The Stand Up India (SUPI) Scheme, launched on 5 April 2016 to promote entrepreneurship at the grassroots level focusing on economic empowerment and job creation, has been extended up to the year 2025.

Recognising the challenges that energetic, enthusiastic, and aspiring SC, ST and women entrepreneurs may face many in converting their dream to reality, the scheme was launched to promote entrepreneurship amongst women, Scheduled Castes (SC) & Scheduled Tribes (ST) categories, to help them in starting a greenfield enterprise in manufacturing, services or the trading sector and activities allied to agriculture.

Advertisement

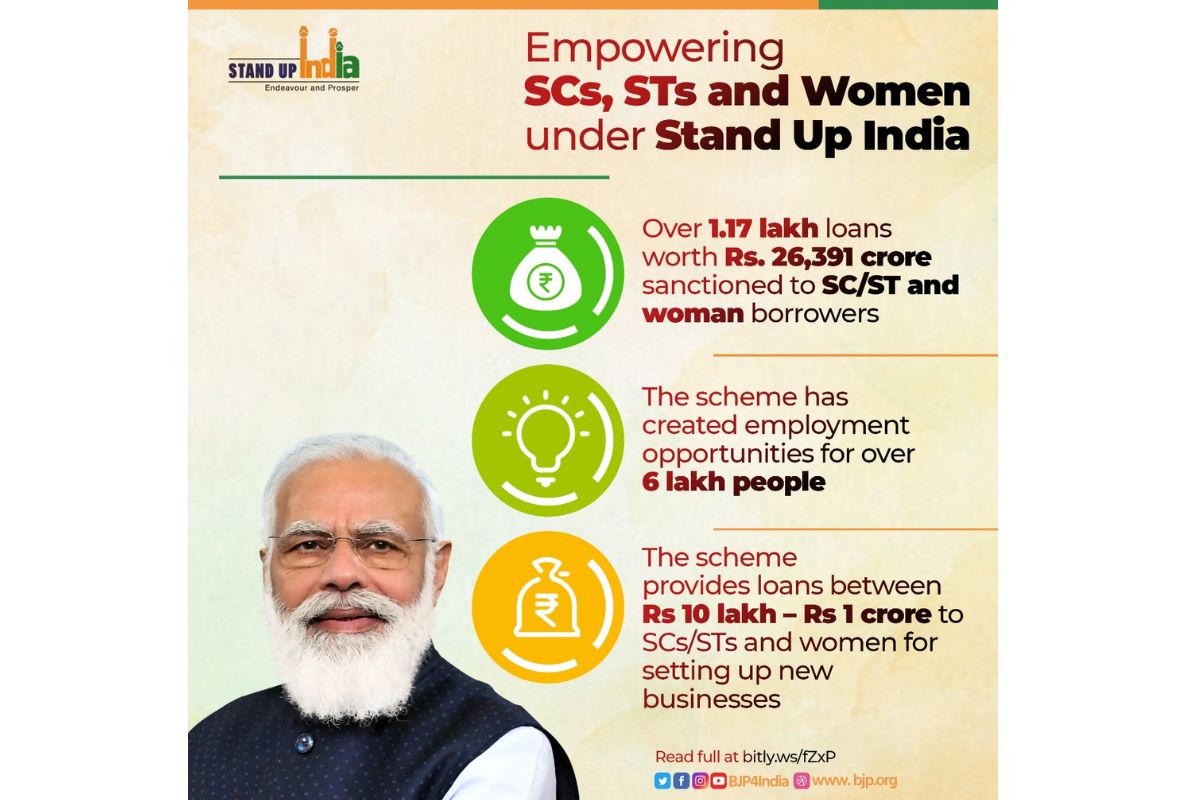

On the occasion, Union Finance Minister Nirmala Sitharaman said, “It is a matter of pride and satisfaction for me to note that more than 1.8 lakh women and SC/ST entrepreneurs have been sanctioned loans for more than Rs. 40,600 crore.”

“The scheme has created an ecosystem which facilitates and continues to provide a supportive environment for setting up green field enterprises through access to loans from bank branches of all Scheduled Commercial Banks. The Stand-Up India Scheme has proved to be an important milestone in promoting entrepreneurship among SC, ST and women,” Sitharaman said on the seventh anniversary of the SUPI Scheme.

She said the scheme has touched numerous lives by ensuring access to hassle-free affordable credit to the unserved/underserved segment of entrepreneurs. The finance minister said that the scheme has provided wings to aspiring entrepreneurs to showcase their entrepreneurial acumen and the potential entrepreneurs hold in driving economic growth and building a strong ecosystem by being job creators is immense.

Union Minister of State for Finance Bhagwat Kisanrao Karad said the scheme is based on the third pillar of the National Mission for Financial Inclusion namely Funding the unfunded. The scheme has ensured availability of seamless credit flow from branches of Scheduled Commercial Banks to SC/ST and women entrepreneurs. The scheme has been instrumental in improving the standards of living for entrepreneurs, their employees and their families.

The purpose of the scheme is to:

–promote entrepreneurship amongst women, SC & ST category;

–provide loans for greenfield enterprises in manufacturing, services or the trading sector and activities allied to agriculture; and

–facilitate bank loans between Rs.10 lakh and Rs.100 lakh to at least one Scheduled Caste/ Scheduled Tribe borrower and at least one woman borrower per bank branch of Scheduled commercial banks.