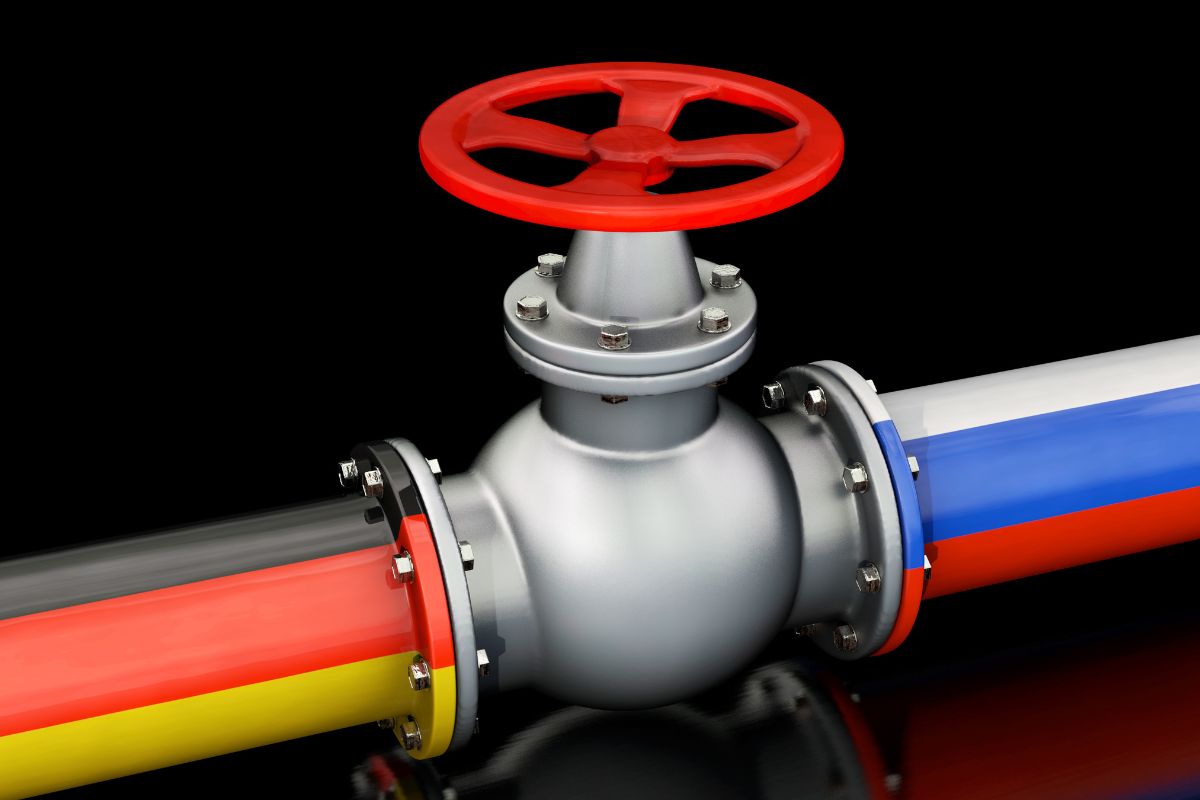

Germany is in crisis in the immediate aftermath of Russia’s energy giant, Gazprom, effecting a 60 per cent reduction in the amount of natural gas it supplies to the country. This appears to be the latest move by the Kremlin to punish Europe for sanctions and military support for Ukraine. The government in Berlin has warned residents and business enterprises that the country was in a natural gas crisis that could worsen in the coming months. “The situation is serious and winter will come,” Robert Habeck, the country’s economy minister, said in Berlin. He has let it be known that the government had triggered the second stage of its three-step energy gas plan. The next step envisages gas rationing. “Even if we don’t feel it yet, we are in a gas crisis,” he said. “Gas is a scarce commodity from now on.

Prices are already high, and we have to be prepared for further increases. This will affect industrial production and become a burden for many consumers.” Gazprom has attributed the reductions to a turbine, specifically that a compressor station sent to Canada for repairs has not been returned because of sanctions. For all that, Mr Habeck has described Gazprom’s cutbacks as a deliberate economic attack by the President of Russia, Vladimir Putin. It is obviously Putin’s strategy to “create insecurity, drive up prices, and divide us as a society,” he said. The recent developments have stoked concerns that the gas crisis is gaining dangerous momentum that could have unforeseen consequences for the economy in the wider canvas, and that governments are not moving fast enough to stop it.

Advertisement

“We are one step away from the rationing of gas which could affect many sectors, businesses and consumers,” is the prognosis of an investment banker. Russia’s actions could lead to “contagion and knockout effects” across Europe not the least because the gas markets are connected. Arguably, restrictions on flows to Germany are likely to affect prices in Britain. Russia is also inflicting financial damage on its corporate customers. Utilities that have contracts to buy gas from Gazprom might find themselves short of the fuel, and then need to buy additional supplies at much higher prices to meet their obligations, resulting in losses.

“Due to the restrictions on the Nord Stream 1 pipeline, significantly smaller quantities of gas are currently coming from Russia, and replacements can only be procured from the markets at very high prices,” said Klaus Dieter Maubach, chief executive of Uniper, a German utility. Uniper has said it is receiving only 30 per cent to 60 per cent of its requested volumes. The shortages have driven gas prices to extraordinarily high levels, indeed six times what they were a year ago. Such high prices were forcing energy providers to take on losses, which could threaten the entire energy market. Clearly, sanctions are taking an unintended toll.