Last week, two headlines, on the same day, caught one’s attention for their mutual incongruity: the first was a ‘nowcast’ (current forecast) by RBI titled “An Economic Activity Index for India” that stated that the Indian economy was in a ‘technical’ recession for the first time in history and the other was a statement of the Finance Minister predicting a fast recovery by the Indian economy. These, seemingly incompatible, propositions were sought to be reconciled by the FM who stated that “Quite a few indicators (are) showing a distinct recovery in the economy.”

Frankly, such sophistry is beyond the understanding of most of us. To add to the prevailing confusion, the issue of economic recovery is being endlessly debated with contradictory, and often counterintuitive, pronouncements appearing daily in the media with columnists suggesting slow, medium, fast, U-shaped, V-shaped, W-shaped or K-shaped recovery and variants thereof. The prescriptions for ensuring a quick recovery are equally varied with some suggesting increased fiscal stimulus and others batting for cost-cutting measures.

Advertisement

These apparent contradictions can be somewhat understood if we look at the economy, not as a monolithic whole, but as an aggregate of disparate parts. Some parts of the economy like agriculture never went into recession and others like the medical and pharma sectors recovered in the first quarter and still others like the auto sector started doing well by the end of the second quarter. Still others, like hospitality and construction will take a while to recover. The path and pace of recovery of each sector is different and can be U, V, K or W shaped.

While trade bodies have their own compulsions for projecting a particular point of view, Government spokesmen would be failing in their duty if they do not sound optimistic. The labelling of the current recession as ‘technical’ by the RBI does not soften its rigour in any way. Conflating financial statistics with anecdotal evidence one can easily see the havoc wrought by the recession – the closed shops, the retrenched neighbour and other similar indicators of a slowing economy.

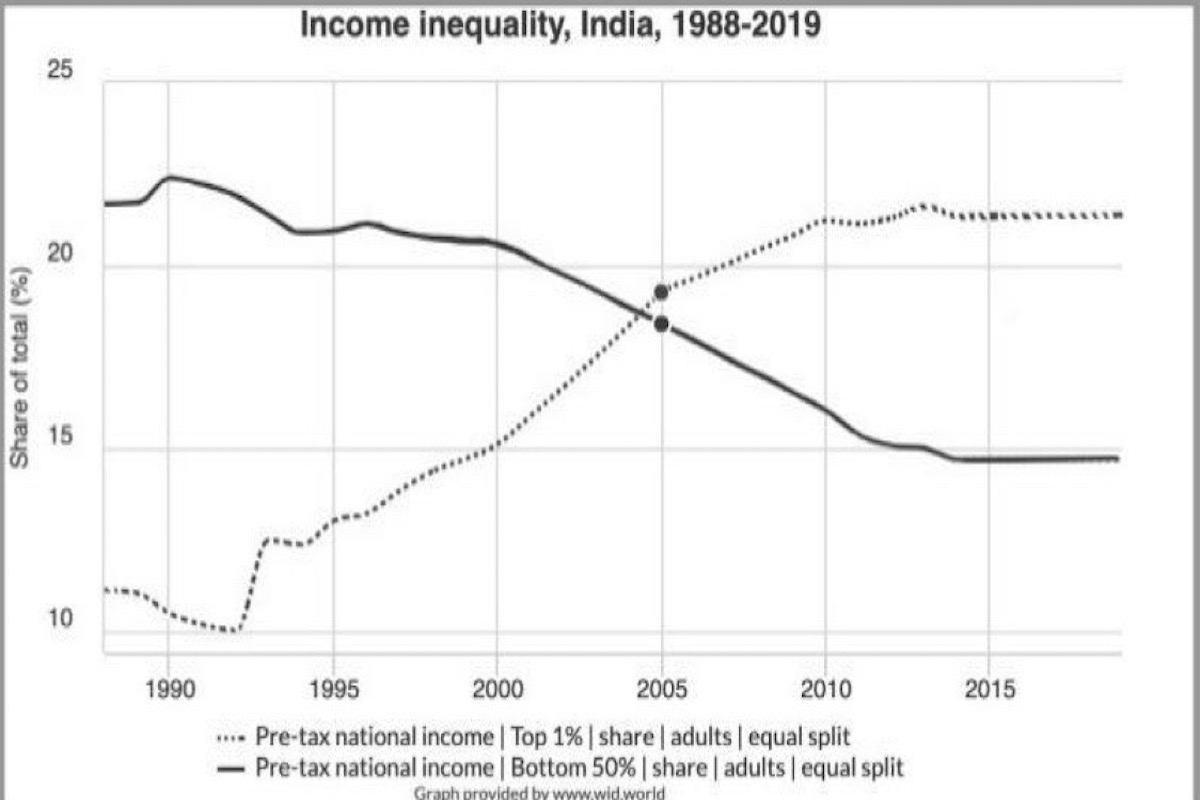

Incongruously, while the coronavirus pandemic made millions lose their means of sustenance, and while the Indian economy contracted by 23.9 per cent in the first quarter and is expected to contract by 8.6 per cent in the second, the IIFL Wealth Hurun India Rich List 2020, found that cumulative wealth of the richest 827 individuals, who had wealth exceeding Rs. 1,000 crore, increased by 20 per cent in the last one year, ended 31 August 2020. Hurun also reported that the number of such ultra-rich individuals had increased three-fold in the last five years and the average wealth of these 827 individuals stood at Rs. 7,300 crore.

Visiting the relationship between taxation and inequity, the French economist Thomas Piketty had observed in his treatise “Capital in the Twenty-First Century,” that economic inequality was worsening not by accident, but rather as a feature of capitalism, which had to be reformed to preserve democratic order, and social and economic stability. Piketty hypothesized that there is concentration of wealth, if in the long term, the rate of return on capital exceeds the rate of economic growth. Piketty proposed a global system of progressive wealth taxes to help reduce inequality and avoid the trend towards a tiny minority controlling the vast majority of wealth.

In the Indian context, much of this inequity is a result of the tinkering of successive governments with the taxation system put in place by the economist Nicholas Kaldor. Only income-tax remains of the four taxes (Incometax, Wealth-tax, Estate Duty and Gift-tax) proposed by Kaldor. Now, with the capacity of the Government to grant further stimuli restricted because of falling revenues and burgeoning expenditure, and a further cut in interest rates by RBI looking difficult because of mounting inflation, new measures are required to raise revenue and put the economy back on rails. The increase in inequality and the need for more revenue make out a strong case for re-introduction of wealth tax, at least on the ultra-rich. Many countries with a progressive taxation system like Switzerland levy wealth tax. Wealth tax was abolished in India because the cost of collection was stated to be inordinately high but with the complete computerization of the Income-tax Department, this impediment in the levy of wealth tax has been removed. So, wealth tax may be reintroduced with suitable amendments and a substantial increase in the earlier threshold of Rs 30 lakh.

Similarly, the reintroduction of Estate Duty or a tax on inheritance, would reduce the propagation of income inequality, through successive generations. Here again, computerization has cleared the way for smooth levy. Notably, most countries like the United States, United Kingdom, Canada and France impose a tax on inheritance.

Then, there is a need to have a more equitable income- tax regime. One finds that while individuals are taxed at 30 per cent (on income exceeding Rs 15 lakh) and firms are taxed at 30 per cent on all income, manufacturing companies are taxed at 15 per cent and non-manufacturing companies are taxed at 22 per cent. Firstly, high rates of personal taxation combined with low tax rates for companies incentivises tax evasion with owners declaring higher corporate income and availing various doubtful exemptions on personal income.The legendary investor, Warren Buffet, found that while he was paying taxes at 18 per cent, his secretary was being taxed at 35 per cent. Such anomalies are best avoided. Secondly, small businesses, which are more labour intensive, are generally organised as firms and consequently suffer a higher rate of tax. Given the requirement of numerous statutory compliances for corporates, it is not easy to run a company, so a higher taxation rate for firms disincentivises small businesses. To promote small businesses and generate employment, tax rates for firms should be brought on par with those of corporates. The cost to the exchequer would not be high; Income-tax Departmental statistics for the assessment year 201819 show that the aggregate tax liability for 12,69,736 firms was Rs 42,993 crore while aggregate tax liability for 8,41,942 companies was Rs 4,31,041 crore. Thus, halving the tax rate for firms would result in an outgo of less than Rs 20,000 crore which could be made up in due course from the increased income of firms. Moreover, smaller businesses are also entitled to some small relief, in view of the tax write down of Rs 1,45,000 crore for corporates.

A more serious and complex issue is that of reforming the GST regime. As a general principle, indirect taxes are regressive, affecting the poor more than the rich. The tendency of the Government to boost revenue collection by increasing GST rates, like in the case of raising GST on petroleum products to astronomical levels, should be discouraged. As of now, the share of indirect taxes in Government revenues has progressively increased to equal that of direct taxes. This trend should be quickly reversed.

Also, we have adopted multiple GST rates which are politically attractive because they ostensibly ~ though not necessarily ~ serve an equity objective, but the administrative price for addressing equity concerns through multiple GST rates has proved quite high. The cost effectiveness of our multiple-rate system should be carefully reviewed. Then, the credit mechanism for GST is excessively restrictive (that is, there are denials and delays in providing proper credits for GST on inputs), especially when it comes to capital goods. As these features allow a substantial degree of cascading (increasing the tax burden for the final user), they reduce the benefits of introducing GST in the first place. A number of input credit frauds have also been noticed. Steps should be taken to rectify these limitations in the GST design and administration.

Paying tax is never a pleasant experience, but it could be made bearable by having a transparent and equitable tax regime. The ancient economist Chanakya recommended that tax collectors be like honey bees, collecting taxes like the bees collect nectar, causing the least discomfort to flowers.

Chanakya’s ideal has not been realized till now but is worth striving for.

The writer is a retired Principal Chief Commissioner of Income-Tax