There was a palpable difference between the runup to Budget 2019 and Budget 2020. Budget 2019 was presented in a mood of optimism, at a time when a popular government with an overwhelming mandate, promising sabka saath sabka vikas, had just been installed. The mood could not have been more different when the Finance Minister rose to present Budget 2020.

The faltering economy had dampened expectations of the business community; the common man was bewildered, unable to cope with the day-to-day problems of inflation and falling real income. The Economic Survey, preceding the Budget, merely parroted the Government’s thinking; we had a great economy in ancient times which got derailed by socialism in the recent past.

Advertisement

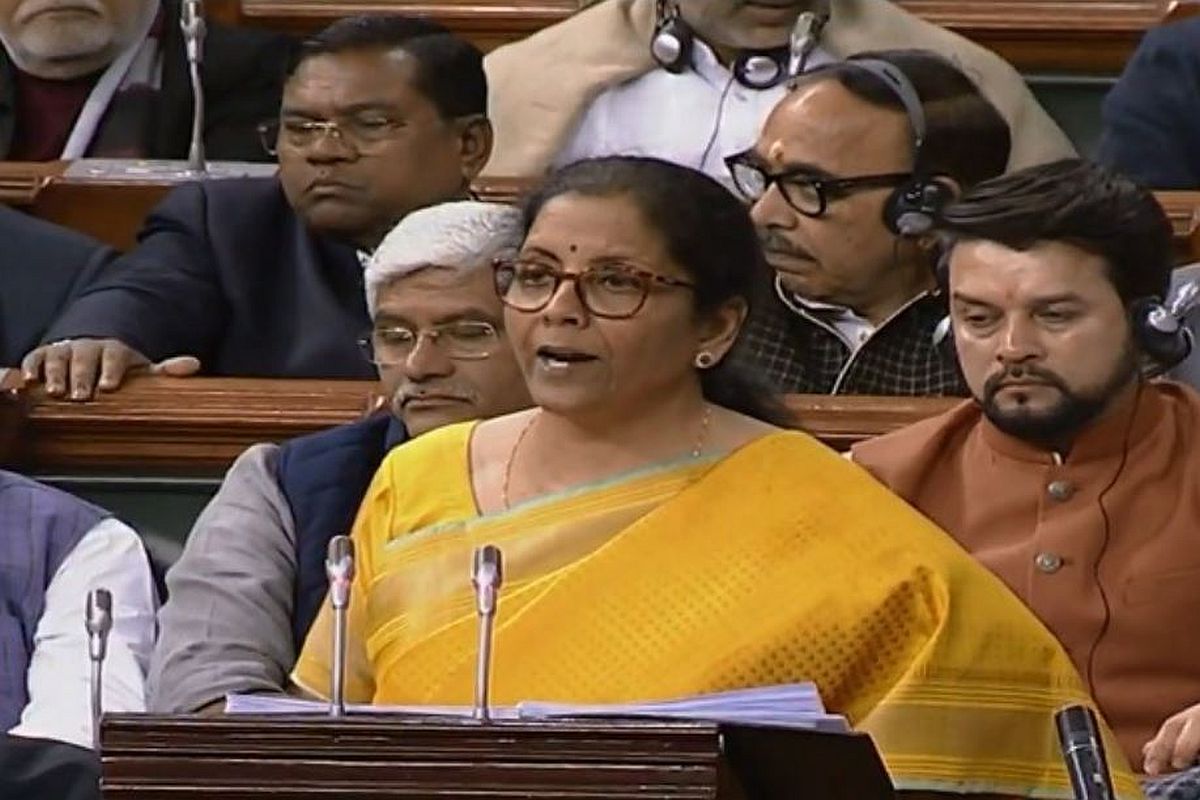

Incisive in parts, the underlying thought of the Economic Survey was to suggest recourse to the ‘trickle down’ theory which means promoting big businesses in the fond hope that some benefits would trickle down to the poor ~ regardless of the fact that application of this theory has resulted in vast inequalities between the wealth and income levels of the haves and have-nots. The longest-ever Budget Speech of the Finance Minister, lasting a record 2 hours 40 minutes, outlined a slew of pious intentions. However, most of the measures announced by the Finance Minister are not backed by adequate resources.

For example, allocation for agriculture has been increased only by 3 per cent ~ from Rs1,30,485 crore in 2019-20 to Rs1,34,400 crore in 2020-21. Significantly, according to the Revised Estimates, only an amount of Rs 1,01,904 crore would be spent on agriculture in the current year pointing to deep-rooted implementation issues. Another disturbing conclusion is that much less than the budgeted amount would be spent on agriculture if we consider both years together. Similarly, against a budget allocation of Rs 93,035 crore for health in the last Budget, according to the Revised Estimates, only Rs 71,584 would be spent in the current year.

Thus, an allocation of Rs 1,06,324 crore in the current Budget for health may not prove very meaningful. Budget allocation for defence has been increased by only 5.8 per cent with only a marginal increase in capital outlay, which may be insufficient to fund the ambitious acquisitions in the pipeline. So far as personal incometax is concerned, there is both good news and bad news. The good news is that income-tax rates have been slashed and there is no income-tax on income upto Rs 5 lakh. A comparison of the old and new rates is given below: Rs 5-7.5 lakh income ~ tax reduced to 10 per cent from 20 per cent. Net gain to taxpayers Rs 25,000 Rs 7.5 lakh to 10 lakhs: tax reduced to 15 from 20 per cent.

Net gain Rs 25,000 + Rs 12,500 Rs 10-12.5 lakh: tax reduced to 20 per cent from 30 per cent. Net gain Rs 25,000 + Rs 37,500. Rs 12.5-15 lakh: tax reduced to 25 per cent from 30 per cent. Net gain Rs 12,500 + Rs 62,500. The bad news is that you will have to forego almost all deductions and exemptions to avail the new rates. Some deductions to be foregone are: Insurance, PF contributions u/s 80C (Rs 1,50,000), deduction for medical insurance etc. u/s 80D (Rs 25,000 in general and Rs 50,000 for senior citizens), Standard Deduction u/s 16 (Rs 40,000), interest on Home Loan u/s 24 (Rs 2,00,000) and a host of similar deductions. Thus it may be advisable for taxpayers to continue with the old regime.

The Finance Minister has been more kind to corporates both Indian and foreign. Dividend Distribution Tax has been axed, power generation companies would be taxed at a concessional tax rate of 15 per cent and sovereign wealth funds investing in infra projects would pay no income-tax. Employees in receipt of ESOPs will enjoy a grace period of five years to pay tax. A new scheme, Vivad Se Vishwas, has been announced for taxpayers to settle their income- tax disputes by paying only the disputed tax, with interest and penalty being waived, if payment is made by March 31, 2020.

This is intended to resolve the 4,83,000 direct tax cases pending in various appellate fora. However, a similar scheme proposed in 2016 failed miserably. The middle class will be badly hit by the Budget, as import duties on a large number of items of common use have been increased substantially. You would have to shell out more for fans, tableware/kitchenware made of porcelain or China, clay iron, steel and copper. Customs duty on things as diverse as walnuts, footwear, chemicals, household appliances, parts of automobiles have been substantially hiked.

You may find prices on e-commerce portals going up, as e-commerce portals would have to deduct TDS on all payments to e-commerce suppliers at a minimum of 1 per cent. A hike in Excise duty on tobacco and cigarettes means that smokers and tobacco users would now find their vice more expensive. The Budget has some forward- looking ideas as well; Rs 6,000 crore have been earmarked for providing Fibre to Home connections to 1 lakh gram panchayats, degree-level full-fledged online education programmes would now be offered by the top 100 institutes, a medical college could be attached to a district hospital in PPP mode and viability gap funding would be provided to set up such medical colleges, an IND-SAT exam to be held in African and Asian countries, for benchmarking foreign candidates who wish to study in India and finally a common all-India examination is proposed for recruitment to non-gazetted posts.

However, some measures to kickstart the economy, suggested in the Economic Survey, have been quietly forgotten. For example, the across the board hike in import duties puts paid to the suggestion of becoming a part of Global Value Chains. Given the high import duties, the prescription of ‘Assemble in India’ to increase employment also cannot be implemented. Similarly, the suggestion to empower farmers through direct investment subsidies and cash transfers, or restricting the coverage of National Food Security Act to the bottom 20 per cent finds no mention in the Budget document.

The share market, which was touted as a benchmark for our economy by the current Economic Survey, has given a thumping thumbs down to the Budget. The BSE Sensex went down by 987 points as the Budget Speech was being read out. This is markedly worse than last year, when the Sensex fell by 400 points. The Finance Minister has been more than optimistic in projecting a fiscal deficit of 3.8 per cent based on an increase in tax collection by 4 per cent, while indications are that tax collections may not even touch last year’s level.

In this scenario, the current Budget target envisaging an increase of 15 per cent in tax revenues, over the Revised Estimates, in financial year 2020-21 may also not be realised. As could be gauged from the Finance Minister’s unfinished marathon Budget Speech, too much has been attempted and resources have been spread rather thinly. The Finance Minister had the opportunity to disregard doomsday prophets and present a development-oriented benign budget aimed at reviving demand by increasing the disposable income of taxpayers and nontaxpayers alike.

But then she would have to suggest some measures which would not have been in line with the thinking of the present Government. The present Budget can be said to be a case of missed opportunities. But one should not worry too much. Most of the significant economic initiatives like Demonetisation, GST, bank mergers, corporate tax cuts were announced after the Budget. One only hopes that the Finance Minister announces some better initiatives in the days to come.

(The writer is a retired Principal Chief Commissioner of Income-Tax)