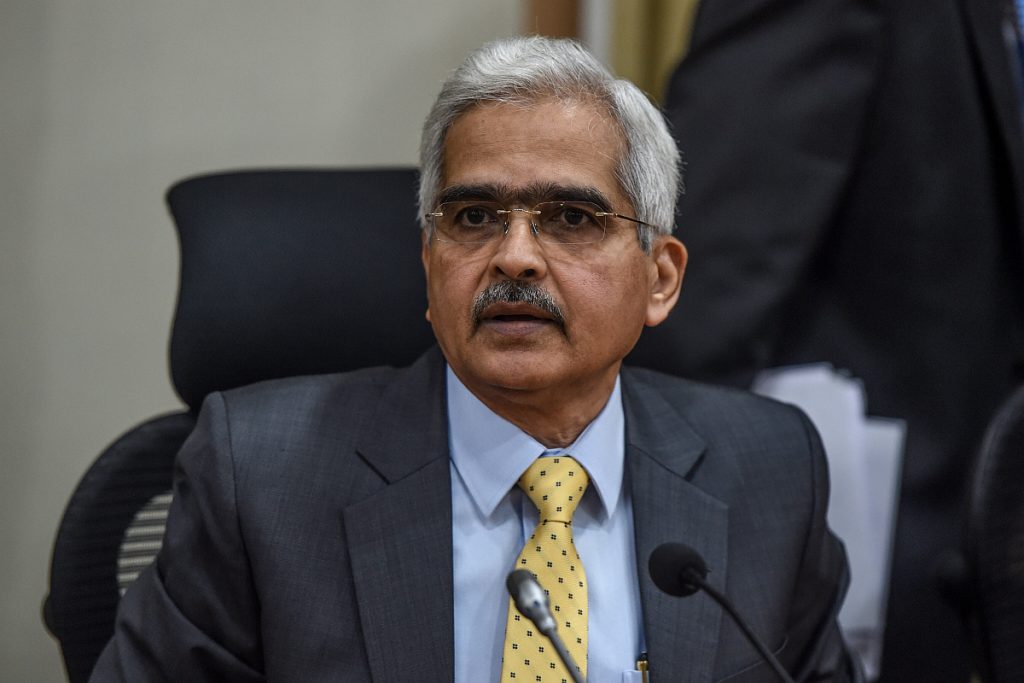

RBI notifies lending institutions to implement interest on interest waiver scheme

The finance ministry wants all payments to be credited in the accounts of borrowers well before Diwali by November 5.

The finance ministry wants all payments to be credited in the accounts of borrowers well before Diwali by November 5.

At 1.20 p.m., Sensex was trading 283.74 points higher at 40,466.41 levels while the Nifty was at 11,903.70, up by 69.10 points.

Das noted that the move is expected to give a fillip to bank lending to the real estate sector.

The central bank had previously conducted OMO in October worth Rs 10,000 crore to maintain liquidity.

"India's potential output can undergo a structural downshift as the recovery driven by stimulus and regulatory easing gets unwound in a post-pandemic scenario," RBI noted.

The higher inflation last month comes in the backdrop of rising global crude oil prices which have been ruling at over $75 a barrel.

The BSE Sensex surged over 400 points while the Nifty reclaimed the 10,800-mark in mid-session trade today on widespread buying,…

Broadly negative global cues along with caution ahead of the RBI’s monetary policy review depressed the key Indian equity indices…

The Reserve Bank of India (RBI) is expected to keep its key interest rate unchanged at its penultimate monetary policy…

The stock market will be driven this week by the RBI policy meet outcome after the upbeat GDP numbers for…