Trinamool Congress calls for rollback of Mudra scheme due to rising bad loans

The Mudra scheme was launched in 2015 for providing small loans to income generating small enterprises in manufacturing and services.

The Mudra scheme was launched in 2015 for providing small loans to income generating small enterprises in manufacturing and services.

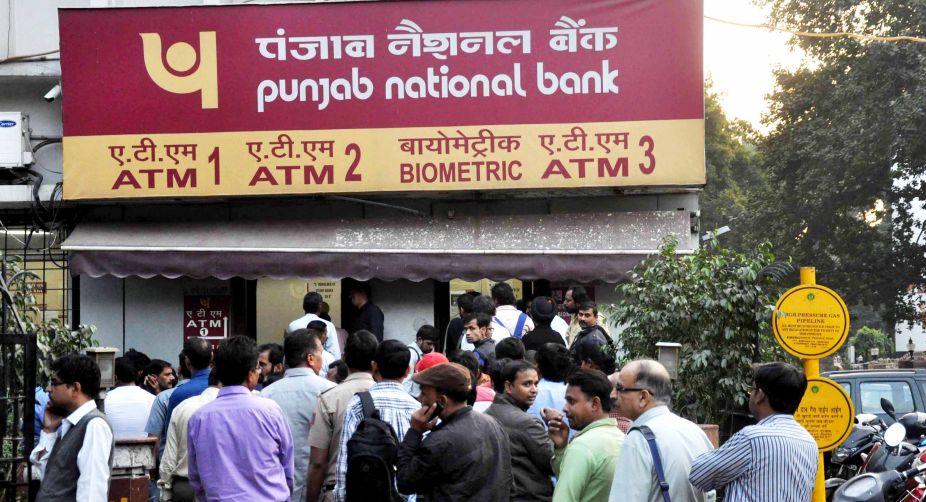

The suggestion comes at a time when the country's banking system is grappling with mounting sour loans.

The question asked by Ritabrata Banerjee was whether Rs 2.4 lakh crore amount of Public Sector banks (PSBs) loans of crony corporate have been written off by the present Union Government till September 2017.

Banks will need to take a “haircut” of up to 60 per cent on their bad loans to resolve the…

Punjab government promise for farm loan waiver is apparently costing banks in the state dear as their non-performing assets (NPAs)…

Non-performing assets (NPAs) in public sector banks have shot up considerably, with 91 per cent respondents from public sector banks…

Banks may require an incremental provisioning of 20 per cent against cumulative debt totalling over Rs 4.3 lakh crore of…

It is so unfortunate that farming that is life-giving has now become life-taking. ~ Dr MS Swaminathan, the architect of…

Despite increasing number of students not paying back their loans spiking NPAs to over 10 per cent, lending continues for…

The finance ministry on Tuesday said the Reserve Bank is not examining any proposal to extend the 90-day period for…