Renewables Race

India’s clean energy ambitions are bold and necessary, but the country faces an uphill battle in turning them into reality.

In post-Covid times, the Fed embarked on a most aggressive and irresponsible monetary policy of hiking interest rates, leading to predictable financial instability all over. All other countries including India have been blindly following its prescriptions even when interest rate hikes were clearly failing to arrest inflation

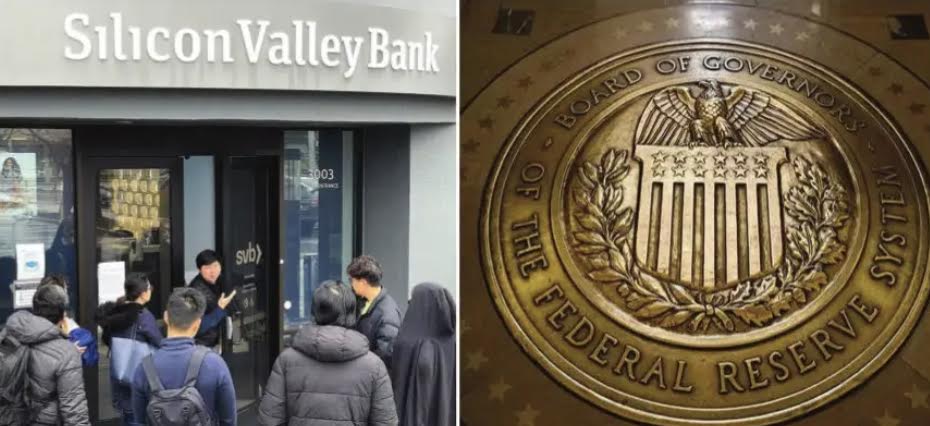

Representation image [Photo:SNS]

Apparently, the US Fed has learnt very little from the 2008 meltdown of the financial sector. Before that crisis, it thought, like most Western economists, that economic disasters could happen only in volatile emerging markets and that developed economies were far too sophisticated to fail, their financial institutions too sound to crack. When the subprime crisis erupted in 2008-09, triggering the most catastrophic global economic collapse since the Great Depression and the banks, mortgage lenders and insurers failed one by one, and then the contagion started spreading across the globe, shrinking economies that made up three quarters of the global GDP, economist and central bankers were taken aback.

The failing institutions and banks considered too big to fail had to be bailed out by the Fed and the US government, while regulatory measures were strengthened by taking various steps, most importantly by the Dodd Frank Act. Most of these economies had recovered through a slow and painful process, but even after 10 years, when Queen Elizabeth-II had asked in 2018, “Why did nobody notice it?”, economists had no idea. That question should haunt the US Fed again, and make it reflect on the consequences thrust upon the global economy when within a span of merely a year, the interest rate is raised from almost nil to 5 per cent.

Advertisement

Systemic financial crises invariably lead to severe economic downturns. The crisis of 2008 should have taught us never to become complacent about the risk of financial disasters ~ they are by no means things of the past, and the next crisis may strike at any time. But the US Fed has been extraordinarily myopic in the policies it has followed during Covid times and afterwards. It ignored all available warnings ~ in fact it is responsible for plunging the banking sector into the present crisis. Three US Banks have already collapsed since March 10 beginning with the startup-funder Silicon Valley Bank (SVB) which was the 16th largest US lender with an asset base of $200bn. Then a fourth ~ First Republic Bank ~ had to be given a morphine dose of $30bn by a consortium of 11 banks.

Advertisement

The contagion then spread to Europe. With the 166-year-old Credit Suisse ~ a bank that is almost synonymous with Swiss identity, about to collapse, it was given a bailout package of $54bn by the Swiss Central Bank, which, however, could not save the bank and it was finally acquired by its rival UBS at a cost of only $3.3 billion against its market value of $8 billion. The fallout of this takeover is likely to spread across the Eurozone and beyond. While the banking crisis has pulverised stock markets across the globe including in India, the contagion is unlikely to stop anytime soon. The US Fed must introspect on its faulty policies of continuing with raising interest rates to contain inflation which, in any case, it has not been able to do. The remedy for taming stubborn inflation may have to be sought elsewhere.

The great recession of 2008- 09 led to governments giving unprecedented stimuli. From 2008 to 2011, governments of the hardest-hit 11 countries had spent an average of a quarter of their GDPs on stimulus packages ~ and taxpayers’ money was spent uneconomically and inefficiently. Public anger led to protest movements ~ Occupy Wall Street, Occupy London, Spanish 15M or Indignados. In December 2008, the US Fed cut the interest rate to zero and then gradually bought huge tranches of financial assets, inflating its balance sheet to a quarter of US GDP, and unleashing a copious supply of liquidity in the market through quantitative easing, buying bonds from the secondary market, while flooding the market with dollars. When it indicated the intention to tighten monetary policy in 2013, the taper tantrum that followed threw global economies including emerging ones like India into a tailspin.

After the crisis, the DoddFrank Act of 2010 empowered the US regulators to force the largest banks to significantly increase their capital base while reducing their reliance on short-term funding to prevent a repeat of 2008. Supervision by the regulator was strengthened with large banks being subjected to regular stress tests, and failure to pass the tests led to penal measures like stopping them from paying dividends to shareholders, or buying back their own shares, or expanding the balance sheets.

While the Act made the opaque banking business a little more transparent, its major and fatal flaw was its focus on the mainstream banking system while ignoring the mid-level banks like the SVB and non-banking financial institutions known as “Shadow Banks”, which did not follow the stricter norms of the larger mainstream banks; they now started attracting borrowers.

A majority of US mortgages are now created by such “shadow banks”, hiding the vulnerabilities that need to be fixed and making the crisis doomed to be repeated.

Almost a third of the assets in the US banking system are held by banks smaller than the SVB, which are inadequately capitalised with large volumes of uninsured deposits. Such a situation exists even in India as seen by periodic hiccups in our financial system whenever a shady institution like IL&FS or Yes Bank fails. Given such vulnerabilities, it was not a surprise that a 40- year-old bank like the SVB took less than 40 hours to collapse. It was a bank for the start-ups ~ it financed them unlike other banks that insisted on collaterals, and most startups did not have any. As the Silicon Valley startups flourished, SVB’s business boomed and its client companies were flush with cash which they deposited with SVB, quadrupling its deposits from $44bn to $189bn between 2017 and 2021 ~ while its loan book grew only from $23bn to $66bn. A deposit base larger than loans makes a bank vulnerable by itself. SVB invested $128bn of its deposits in US Treasury bonds at their peak price with almost zero yield, considering them safe which they were, and expecting the policy rate to remain stable in future.

But then Covid struck and the world crashed. As inflation became entrenched to contain which the Fed started raising interest rates, the bonds held by the SVB became worthless as they were not marked to the market. With venture-capital fundraising drying up, its clients started withdrawing their deposits and SVB was forced to sell off its entire liquid bond portfolio at lower prices incurring a loss of $1.8bn, to cover which it wanted to raise capital for $2.5bn. Announcement of this prompted a scrutiny of its balance-sheet, when its share price plunged by 60 per cent and then by 70 per cent.

On March 10, the regulator declared its collapse. Federal insurance covers deposits only up to $250000 (in our case only Rs 5 lakh), and SVB’s clients were mostly companies with larger deposits. Consequently, 93 per cent of its deposits were uninsured. The crisis was always there, waiting to unravel. That SVB was not the only bank facing a similar predicament was demonstrated by the other banks failing and more will be likely to follow. Following the collapse of Credit Suisse, the shares of the German lender Deutsche Bank plunged by 14 per cent. Despite its stronger fundamentals, investors have cause to worry.

Changes in interest rates affect financial institutions, and rapid changes like what the Fed has been doing make them even more vulnerable. SVB’s fall has focussed attention to erosion in the value of banks’ portfolios as a result of rising interest rates, and the portfolios are not marked to the market. The regulator, Federal Deposit Insurance Corporation, estimates $620bn in unrealised mark-to-market losses in the US financial institutions, and a 10-per cent hit to bond portfolios would suffice to wipe out more than a quarter of all equity in the US banking system. Fed should have seen the banking crisis coming.

In post-Covid times, the Fed embarked on a most aggressive and irresponsible monetary policy of hiking interest rates, leading to predictable financial instability all over.

All other countries including India have been blindly following its prescriptions even when interest rate hikes were clearly failing to arrest inflation. Despite the exorbitant monetary stimulus which made no distinction between the poor and the rich, the pandemic was a period of deflation as consumption declined, and bank deposits increased more than the loans. Much of the new money that was saved went into asset markets, vastly increasing asset prices.

As the supply side was shattered by the pandemic, once the shock was over, it was expected that demand would soar. Excess demand incentivises business investment which is essential for supply-side recovery. Raising interest rates to dampen inflation when the supply side is damaged is bad policy ~ it not only dampens business investment but creates panic. In such situations, it might be better to tolerate higher inflation to help the supply side recover.

Today except the large banks, all other US banks are reeling from the consequences of higher interest rates which has reduced the value of their securities’ portfolios, making it likelier for their depositors to flee to bigger and safer banks or to money-market funds. It will again trigger a system-wide panic, setting off a chain of increasing bank failures with consequent spilling over effect. Living with inflation while incentivising policies to raise output is a better option than facing such a doomsday scenario. Inflation needs to be brought down in a controlled manner, without producing chaos all over.

(The writer is a commentator, author and academic)

Advertisement