RBI notifies lending institutions to implement interest on interest waiver scheme

The finance ministry wants all payments to be credited in the accounts of borrowers well before Diwali by November 5.

The finance ministry wants all payments to be credited in the accounts of borrowers well before Diwali by November 5.

At 1.20 p.m., Sensex was trading 283.74 points higher at 40,466.41 levels while the Nifty was at 11,903.70, up by 69.10 points.

Das noted that the move is expected to give a fillip to bank lending to the real estate sector.

The central bank had previously conducted OMO in October worth Rs 10,000 crore to maintain liquidity.

"India's potential output can undergo a structural downshift as the recovery driven by stimulus and regulatory easing gets unwound in a post-pandemic scenario," RBI noted.

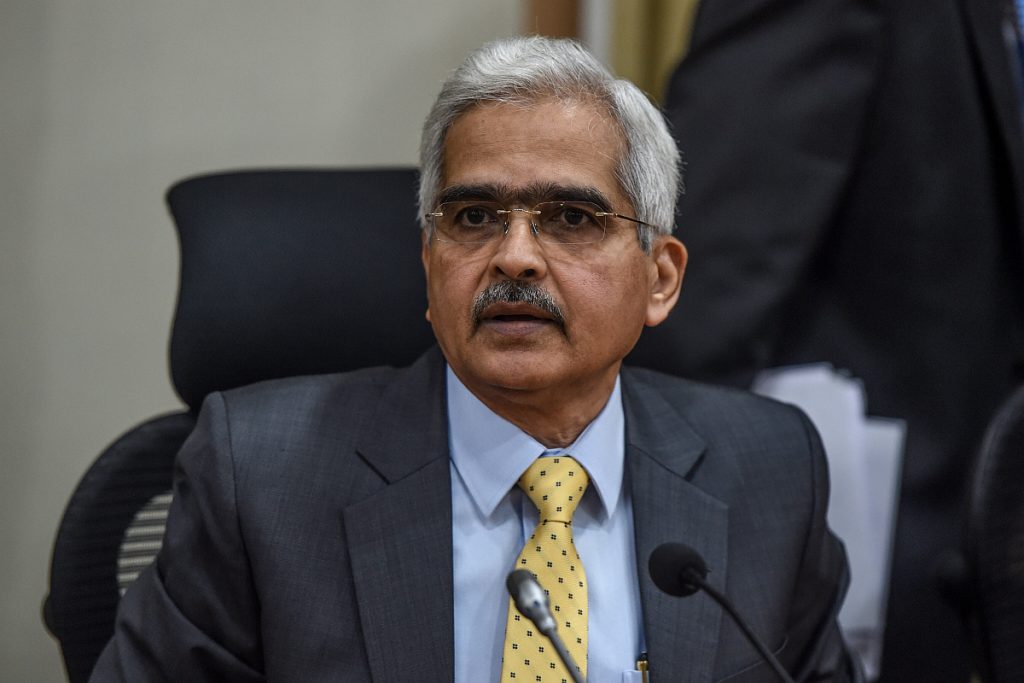

The Monetary Policy Committee (MPC), headed by RBI Governor, is scheduled to meet for three days beginning August 4 and will announce its decision on August 6.

The Central Bank has cut rates by a steep 1.15 per cent in two actions since the onset of the COVID-19 pandemic, which has adversely affected the economy.

The estimated gross market borrowing in the financial year 2020-21 will be Rs 12 lakh crore in place of Rs 7.80 lakh crore as per Budget Estimate (2020-21).

The clarification will help assuage concerns over the fate of the depositors following the cancellation of the city-based bank's license on Saturday.

All the sectoral indices on BSE and NSE traded in the red led by metal, auto and healthcare stocks. Interest sensitive banking stocks traded 0.6 per cent lower on BSE