FinMin launches new credit assessment model for MSMEs

Union Finance Minister Nirmala Sitharaman, along with Minister of State for Finance Pankaj Chaudhary, on Thursday launched the New Credit Assessment Model for MSMEs.

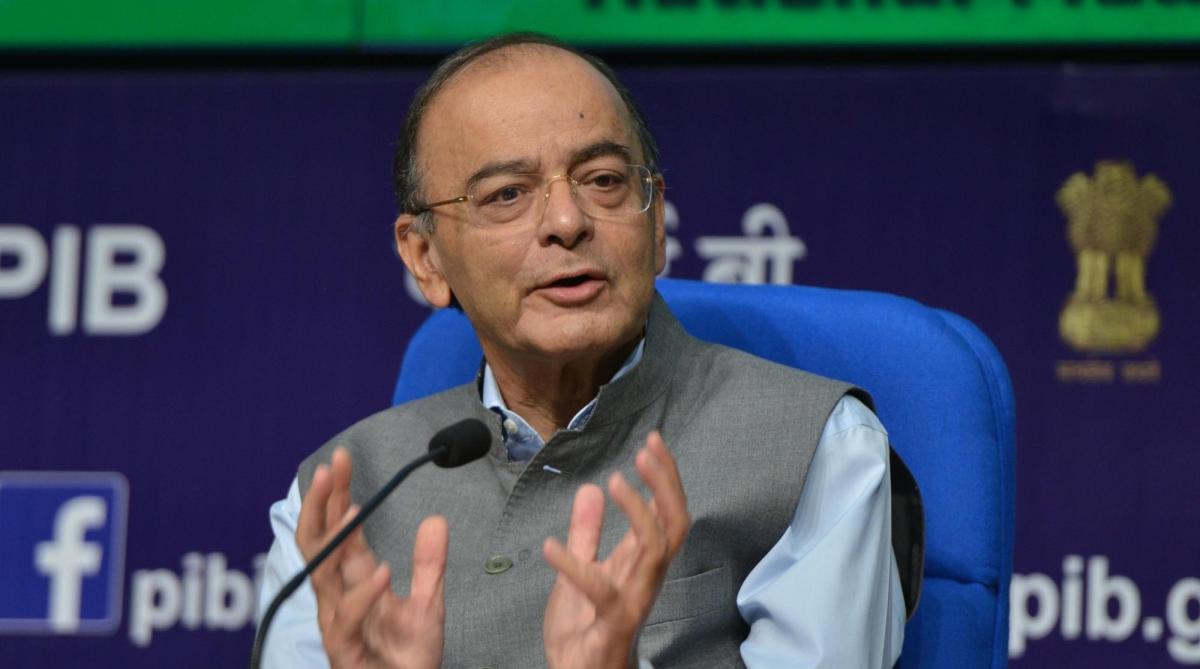

Union Finance Minister Arun Jaitley. (Photo: IANS)

That the Finance minister’s tweet after having briefed a press conference on his dubious plan to reduce oil prices by Rs 2.50 a litre should have been met by derision was only to be expected given that he had very recently argued that oil prices were not under his control.

His sense of smugness over the proposed reduction too was somewhat punctured by his followers who held that having allowed Mumbai oil prices, for instance, to rise from Rs 76.98 per litre around September 8 to Rs 87.73 per litre on October 10, there was no case for Mr Arun Jaitley to take credit for a Rs 2.50 cut while forcing states, already in financial straits, to forgo their earnings.

Advertisement

Whilst supporters from his own party agonized over the pre-election promises on the oil front and suggested that Mr Jaitley take recourse to every means at his disposal to get it down to at least Rs 68-Rs 69 because “elections were important too”, the fact remained that in getting the state-owned oil marketing companies (OMC) to take a hit in earnings and in share value, Mr Jaitley hammered a nail into the economic coffin, as it were.

Advertisement

The combined OMC loss of Rs 39,000 crore in market capitalisation last week, accompanied by an 800-point drop in the BSE Sensex and the rupee sinking to new lows have the economy gasping. Worse may follow with the net collective OMC hit in the next two quarters estimated at Rs 9,000 crore.

The larger question is how it all impacts the fiscal deficit because the government cannot possibly handle twin deficits; the current account deficit (CAD) is already daunting. Moody’s has gone public with a projected slippage vis-à-vis fiscal deficit from 3.3 per cent to 3.4 per cent, following the fuel excise duty cut. Given the palpable headwinds on the external front, the convoluted trade regime, India’s worrisome debt burden ~ private debt in 2017 at 54.5 per cent of the GDP and general government debt at 70.4 per cent ~ the walls are closing in on the economy.

Though its external debt was pared down a little to $ 514395 million in the second quarter of 2018 from the all-time high of $ 529673 million in the first and the IMF consoled that advanced economies have worse debt positions, the $222 billion of short-term debt (August 2018), that will consume about half of India’s forex reserves, come up for maturity this fiscal year.

Should Mr Jaitley not prepare the country for the much-dreaded twin deficits, the CAD being the worse of the two with even optimistic assessments saying that oil will not ease before 2019 and monthly trade deficits read (-) $18-19 billion. India’s faint hope of keeping the CAD within three per cent of the GDP lies in a massive inflow of overseas funds that, like all fair-weather friends, are seeking safer shores.

Advertisement