DMI Group acquires troubled fintech startup ZestMoney

DMI Finance, the NBFC arm of DMI, will be a preferred lender on the Zest platform. Through this acquisition, DMI will have the exclusive right to the use of all Zest brands.

DMI Finance, the NBFC arm of DMI, will be a preferred lender on the Zest platform. Through this acquisition, DMI will have the exclusive right to the use of all Zest brands.

The increase in affordability and security of owning a physical asset is also among the other contributing factors.

Earlier, the Reserve Bank of India (RBI) announced the status quo on the repo rate maintaining it at February level of 6.5 per cent.

Hero Electric has partnered with two-wheeler life cycle management company Wheels EMI for offering easy financing options to customers buying electric

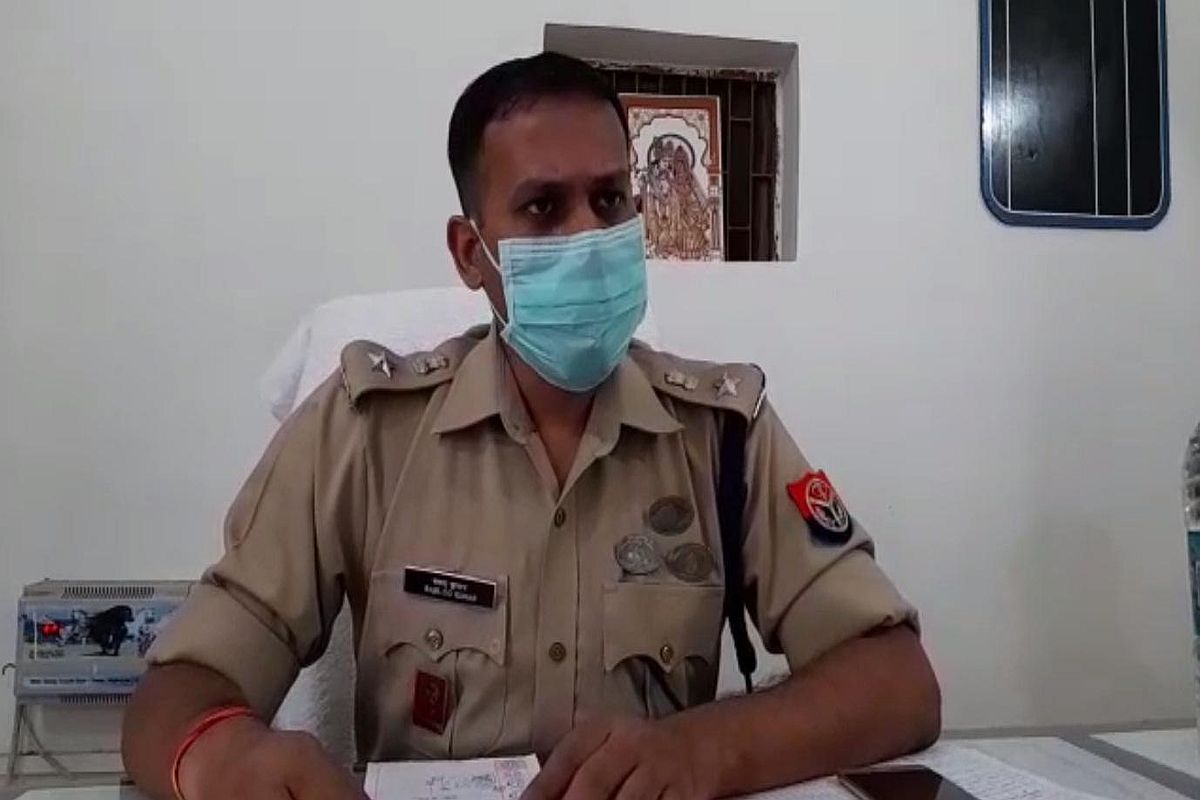

The bus, which was travelling from Haryana's Gurugram to Madhya Pradesh's Panna, was overtaken and seized by members of a finance company, that apparently financed the bus.

One-year MCLR, to which majority of the consumer loans are tied, now stands at 7.40 per cent against 7.60 per cent earlier.

Such scamsters have now come up with a new method to dupe gullible citizens by sending them OTPs.

The RBI made it clear that this will not affect the credit history of people and neither will it let to asset classification.

The industry is crippled with poor income and the operators are facing difficulties in running their businesses. Paying the full EMI amount is becoming difficult for us. On failure of EMI payment, the financiers are taking back the vehicles from the operators: Sajal Ghosh.

SBI will have a one-year reset clause on floating rate home loans that are typically linked to its one-year MCLR. If you are an existing home loan customer of SBI, the latest cut of 10 basis points in MCLR may not lower your home loans interest rate or EMIs immediately.