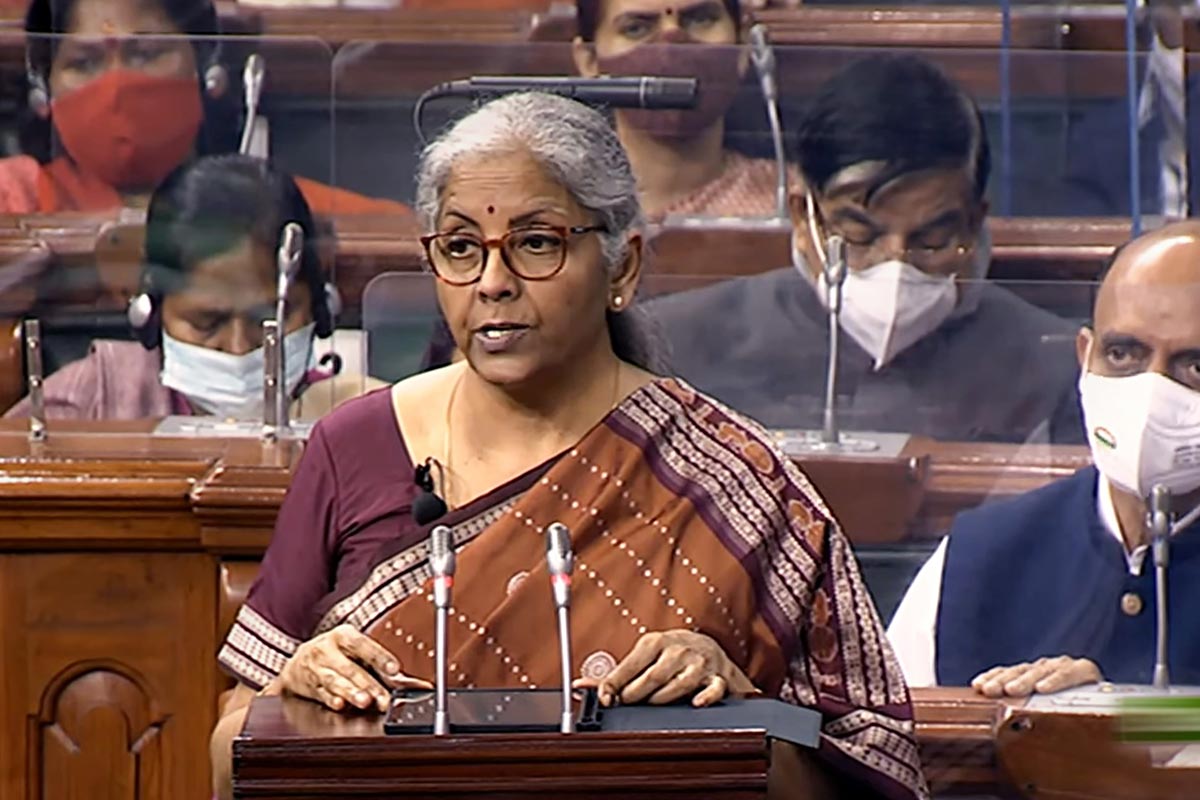

Any analysis of the Union Budget – presented on Tuesday by Finance Minister Nirmala Sitharaman ~ must be tempered with the knowledge that the annual exercise over the years has lost at least some of its lustre because major fiscal policy changes are now not restricted to a single day of the year. But even within the constraints dictated by this approach, this year’s Budget, except for a few significant announcements, does not really rock the boat, nor set the pulses racing.

Without a doubt, the major jump in infrastructure spending ought to boost the economy, for a 35 per cent increase or an addition of some Rs 2 lakh crore is not to be sniffed at. The government’s thinking seems to be that expenditure on that scale, with capital expenditure pegged at 2.9 per cent of GDP, will create synergies in terms of both wealth and job creation, and contribute to the economic growth that has been projected. This is a laudable objective, and one that the government must strive to achieve.

Advertisement

The other significant announcement is that the fiscal deficit has gone up further, and worryingly this seems to have happened despite the government having accounted for the disinvestment in Life Insurance Corporation, pencilled in at Rs 1 lakh crore, this year itself.

The other major announcements are that the RBI will issue a digital rupee using blockchain technology this year, and that gains from sale of digital assets will be taxed at 30 per cent, the latter in at least one sense pre-empting the legislation on cryptocurrency which was expected this session but finally did not make it to the agenda.

The first reactions to the budget came from the bourses, which seemed to have retained the buoyancy they had acquired as the speech was being read out, and clearly seemed enthused by the large investment in infrastructure. But there are two sections of Indians, one of whom has a tangential interest in the bourses and the other very little, who would have expected to feel the impact of the Finance Minister’s speech but did not.

The first, the middle-class, that might have expected some changes in personal taxation rates, was in for a disappointment. Indeed, this section might well wonder whether its lot is to fund the government’s infrastructure plans and later see state-owned assets be divested.

The poor, whose existence has been rendered precarious by the pandemic, but who contribute to the growing GST kitty ~ Mrs Sitharaman announced a record collection in January ~ are entitled to ask if sufficient steps have been taken in the budget to widen the social security net.

Indeed, with income disparities having grown exponentially, there was a case for innovative tax reforms, but clearly, adventurism was not on the Finance Minister’s agenda. Indeed, Mrs Sitharaman eschewed any desire she might have had to be even remotely populist, notwithstanding the fact that five crucial states are headed for the polls, and for that she must be generously commended.