Foreign investors selling Indian equities due to ‘profit booking’: Nirmala Sitharaman

Union Finance Minister Nirmala Sitharaman Monday said the foreign institutional investors (FII) are selling Indian equities lately due to the profit booking.

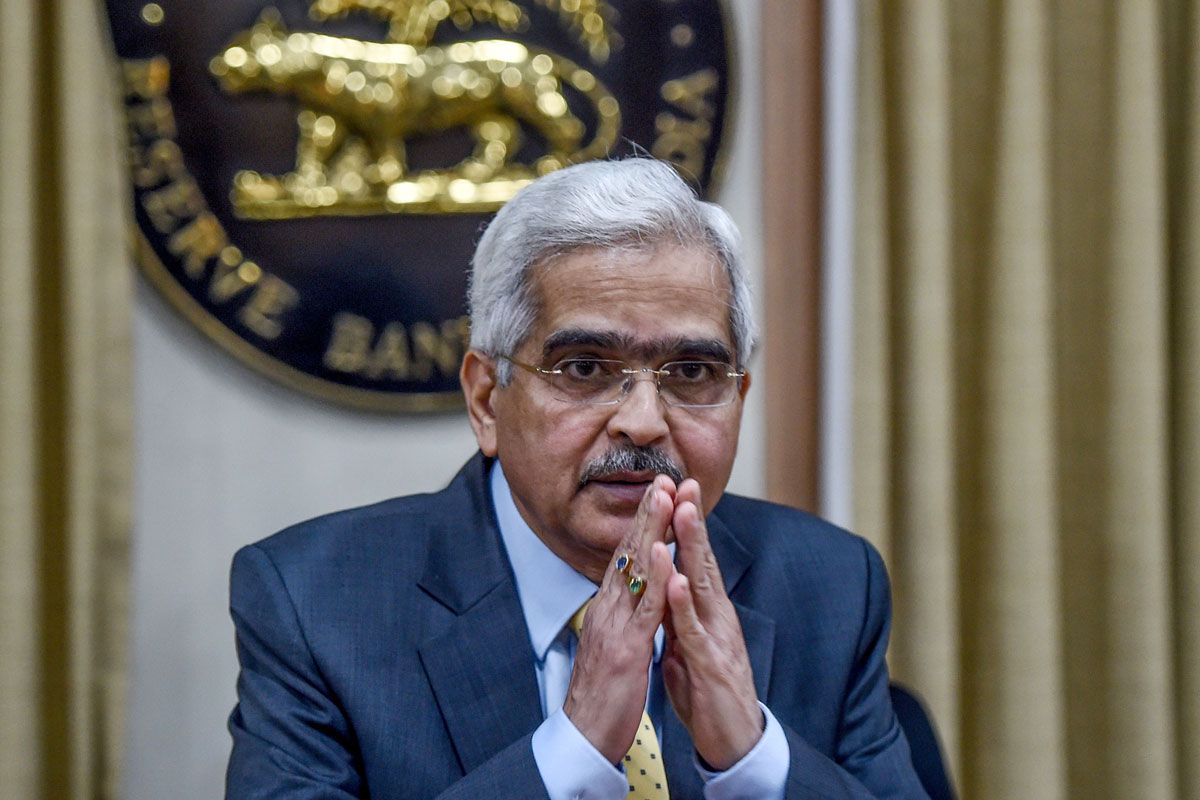

Reserve Bank of India Governor Shaktikanta Das has signalled a cautiously optimistic stance on inflation management, underscoring the dual focus on growth and price stability.

RBI Governor Shaktikanta Das (AFP file photo)

Reserve Bank of India Governor Shaktikanta Das has signalled a cautiously optimistic stance on inflation management, underscoring the dual focus on growth and price stability. With inflation showing signs of moderation, the Indian economy appears resilient, positioning the central bank to pursue its inflation target of 4 per cent within a 2 per cent tolerance band. This moderation, however, does not imply a retreat from vigilance, as unanticipated factors could potentially disrupt this delicate balance.

Inflation management is never a simple task, especially in an emerging economy like India where global and domestic variables interact dynamically. One key challenge is weather unpredictability, as India’s heavy reliance on agriculture makes its economy highly sensitive to climate-related fluctuations. Unseasonal rainfall or droughts can impact food supply, leading to price volatility in essential commodities. This risk is compounded by India’s complex agricultural supply chains, which can magnify the effect of any production shortfall on consumer prices. To address these challenges, the RBI will need to carefully monitor agricultural production cycles and respond swiftly to any indications of weather-related disruptions.

Advertisement

Global geopolitical tensions add another layer of complexity, as recent events have shown how fragile international supply chains can become. While India is pursuing economic resilience and diversification, its economy remains intertwined with global trade flows. Shocks originating from conflicts or political tensions can quickly translate into supply bottlenecks, impacting a wide range of imported goods from energy resources to essential industrial inputs. This, in turn, could trigger price hikes in sectors like manufacturing and energy, rippling through to consumer goods and ultimately affecting inflation. The RBI’s awareness of these risks is reassuring, as it highlights a readiness to manage inflationary pressures that may emerge beyond its borders.

Advertisement

The balance between controlling inflation and fostering economic growth is further complicated by the central bank’s need to retain policy flexibility in a rapidly changing economic landscape. While the central bank’s stance is to align inflation with the 4 per cent target as closely as possible, it must also weigh the costs of potential overshoots. Tightening monetary policy too aggressively could stymie growth, which is crucial for India’s broader development agenda. By adopting a balanced approach, the RBI seems committed to ensuring price stability while maintaining the momentum needed to support employment and investment. In this climate of heightened uncertainty, the RBI’s vigilance on inflation is both a prudent and necessary stance.

The commitment to moderating inflation around a defined target signals to investors and consumers that India is serious about maintaining economic stability. This stability, in turn, is essential for India’s longer-term economic goals, particularly as it seeks to attract foreign investments and become a manufacturing hub. Ultimately, the central bank’s proactive approach to monitoring inflation drivers ~ whether domestic or global ~ highlights its adaptability in a complex economic environment. As India continues its growth trajectory, the ability of the RBI to navigate these multifaceted risks will be crucial.

Advertisement