Cabinet increases minimum support price for raw jute by Rs 315

The Union Cabinet has increased the minimum support price (MSP) for raw jute by Rs 315, setting it at Rs 5,650 per quintal for the 2025-26 marketing season.

Proposed to be effective from 1st April, 2025, the scheme has assured pension, which will be 50 per cent of the average basic pay drawn over the last 12 months prior to superannuation, for a minimum qualifying service of 25 years.

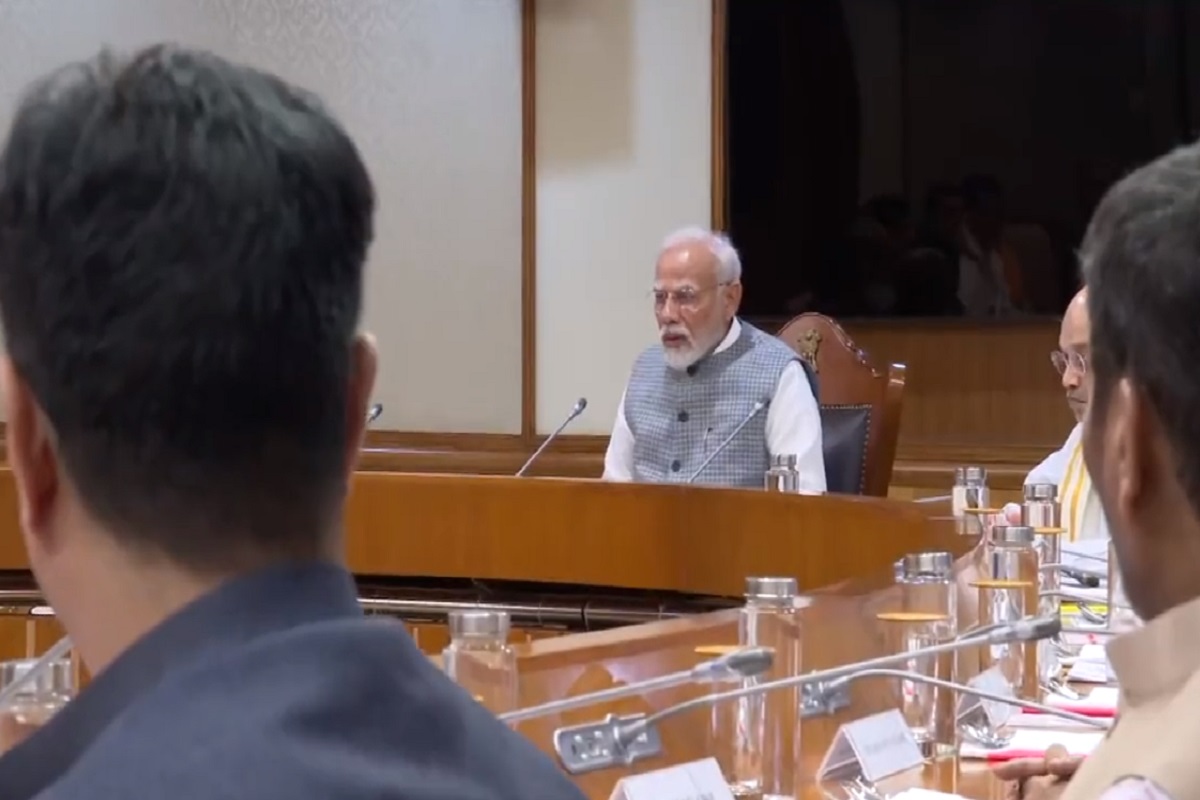

File Photo

The Union Cabinet, chaired by Prime Minister Narendra Modi, on Saturday approved a comprehensive Unified Pension Scheme (UPS) for its employees that will have an assured pension with inflation relief and greater contribution by the government.

Proposed to be effective from 1st April, 2025, the scheme has assured pension, which will be 50 per cent of the average basic pay drawn over the last 12 months prior to superannuation, for a minimum qualifying service of 25 years. This pay is to be proportionate for a lesser service period up to a minimum of 10 years of service.

Advertisement

The UPS will have an assured family pension which will be at 60 per cent of the pension of the employee immediately before her/his demise. It will also have assured minimum pension which will be at 10,000 per month on superannuation after minimum 10 years of service.

Advertisement

The scheme will have inflation indexation, on assured pension, on assured family pension and on assured minimum pension, Information and Broadcasting Minister Ashwini Vaishnaw told newspersons after the Cabinet meeting. The scheme will be fully-funded.

Cabinet Secretary-designate T V Somanathan who chaired a committee to prepare the scheme explained some of the features of the scheme. The committee was formed last year.

Employees’ representatives on the government-employees Joint Consultative Machinery (JCM) met the Prime Minister on Saturday and thanked him for the scheme finalized by the government.

The Dearness Relief will be based on All India Consumer Price Index for Industrial Workers (AICPI-IW) as in case of service employees.

The scheme has provision for a lump sum payment at superannuation in addition to gratuity. This will be 1/10th of monthly emoluments (pay+DA) as on the date of superannuation for every completed six months of service this payment will not reduce the quantum of assured pension.

The committee had consulted over 100 employee unions. The scheme has been prepared after employees demanded improvement in the current NPS.

The Central government’s 23 lakh employees will benefit from the schemes. The employees can opt to stay in the existing pension scheme NPS. The State governments are also free to use this architecture; if they join it will benefit their 90 lakh employees,

So far employees have been contributing 10 per cent in the scheme. This will continue. The Narendra Modi government had earlier increased the government’s share from 10 per cent to 14 per cent and this is being further raised to over 18.5 per cent. Mr Vaishnaw said the pension decision had no link to electoral politics.

The scheme will cost an expenditure due to arrears this year of Rs 800 crore. There will be Rs 6250 crore additional expenditure in the first year of the scheme. An annual increase is possible. There will be a re-assessment of the government’s contribution every three years.

Advertisement