In an era marked by economic turbulence and fluctuating market sentiments, the Reserve Bank of India’s (RBI) decision to hold its key interest rate steady at 6.50 per cent for the ninth consecutive policy meeting speaks volumes about its strategic approach to monetary policy. This decision, supported by a majority of the Monetary Policy Committee (MPC) members, highlights a clear prioritisation of domestic economic stability over reacting to global market pressures.

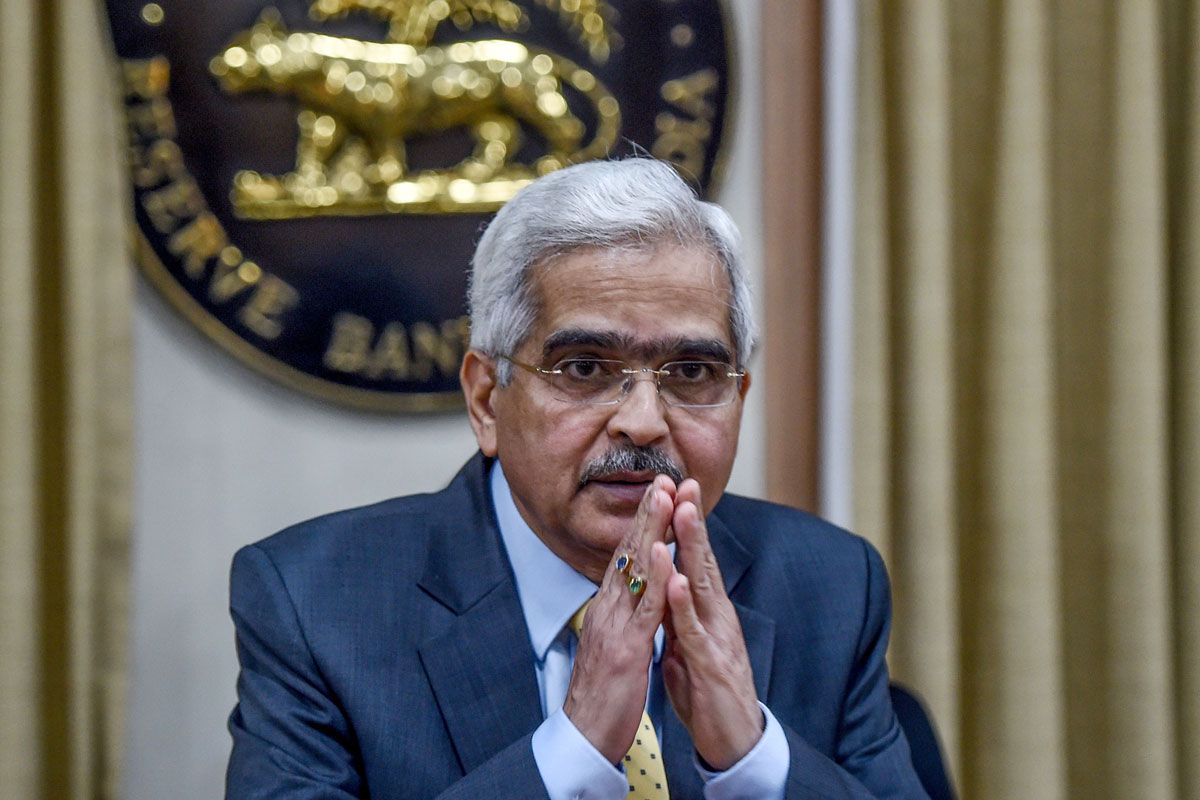

The central bank’s stance is a calculated one, rooted in the necessity to bring inflation down to its medium-term target of 4 per cent. Despite significant global volatility, particularly influenced by actions from other major central banks, the RBI remains steadfast in its focus on domestic inflationary trends. Governor Shaktikanta Das’s comments underscore this resolve, pointing out the stubborn nature of India’s food inflation, which significantly impacts the public’s perception and experience of overall inflation. Maintaining price stability is crucial for sustainable economic growth.

Advertisement

The RBI’s decision to retain the ‘withdrawal of accommodation’ stance reflects a commitment to this principle. While inflation has shown a downward tre nd, and core inflation, excluding food and energy prices, has decreased, the persistently high food prices ~ especially of vegetables such as onion, potato and tomato continue to pose a challenge. This is particularly significant in a country like India, where food constitutes a substantial part of household expenditure and, thus, the inflation experience for the average consumer.

The RBI’s approach also considers the resilience of domestic economic activity. India’s growth forecast for fiscal 2025 remains unchanged at 7.2 per cent, a figure that, while lower than the previous year’s 8.2 per cent, still signifies robust economic performance. This resilience provides the central bank with the leeway to maintain its current monetary policy stance, ensuring that any adjustments are made based on concrete domestic economic indicators rather than reactive measures to global market fluctuations. The potential for a policy shift in October, with possible rate cuts beginning in December, indicates that the RBI is not rigid in its approach but rather measured and data-driven.

This flexibility is vital in navigating the complex interplay between domestic and global economic factors. In a world where central banks are increasingly influenced by global market sentiments and pressures, the RBI’s decision to prioritise domestic considerations sets a commendable precedent. This approach not only ensures that monetary policy aligns with the country’s specific economic realities but also reinforces the importance of maintaining a steady course towards achieving long-term economic stability.

As global market volatility continues, influenced by actions such as the Bank of Japan’s rate hike and expectations of the US Federal Reserve’s potential rate cuts, India’s central bank demonstrates a commitment to its strategic goals. By remaining watchful and data-driven, the RBI ensures that its monetary policy supports sustainable growth and price stability, ultimately benefiting the broader economy.