Deepak Punia to join Bajrang in U.S. training camp

Deepak Punia won a bronze medal in the 86kg freestyle weight category at the U23 Asian wrestling championships 2022 in Bishkek, Kyrgyzstan.

Overall, the government has issued a total of Rs 2826.92 crore as the sports budget for the next fiscal year which is a mere increase of Rs 50 crore.

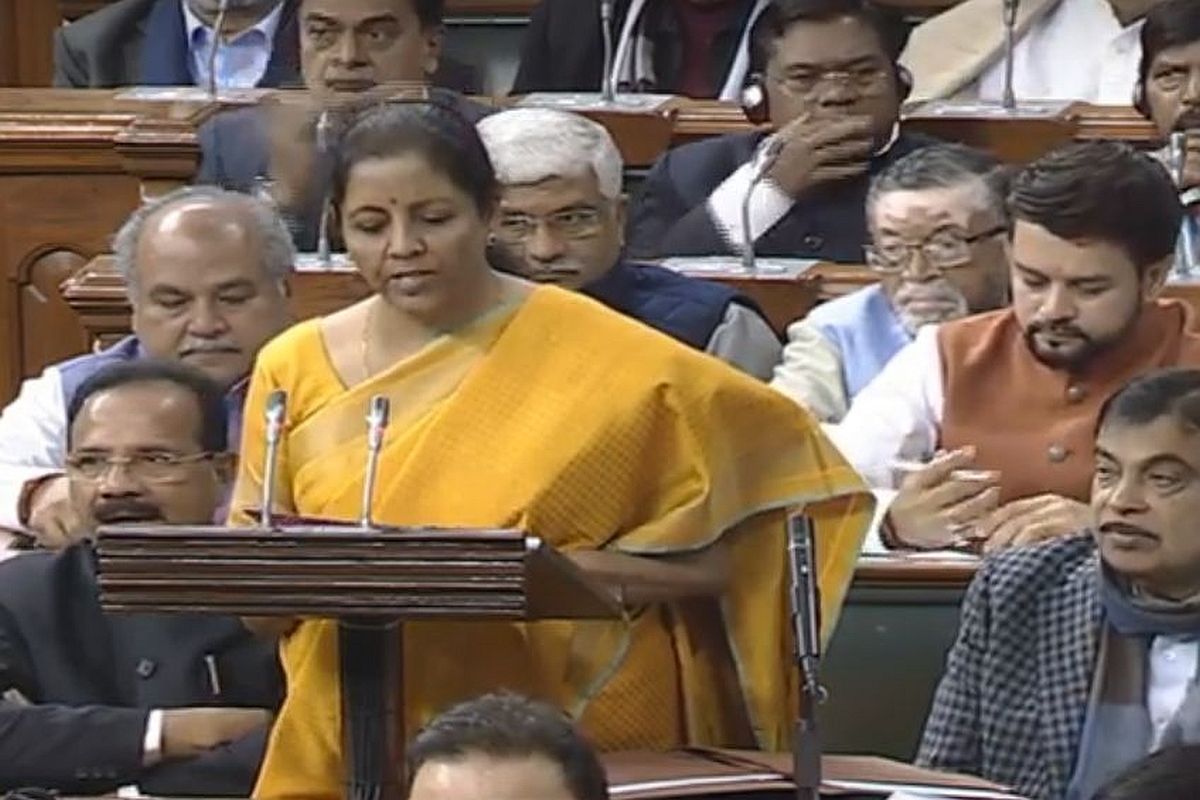

Union Finance and Corporate Affairs Minister Nirmala Sitharaman presents the Union Budget 2020-21 in the Parliament, in New Delhi on Feb 1, 2020. (Photo: IANS)

Finance Minister Nirmala Sitharaman reduced the allocation of incentives for sportspersons by more than Rs 40 crore while presenting the Union Budget for the fiscal year 2020-21 on Saturday.

The amount has been slashed from Rs 111 crore to Rs 70 crore for the year which will see the numerous Indian athletes participating in the Olympic Games, to be held in Tokyo between July 24 and August 9.

Advertisement

The government has also cut the allocation to the Sports Authority of India (SAI) from the revised amount of Rs 615 crore to Rs 500 crore. The SAI is the apex national sports body of India responsible for the development of sports in the country.

Advertisement

Few of its responsibilities include managing the national camps, providing infrastructure and other logistics to the country’s top-ranked athletes on a regular basis.

However, the latest budget has given a substantial hike of Rs 291.42 crore to the Indian government’s flagship Khelo India Youth Games. The programme was started to develop the culture of sports at the grassroot levels of school and college.

Overall, the government has issued a total of Rs 2826.92 crore as the sports budget for the next fiscal year which is a mere increase of Rs 50 crore from the revised estimate of 2019-20.

Meanwhile, the government announced a new simplified tax regime, under which an individual earning between Rs 5 to Rs 7.5 lakh will have to pay tax at 10 per cent against the earlier 20 per cent.

Similarly, for those earning between Rs 7.5 lakh to 10 lakh, the tax rate has been reduced to 15 per cent against the earlier 20 per cent. Income between Rs 10 lakh to Rs 12.5 lakh will invite a tax of 20 per cent, against the current 30 per cent.

Earnings between Rs 12.5 and Rs 15 lakh will be taxed at 25 per cent from the previous 30 per cent. Those with income above Rs 15 lakh will be taxed at the previous 30 per cent.

Those with earning below Rs 5 lakhs do not need to pay any tax.

(With PTI inputs)

Advertisement