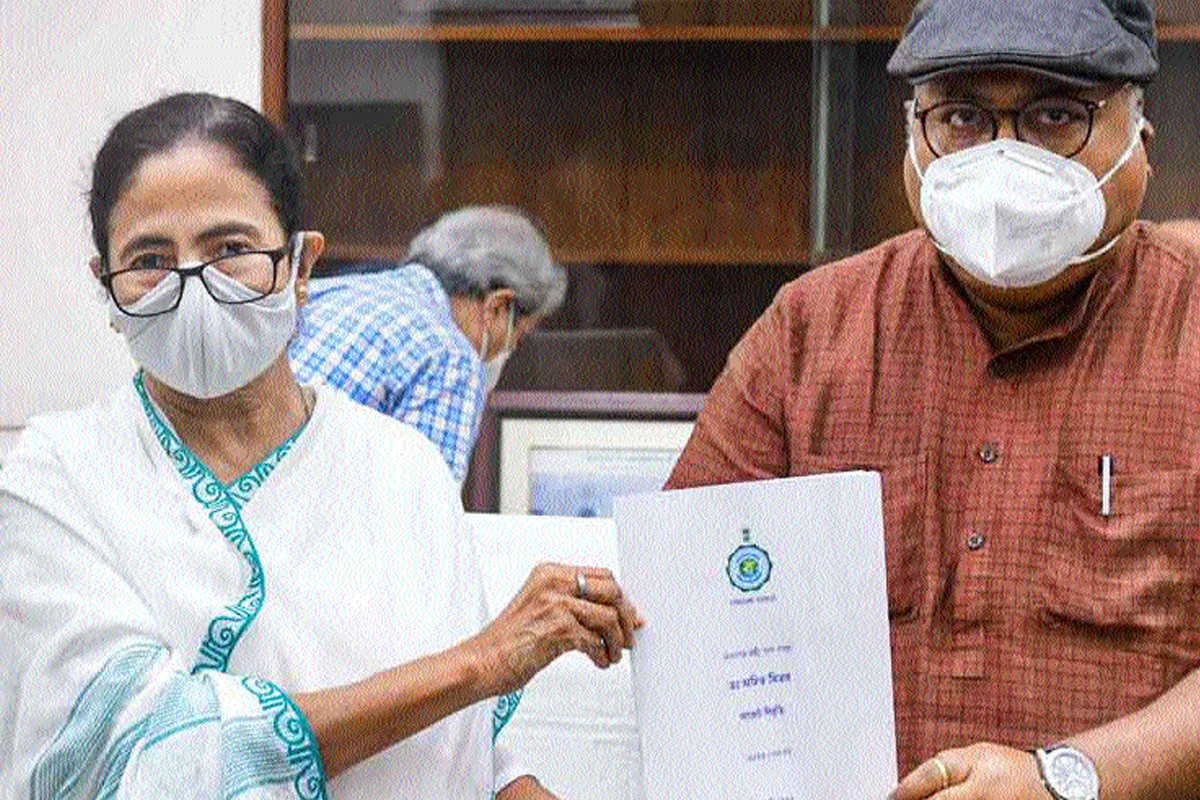

Shorn of the customary carping at the Centre and egalitarian cant, the West Bengal budget for 2021-22 is seemingly riveted to the poor and marginalised segment in a robust enunciation of public policy. In a budget that was read out by the industries minister, Partha Chatterjee, in the absence of finance minister Amit Mitra, now under the weather, Mamata Banerjee has sought to fulfil her electoral pledge of Universal Basic Income (UBI), as often demanded by economists who owe allegiance to the Communist Party of India (Marxist), pre-eminently Prabhat Patnaik. It is hard not to wonder whether the CPI-M and Trinamul Congress are on the same page as regards UBI.

Quite the most striking feature of Wednesday’s presentation was that cash would be transferred directly to as many people as feasible. This is easier announced than accomplished not the least because the number of potential beneficiaries has been indeterminate even on budget day, let alone the formalities that will have to be observed.

Advertisement

The plan of action will, it is hoped, enhance the spending power of the people; but the bout of macro-management ought to have taken care of the economic matrices. The four new schemes ~ revised Krishak Bandhu, Students’ Credit Card, Lakhsmir Bhandar and Duare Ration ~ had been promised in the election manifesto of the Trinamul Congress.

It may be just a coincidence that the state government’s signal of intent was advanced on a day when markets in Kolkata registered ballooning food inflation, notably the price of vegetables.

To that must be added the steep rise in the cost of transportation ~ a thorougly arbitrary exercise by bus and minibus operators and without the concurrence of the government. The latter was engaged in masterly an activity.

There appears to be little or no governmental involvement in the economics of this segment of public transportation, save in the ballooning cost of fuel for which the Union government is more responsible. The problem becomes still more acute with the overwhelming presence of private buses… with the government’s public conveyance network dwindling to almost a skeletal service.

Of course, the waiver of the road tax is bound to benefit the owners of buses, minibuses and taxis, albeit at the cost of a fair amount of revenue to the state exchequer. It is utterly preposterous, therefore, to demand Rs 20 from a passenger even for travelling from one stoppage to another, The Chief Minister may be spot on in terms of theory ~ “Our effort is to hand out cash to the people so that they can spend. This will result in creation of demand, trigger economic activity and spur growth”.

Admittedly, demonetisation had hampered hoi-polloi’s spending power; but the economic blight, such as it was, had happened close to five years ago (November 2016). Post-demonetisation, inflation has been pronounced in West Bengal.

The booming real estate sector in Kolkata and the districts is expected to get an impetus with the reduction in stamp duty and what they call the “circle rate”. The budget envisages a two per cent rebate on stamp duty for registration of property deeds and a ten per cent reduction in circle rates ~ the minimum value at which property in a certain area can be bought and sold. One can almost hear a collective sigh of relief from middle Bengal, the segment that is ever so keen on buying flats and on which the real estate operators are increasingly thriving.

Aside from the economics of real estate, the fact remains that from the Left dispensation to the Trinamul, Bengal has been plagued by its attendant red herrings, primarily inter-party and personal rivalry, as often as not mortal, among promoters over the distribution of spoils. To that must be added the dire environmental fallout, exemplified by the rampant filling of waterbodies that skirt the eastern periphery of the city. The budget takes a bow in the direction of women and child development and social welfare. The outlay is more than 2.7 times of the sum in the previous budget. A monthly sum of Rs 500 (Rs 6000 a year) will be advanced to “general cateory households” and Rs 1,000 (Rs 12,000 a year) to families in the Scheduled Castes and Scheduled Tribes category. This will envisage a remarkable expansion of banking operations as the amount will be credited directly to the bank accounts of the female heads of Bengal’s 1.6 crore families. Fairly sweeping is the anticipated impact of public policy, both in terms of education and school education. A neat sum of Rs 10,000 will be given to every farmer each year; an equal sum will be transferred to 10 lakh students in Classes 11 and 12 to enable them to buy tablets to facilitate online studies. Unwittingly or otherwise, this is intended to address the discord over conventional classroom teaching and online instruction. Other direct cash transfer schemes include pensions for widows and artists and monthly doles for farmers. Well might the Chief Minister claim that “no other state has had such a wide range of direct transfer schemes”. The success of the schemes announced ~ but bereft of the customary fanfare and romantic euphoria ~ will hinge on implementation, the reining in of the occasionally violent real estate operatives from Baguiati to Behala and further afield, and to make the people acquainted with the certitudes of banking. The economic condition of the people, most particularly in rural Bengal, has to improve if the state is to be rescued from the cusp of poverty. Dirigisme must of necessity be effectual.

The writer is Senior Editor, The Statesman.