While the proportion of elderly population is growing in India, and also there is an increasing drive to enhance cashless and digital transactions, people are becoming dependent on financial institutions, mainly banks. Many older adults seem to like to continue banking with Public Sector Banks while the younger generation is inclined towards private banks. While the need for service provision in public sector banks is therefore going up, over the last few years many PSU banks have been merged and reportedly staffing has come down creating a deficit in service provision. There are announcements of service delivery at doorstep particularly for senior citizens by some banks, but this it seems has not yet implemented.

Ageing is associated with general slowing in movement, thinking and processing of information, in addition to difficulties in vision or hearing. The aged also have difficulty in walking, and standing for longer periods. Many suffer from physical ailments like diabetes, hypertension and other diseases affecting the blood vessels mainly those carrying blood to the heart and brain. Along with these, many take medications and need to make regular visits to the hospitals, for check-ups and blood tests, for which they need to perform money transactions. Transportation could be another issue.

Advertisement

With all these difficulties that elderly people have, one cannot expect them to learn to do online banking or on their smartphones by themselves. They have also got the daunting task of remembering many passwords, which if it forgotten lead to a cascade of events that need resolving, resulting in delay in completing even simple financial transactions. This only adds to mental fatigue and causes more stress.

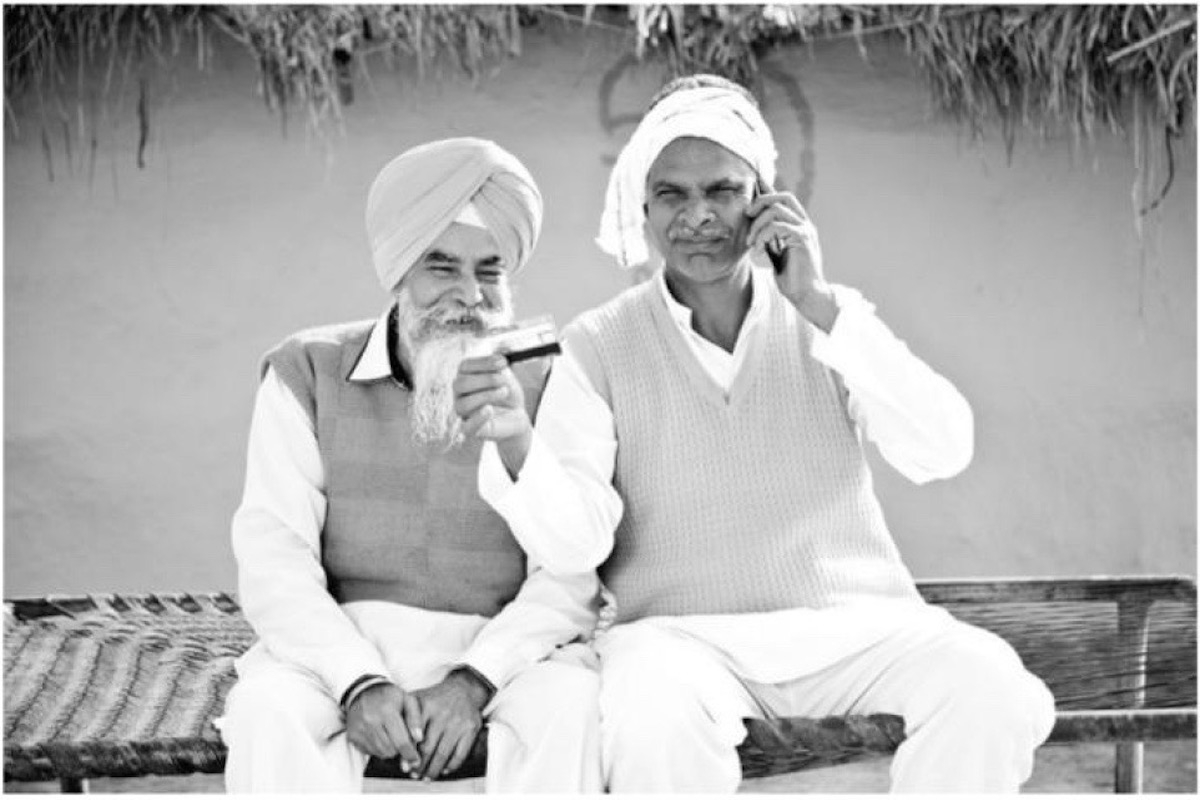

Society needs to find answers to a pressing question. Who is responsible to train its senior citizens to use computers, web programs and latest technology? One wonders if the senior citizen representation or relevant NGOs were consulted before implementation of the online system. If this is mostly the issue in urban areas, one can imagine the service provision in rural areas. Society cannot expect its senior citizens to learn the skills of performing online banking and transactions to the same extent it expects this from the younger generation. The staff members at banks seem to be unable to patiently sit with elderly persons to assist them in learning to do online banking every time.

There are just one or two NGOs offering free training for senior citizens in the use of smartphones, but hardly anyone is training them in online banking and financial transactions so as to create confidence. This means that senior citizens not just in rural areas, but also in urban areas unwillingly depend on their family members or relatives. This leaves room for financial exploitation.

Also, if elderly persons have undetected Mild Cognitive Impairment or have early signs of Dementia that affects their ability to manage finances, then there seems to be no system in place to assist or serve them in their best interest. If the wife of this person is dependent on his ability to manage finances and has to urgently pay for his medical bills, then it is nothing but running from pillar to post.

Many females belonging to the Baby Boomer generation are housewives with minimal education. Many of these female senior citizens hardly have skills to do normal banking, let alone the ability to do it online. Financial transaction is a very basic issue, the easier it is, the better for the elderly persons. Elderly females could try to equip themselves with skills to use the system, by learning with their husbands or their children. NGOs also must try and look to close this gap in digital literacy. Financial Institutions advisories focus mainly on making money out of money. Most likely they would be trying to secure already saved money and want to make easier and secure transactions.

There must be a separate Standard Operating Procedure for senior citizens in all banks. One comfortable counter with a dedicated, sensitized and well-trained staff member must be available for senior citizens. If needed, the bank should arrange home visit services. The bank environment must be made age friendly similar to what exists for the differently- abled people. All staff members should be sensitized and trained in terms of customer care skills including communication and soft skills in this respect. Financial institutions and the State must focus beyond just perks in terms of higher rate of interest for Fixed Deposits as it is entirely their intention to make transactions mostly digital. Such measures will enhance social support, reduce stress, and thus promote mental health of older adults.

The writer is a Bengaluru-based Consultant Psychiatrist with experience in Geriatric Psychiatry & Dementia.