Odisha black money haul shoots up to Rs 270 crore

The bankers are having a tough time to keep count of the black money haul after the seizure of "unaccounted" cash in the wake of the Income Tax Department raid on an Odisha-based distillery group.

The bankers are having a tough time to keep count of the black money haul after the seizure of "unaccounted" cash in the wake of the Income Tax Department raid on an Odisha-based distillery group.

Many methods have been tried for elimination of black money; we had several rounds of demonetisation, several voluntary disclosure schemes, some schemes to regularise undisclosed foreign assets, and so on. The only commonality between all such measures was their failure to prevent generation of black money. Strategically declaring their black money, tax evaders took full advantage of the frequently announced Government schemes. However, not many of the tax evaders discontinued their tax evading ways, so, after a few years, things came back to square one

the former Union Minister said: "Banks have clarified that no identity, no forms and no proof will be required to exchange the Rs 2,000 notes

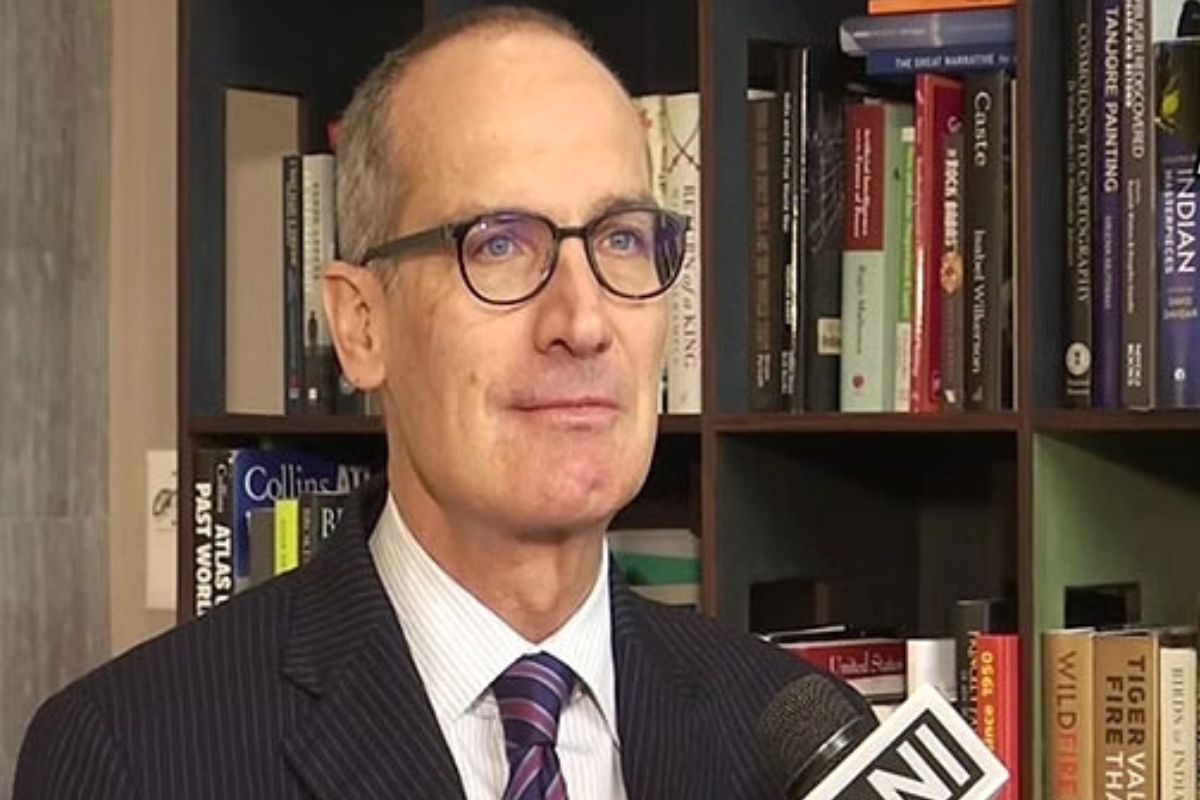

"The black money issue has been dealt with by a bilateral treaty between Switzerland and India in 2018 on the automatic exchange of banking information between Switzerland and India (in both directions)," said Heckner.

The plea said that India has been ranked at the 80th position among 180 countries and territories in the Corruption Perception Index (CPI)

The sleuths gathered evidence of prima-facie unaccounted and 'benami' transactions, incriminating documents, etc from the two realty groups of around Rs 184 crore.

The move led to nearly 86 per cent of the currency in circulation becoming null and void from the midnight of the announcement.

Fiscal and tax policies alone will not be enough to bring about achche din. The bottom line is: Government efforts alone cannot bring achche din, but acting in tandem, progressive policies of the Government, the enterprising nature of our business class and the efforts of our people can definitely bring achche din for us.

The ED has registered a case of money laundering against Biswas and others on the basis of FIR registered by NIA under Unlawful Activities (Prevention) Act, 1967 in the fake notes case.

The automatic exchange of information with India is being implemented based on the Multilateral Competent Authority Agreement on the Automatic Exchange of Financial Account Information (MCAA).