FinMin launches new credit assessment model for MSMEs

Union Finance Minister Nirmala Sitharaman, along with Minister of State for Finance Pankaj Chaudhary, on Thursday launched the New Credit Assessment Model for MSMEs.

In a major move just months ahead of the Lok Sabha elections 2019, the Centre removed six items from the 28 per cent bracket of Goods and Services Tax (GST) regime on Saturday.

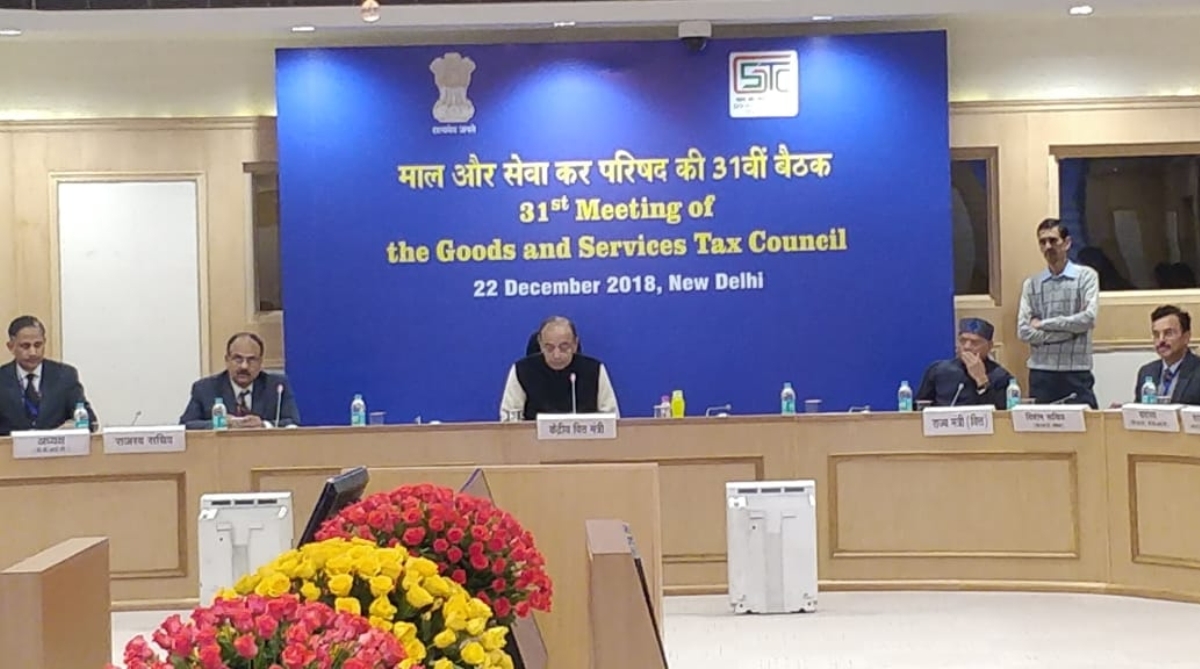

Union Finance and Corporate Affairs Minister Arun Jaitley chairs the 31st GST Council Meeting at Vigyan Bhawan in New Delhi, on Dec 22, 2018. (Photo: IANS/MoF)

In a major move just months ahead of the Lok Sabha elections 2019, the Centre removed six items from the 28 per cent bracket of Goods and Services Tax (GST) regime on Saturday. Following the decision, only 28 items remain in the 28 per cent bracket of the GST.

After chairing the meeting of the 31st GST Council at Vigyan Bhavan in New Delhi, Finance Minister Arun Jaitley said that all the items on which GST of 28 per cent is applicable are luxury items. The 28 per cent bracket is the highest of the four slabs in the GST.

Advertisement

“There are 28 items left in the 28% bracket if we include luxury and sin items,” said Jaitley.

Advertisement

“Of the 28, 13 items are from automobile parts and 1 is cement. Cement’s revenue is Rs 13,000 crore and automobile parts revenue is Rs 20,000 crore. If they are brought down from 28% to 18% implications are of Rs 33,000 crore,” he said.

Jaitley said that Law Fitment Committee will take a view on GST on real estate in the next meeting.

“There is a consensus that something needs to be done on this,” he added.

What’s out of the 28 per cent slab?

GST on monitors and television screens, tyres, power banks of Lithium-ion batteries down from 28% to 18%.

Movie tickets up to Rs 100 brought down to 12% and above Rs 100 brought down to 18% from 28%.

Other reductions

Accessories for carriages for specially-abled persons brought down to 5%.

Services supplied by the banks to Jan-Dhan account holders to be exempted from GST.

The Finance Minister said that there will be no GST cut on cement and auto parts. He added that today’s GST rate reduction will have an overall impact on revenue of Rs 5,500 crore.

Jaitley said that the new GST rates will be come into effect from 1 January 2019.

The decision to slash GST rates comes after Prime Minister Narendra Modi on Tuesday pledged a further rationalisation of the GST to ensure that items of regular use won’t face the top 28 per cent rate.

“All things related to common man will be 18 per cent or below that… 99 per cent articles will be 18 per cent or below 18 per cent rate,” he said, adding that GST should be made as simple and as convenient as possible. That could mean cement, marble, air conditioners, dishwashers and other items becoming cheaper.

“I have already given my suggestion to the upcoming GST Council because that (rate) is decided by all the states together,” PM Modi said in his address at a function in Mumbai.

The decision to slash the rates of movie tickets was welcome by film personalities.

Thanking the PM in a tweet, actor Anupam Kher wrote, “Superb news for #IndianFilmIndustry. Cinema tickets upto Rs. 100 which were under 18% GST slab is brought down to 12% slab. Tickets above Rs. 100 were under the 28% slab. These tickets will now be under 18% slab. Thank you PM @narendramodi & officials for this great decision.”

The 31st GST Council meeting has reportedly approved a proposal to form a 7-Member Group of Ministers to study the revenue trend, including analysing the reasons for structural patterns affecting the revenue collection in some of the states.

The study would include the underlying reasons for deviation from the revenue collection targets vis a vis original assumptions discussed during the design of GST system, its implementation and related structural issues.

Advertisement