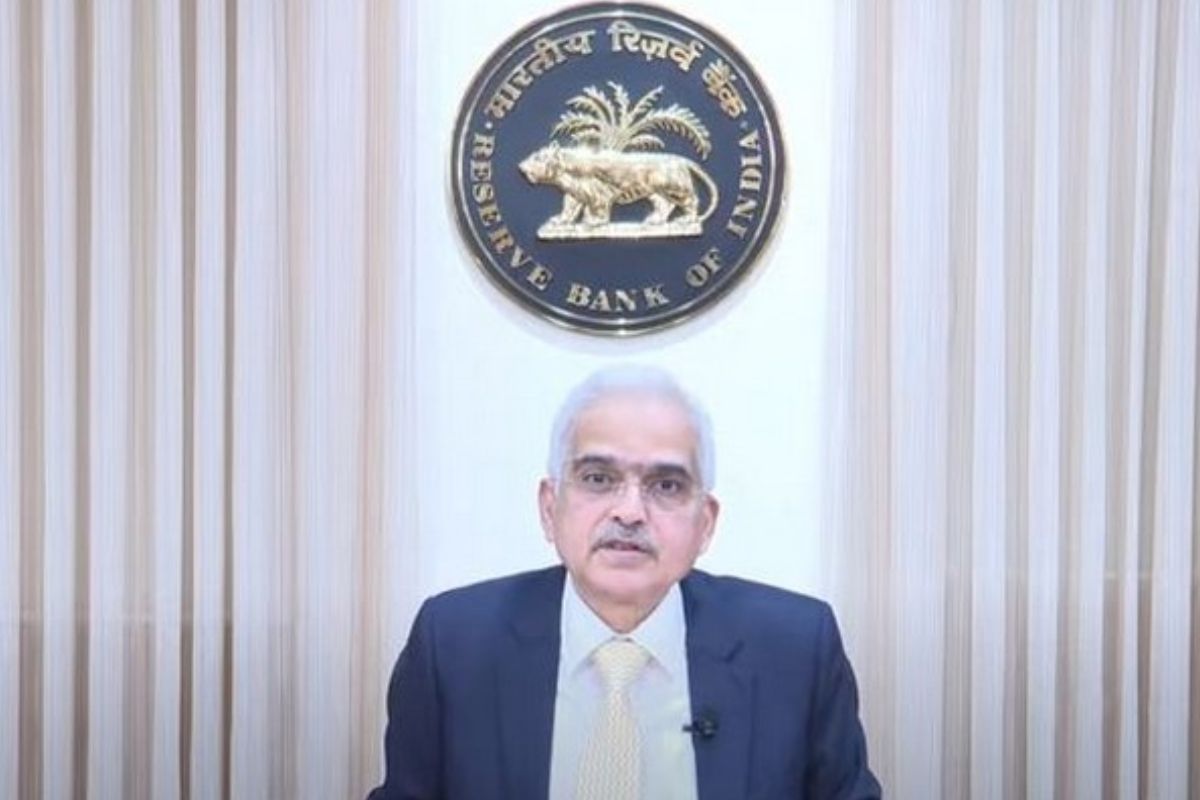

Reserve Bank keeps policy repo rate unchanged at 6.5 per cent

RBI Governor Shaktikanta Das attributed comfortable inflation and firm growth dynamics as the reasons behind keeping the repo rate unchanged.

RBI Governor Shaktikanta Das attributed comfortable inflation and firm growth dynamics as the reasons behind keeping the repo rate unchanged.

In its last three meetings in April, June, and August, the RBI kept the repo rate unchanged at 6.5 per cent.

Faced with elevated retail inflation in August, the Reserve Bank of India is expected to raise interest rates in the range of 35-50 basis points in its next monetary policy committee meeting, said SBI Research.

The Monetary Policy Committee (MPC) of India's central bank voted to maintain the repo rate, or short-term lending rate, for commercial banks at 4 per cent.

Consequently, the reverse repo rate, at which the RBI borrows from lenders, stood at 3.35 per cent.

In a bid to keep inflation under a specified level, the government in 2016 had decided to set up Monetary Policy Committee headed by RBI Governor.

Meanwhile, the apex bank has projected the GDP growth for FY21, starting April 1, at 6 per cent while retaining the estimate for the current financial year at 5 per cent.

The RBI's fifth policy statement of the current financial year comes at a time when the GDP growth rate has slipped to a six-year low for the September quarter.

The RBI's monetary policy committee (MPC) in its fourth policy review of the current fiscal also revised the GDP outlook for FY2019-20 to 6.1 per cent from the previous 6.9 per cent.

This is the fourth reduction in repo rate during 2019.