India not a destination for money laundering, ‘victim of terror’ from Al-Qaeda, ISIL: FATF

FATF has released India’s mutual evaluation report on combating terror financing and anti-money laundering regime.

FATF has released India’s mutual evaluation report on combating terror financing and anti-money laundering regime.

The recent recommendations by the Financial Action Task Force (FATF) for India to strengthen scrutiny on the bank accounts of politically exposed persons (PEPs) signify a crucial step in combating corruption and enhancing transparency within the financial system.

The Mutual Evaluation Report of India was adopted in the FATF plenary held in Singapore between June 26th and June 28th, 2024.

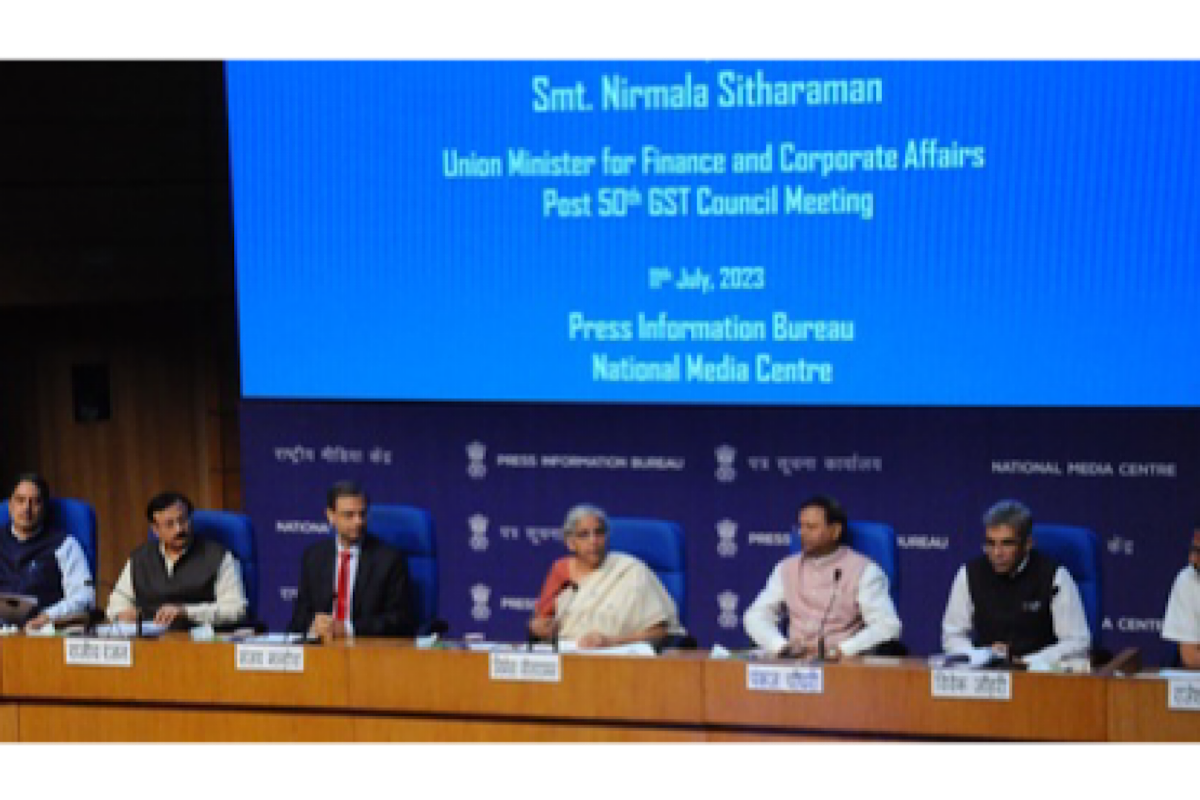

The GST Council in its 50th meeting on Tuesday, presided over by Union Finance Minister Nirmala Sitharaman, exempted cancer treatment drugs, special medicines, and food for medical purpose from levy of the Goods and Services Tax

The statement was released during the one-on-one meeting between Prime Minister Modi and US President Joe Biden at the Oval Office in the White House, on Thursday.

Pakistan is the only country in the world that hosts thousands of terrorists, run terrorist training camps for global jihadis

Pakistan was retained on the grey list as the Paris-based UN watchdog judged it deficient in prosecuting the top leadership of UN Security Council-designated terror groups.

These will include goods at godowns, maalkhanas or any other place and will be confiscated.

The report findings come at a time when Pakistan's progress on actions taken to comply with FATF's global standards to curb money laundering and terror financing, are going to be reviewed at the plenary meeting of the FATF in Paris.

This is a requirement of FATF (Financial Action Task Force) Dealers in Precious Metals and Precious Stones (DPMS) to carry out KYC and Customer Due Diligence only when they conduct such big cash transactions.