Haryana achieves significant growth in GST collection

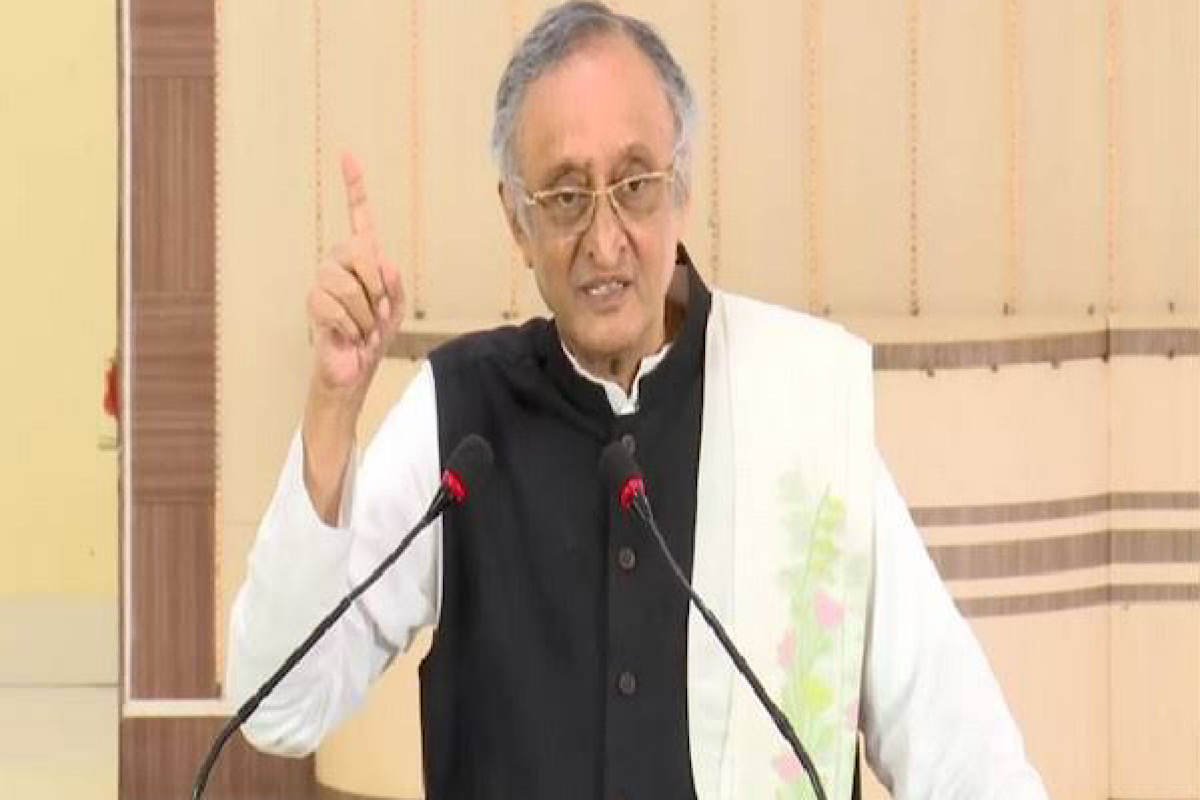

Under the able leadership of Haryana Chief Minister Nayab Singh Saini, who is also the Excise and Taxation Minister of the state, the Excise and Taxation Department has achieved significant growth in the collection of Goods and Services Tax (GST).