Finance Bill proposes to withdraw 6% Equalisation Levy on online ad services

Notably, the Equalisation Levy was imposed on online advertisement services on June 1, 2016.

Notably, the Equalisation Levy was imposed on online advertisement services on June 1, 2016.

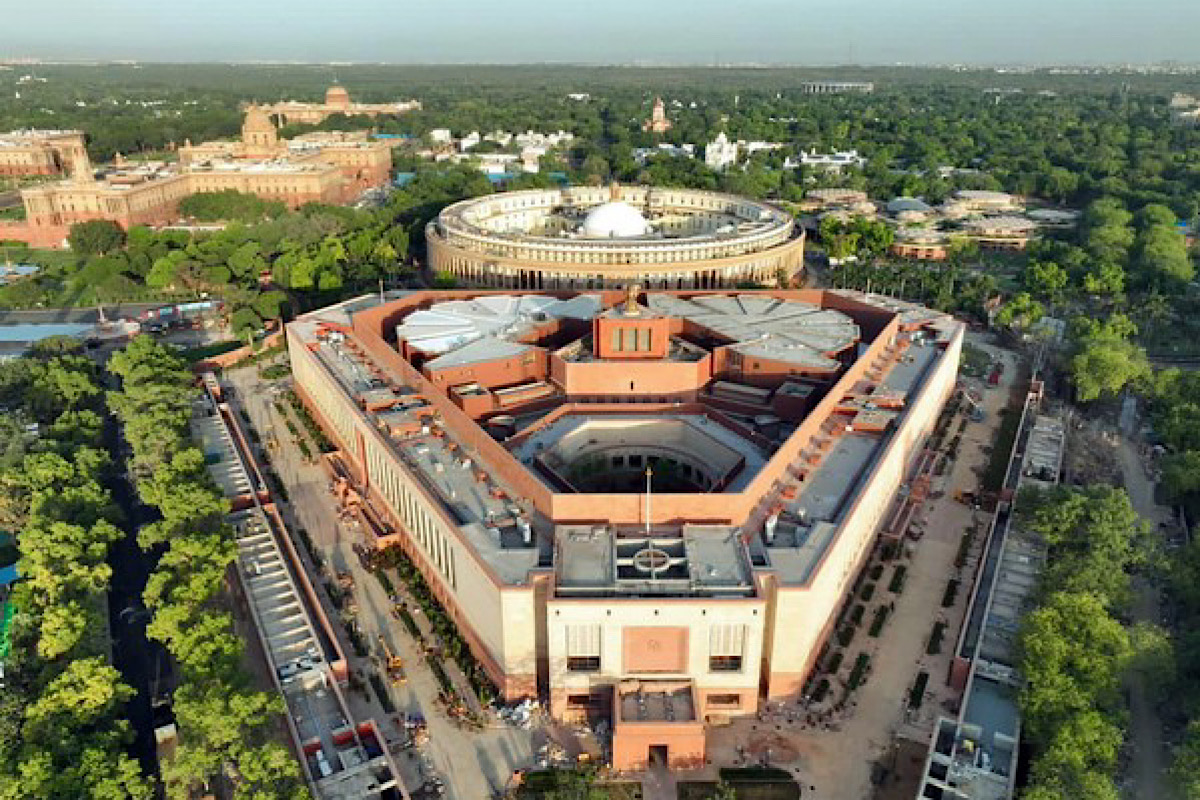

In the Lok Sabha, FM Sitharaman will move the Bill to give effect to the financial proposals of the Central government for the financial year 2025-2026.

The House discussed the Finance (No 2) Bill, 2024, moved by Finance Minister Nirmala Sitharaman, along with the Union Budget, 2024-25.

Taxation proposals approved, and a committee on pension system for government employees proposed.

With the Finance Bill 2023 having been passed in Lok Sabha through voice vote, it has suggested a slew of amendments namely hike in the withholding tax from 10 per cent to 20 per cent on royalty and fees for technical services payments to non-residents and waiver of surcharge on capital gains earned by GIFT Category III.

The Finance Minister defended faceless assessment by the income tax department saying it disallowed scope for personal discretion.

The amendments will confer the power to Pooled Investment Vehicles (defined to include AIFs, REITs, InvITs etc) to borrow and issue debt securities.

Soon after the House assembled at 2 pm -- a first ever move -- it took the Bill moved by Finance Minister Nirmala Sitharaman for consideration and passing.

In the case of an Indian citizen who becomes deemed resident of India under this proposed provision, income earned outside India by him shall not be taxed in India unless it is derived from an Indian business or profession, it said.

The buyback route would help companies avoid dividend distribution tax (DDT) until recently when an additional tax of 20 per cent in case of buyback of shares by listed companies was proposed in the Finance Bill.