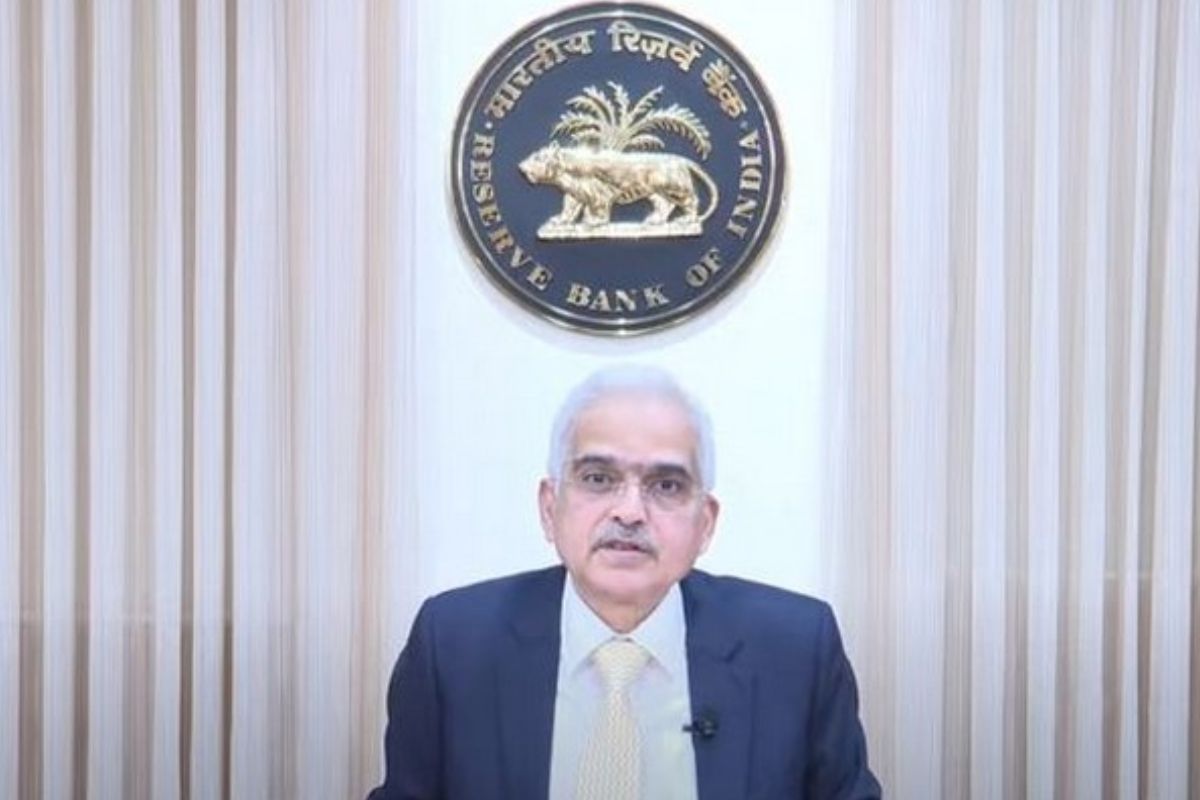

Reserve Bank keeps policy repo rate unchanged at 6.5 per cent

RBI Governor Shaktikanta Das attributed comfortable inflation and firm growth dynamics as the reasons behind keeping the repo rate unchanged.

RBI Governor Shaktikanta Das attributed comfortable inflation and firm growth dynamics as the reasons behind keeping the repo rate unchanged.

In its last three meetings in April, June, and August, the RBI kept the repo rate unchanged at 6.5 per cent.

Faced with elevated retail inflation in August, the Reserve Bank of India is expected to raise interest rates in the range of 35-50 basis points in its next monetary policy committee meeting, said SBI Research.

The Monetary Policy Committee (MPC) of India's central bank voted to maintain the repo rate, or short-term lending rate, for commercial banks at 4 per cent.

Consequently, the reverse repo rate, at which the RBI borrows from lenders, stood at 3.35 per cent.

Three members of the panel are from the RBI, including the Central bank's Governor and the rest three are external or independent members.

1. Governor Das said that the Reserve Bank of India (RBI) expects country’s real GDP growth rate for the first half of FY21 to remain in the negative territory. 2. The MPC expects elevated inflation levels during the second quarter but may ease in the second half of the current fiscal year.

RBI has left the benchmark repurchase (repo) rate unchanged at 4 per cent.

The Monetary Policy Committee (MPC), headed by the Governor Shaktikanta Das, also decided to keep the reverse repo rate at 3.35 per cent.

Union Bank of India managing director and CEO Rajkiran Rai said, There is a possibility of 25 basis points cut or they may hold on (the rate).