NABARD’s solar project helps tribal families in Alipurduar

The project, sanctioned during February, was completed in August.

The only way to inoculate the nation’s fiscal and macroeconomic stability against the virus of political expediency is to build an architecture of fiscal rules backed by setting up a truly independent Fiscal Council. We may draw the lessons from more than 90 countries across the globe, developed and developing both, which have instituted such architecture and are deriving the benefits thereof.

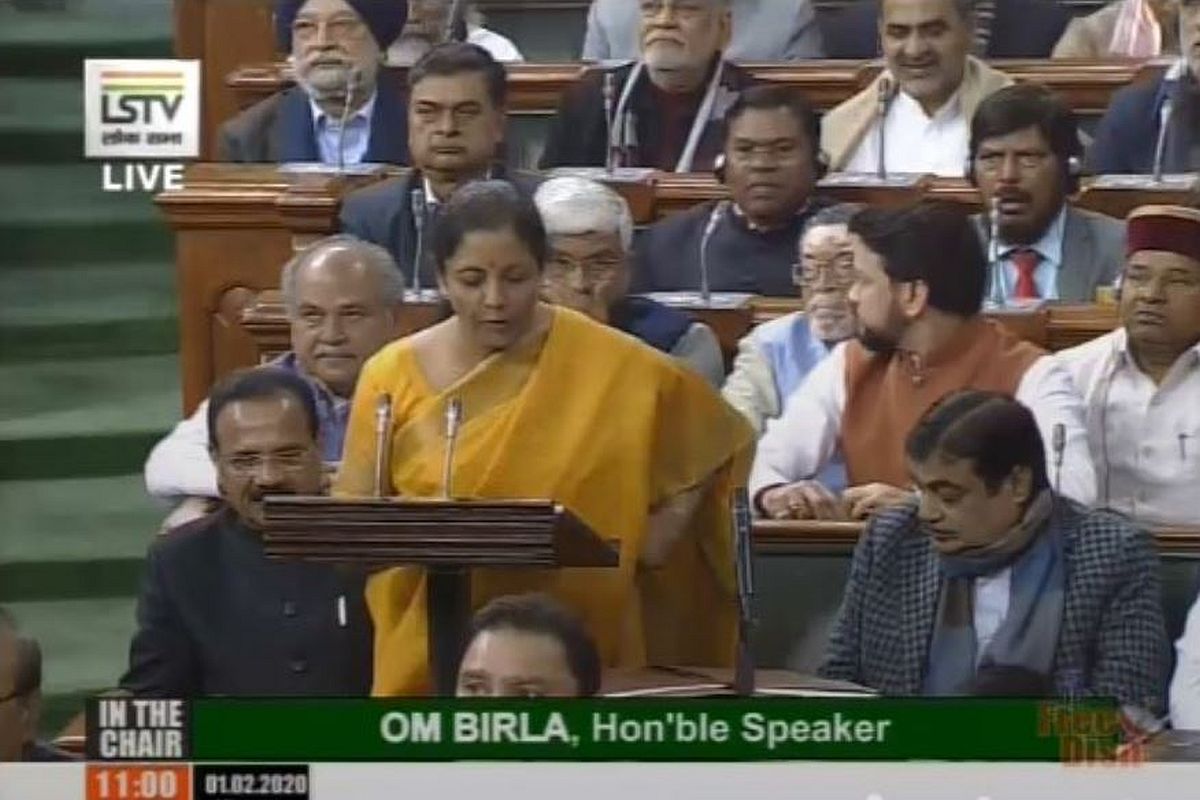

Finance Minister Nirmala Sitharaman presenting the Union Budget 2020 in Lok Sabha. (Photo: Twitter | @loksabhatv)

On 1 February, the Finance Minister (FM) will present her second budget in Parliament. The budget will predictably include the promise of many new schemes for the welfare of the poor, whose financing will remain rather opaque. The FM will endeavour to present the rosiest possible picture of the economy amidst the encircling economic gloom, with all core sectors, investments, consumption, imports and exports pointing unmistakably to a downturn, reflected in the suboptimal growth and shrinking jobs, and the dream of a $ 5-trillion dollar economy looking ever more distant.

We know that the FM does not wield a magic wand to produce miracles, but we do expect that she will present an honest and transparent budget with numbers depicting facts and not fantasy. India’s record of fiscal marksmanship ~ the reliability and accuracy of budget estimates ~ in indeed very poor. The gross fiscal deficit (GFD) projected in the budget continues to be hugely understated due to the enormous off-budget borrowings of the government to finance both its revenue as well as capital spending. These offbudget financing with serious fiscal consequences does not enter the calculation of GFD.

Advertisement

As the CAG pointed out in his Report No. 20 of 2018, the government had used borrowing outside the budget along with creative accounting to severely understate the GFD. Taking advantage of the cash basis on which government accounts are compiled ~ that is, recognition of receipts and expenditure only when they actually materialise and not when they accrue ~ the government had delayed payment of subsidy of thousands of crore of rupees on account of food and fertiliser through special banking arrangements, thereby transferring the current year’s expenditure into the next year.

Advertisement

Once the payment of subsidy, a committed revenue expenditure for the year, is carried over onto the next, the cash flow of the food and fertiliser companies like the FCI is seriously affected, who in turn are forced to borrow from the market at high cost, making the subsidy actually much costlier. In the process, the deficit of the government is passed onto these companies, pushing them into the red. Similarly, the implementation of the Accelerated Irrigation Benefits Programme schemes was financed through borrowings by NABARD. The success of the much-touted Ujjwala scheme depended much on the support of Oil Marketing PSUs.

Even capital projects in railways and power sectors were financed through borrowings by the stateowned Indian Railway Finance Corporation and the Power Finance Corporation respectively, outside the budgetary grants. To reduce the GFD, railway freight was collected in advance from PSUs like Coal India and NTPC as current receipts, which will obviously cascade into a bigger problem next year. If all these off-budget borrowings were included in the fiscal deficit as they should be, the deficit would increase by almost 2 per cent from 3.5 per cent of the GDP as shown in 2016-17, or, by more than Rs 3 lakh crore. Attempts at window-dressing the budget is nothing new.

Indeed, overstating revenue estimates and understating the expenditure estimates have long been a disturbing feature not only of the Union budgets, but equally of all state budgets. Fiscal prudence always becomes an inevitable casualty in the hands of politicians. International credit rating agencies frown at such fudging of budget figures with consequent impact on the foreign investments coming into India. To enforce discipline in our public finances, the Government had enacted the Fiscal Responsibility and Budget Management Act (FRBMA) in 2003, setting targets for its outstanding liability, fiscal deficit and revenue deficit as a percentage of the GDP.

But successive governments showed no enthusiasm to arrest their populist expenditure which naturally surged before every election; hence the FRBMA was amended repeatedly to defer the targets. Unable and unwilling to contain the revenue deficit within the FRBMA targets, the Government invented the so-called “Effective Revenue Deficit” in the 2011-12 budget, deducting capital grants from the revenue deficit. This was all bogus; the CAG found that in respect of Central schemes like MNREGS or MPLAD, the expenditure on procurement for maintenance which had nothing to do with creation of capital assets has been treated as such.

The government’s managers use all kinds of creative accounting and below-the-line, off-the-line adjustments to hide the actual deficit figures. Higher deficit means higher borrowings, which are made not only in the Consolidated Fund but also in the Public Account of India, which is a source of endless distortions and control weaknesses in our financial system. CAG had pointed out that the Public Account liability was understated by Rs 7.6 lakh crore (4.9 per cent of GDP) in 2016-17, which otherwise would have hiked the total liability of the Central Government to Rs 76.7 lakh crore, or 50.5 per cent of GDP, instead of 45.5 per cent as against the projection of 47.1 per cent in the Medium Term Fiscal Policy statement presented along with the budget for 2016- 17.

With an outstanding liability exceeding Rs 85 lakh crore or 45 per cent of the GDP in 2018-19, growing by 10 per cent annually, we must reckon debt as a serious problem facing the economy. Article 292 and 293 of the Constitution mandate the Central and state Governments respectively to enact laws imposing limits on their borrowings, but even after 70 years of running of the Constitution, neither the Centre nor any state has enacted any such law. The only Act imposing some restriction was the FRBMA which has been rendered into a junk by manipulations of the Centre. The only way to inoculate the nation’s fiscal and macroeconomic stability against the virus of political expediency is to build an architecture of fiscal rules backed by setting up a truly independent Fiscal Council.

We may draw the lessons from more than 90 countries across the globe, developed and developing both, which have instituted such architecture and are deriving the benefits thereof. The FRBMA 2003 which mandated the GFD to be reduced to three per cent by 2008-09 qualified as a fiscal rule till 2009, but has ceased to be so thereafter due to the ever shifting targets. Effective enforcement of fiscal rules requires strong financial reporting standards, credible budget reporting systems, and effective internal and external audit. A FRBM Review Committee constituted by the Government in 2016 had suggested a set of benchmarks including reducing the GFD to 3 pere cent, along with creation of a Fiscal Council.

Identifying debt as the new anchor and the ultimate objective of fiscal policy, it recommended the Debt to GDP ratio as a medium-term anchor for fiscal policy and considered a debt ceiling combined with fiscal deficit to provide a robust fiscal framework for India. Without acting on its suggestion of Fiscal Council, the government adopted the other recommendations and amended the FRBM framework through the Finance Act of 2018. It made 3 per cent fiscal deficit as the key operational target to be achieved by FY-21, abolished the targets for Revenue Deficit and hence Effective Revenue Deficit, and included Primary Deficit (GFD minus interest payment) as a fiscal indicator. A ceiling of 60 per cent of GDP, 40 per cent for the Centre’s and 20 per cent for the States’ debt by FY-25 was also adopted, with 5 per cent combined fiscal deficit for the Centre and the states in the medium-term.

The scope of Central debt was expanded to include liabilities in the Public Account plus the financial liabilities of PSUs owed by the Centre. The escape clauses on which deficit targets would be allowed to be breached would include national security, war, national calamity, collapse of agriculture, structural reforms in the economy or decline in real output growth, but no deviation from the GFD target should exceed 0.5 per cent of the GDP. This is once again likely to be junked in view of the precariousness of the government finances, or manipulated through other mechanisms like creative accounting or windowdressing of the budget.

The fiscal deficit for the current year is likely to exceed the 3.3 per cent projected in the last budget due to revenue as well as disinvest collections falling far short of the targets, and is likely to rise further in a slowing economy in the next year. Hence our pleas to the FM are: (1) Present an honest budget depicting all off-budget borrowings and their impact on the GFD; (2) Bring a Constitutional Amendment imposing limits upon the borrowing that cannot be tampered through frequent FRBMA-type amendments; and (3) Announce the creation of an independent Fiscal Council where the government representatives would not constitute a majority.

(The writer is a commentator. Opinions are personal)

Advertisement