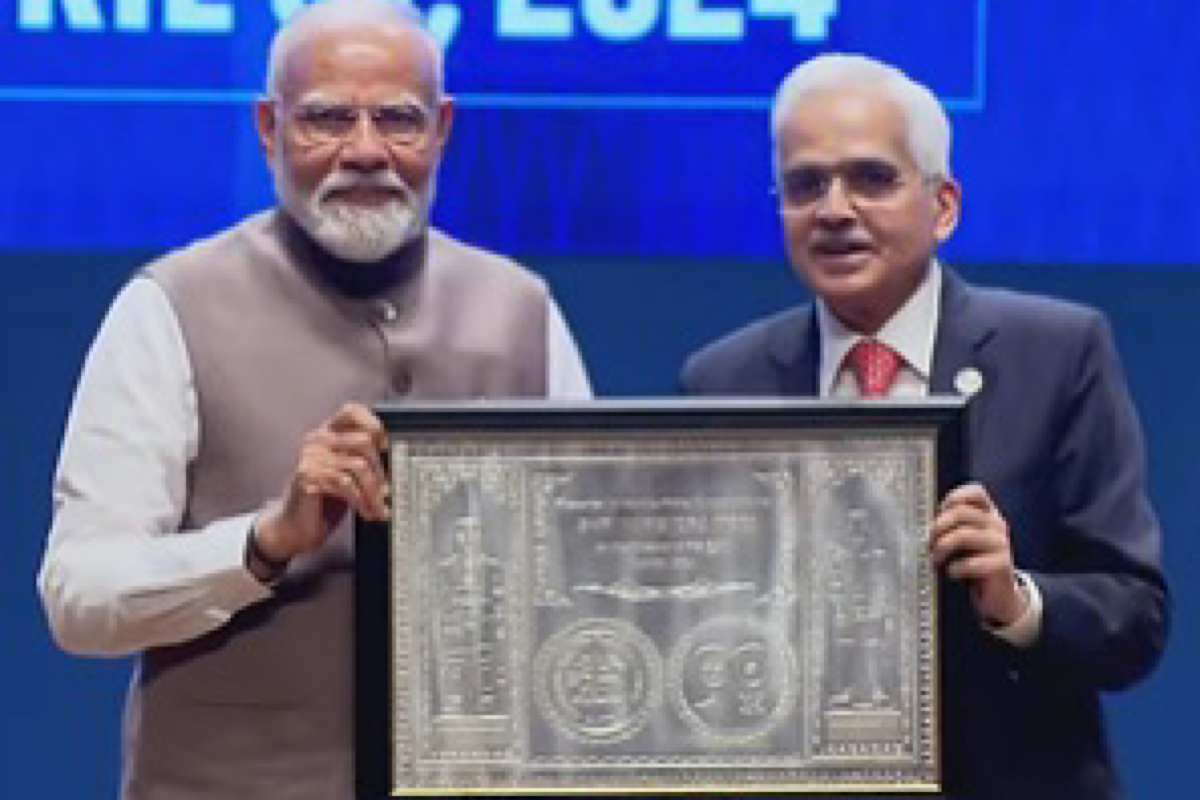

In the last 10 years, the government has highlighted the connection between central banks, banking systems and beneficiaries at the last queue, Prime Minister Narendra Modi said on Monday.

He was speaking at the opening ceremony of RBI@90, a programme marking 90 years of the Reserve Bank of India (RBI) in Mumbai.

Advertisement

On the occasion, PM also released a commemorative coin to mark the 90 years of RBI.

“RBI plays a pivotal role in advancing our nation’s growth trajectory,” he further said.

He pointed out that even though the discussions related to the RBI are often limited to financial definitions and complex terminologies, the work carried out at RBI directly makes an impact on the lives of common citizens.

Highlighting the reforms he mentioned that 55% of the 52 crore Jan Dhan accounts in the country belong to women. He also mentioned the impact of financial inclusion in the agriculture and fisheries sector where more than 7 crore farmers, fishermen and cattle owners have access to PM Kisan Credit Cards providing a significant push to the rural economy.

Referring to the boost for the cooperative sector in the past 10 years, PM threw light on the importance of regulations of the Reserve Bank of India regarding cooperative banks. He also mentioned more than 1200 crore monthly transactions via UPI making it a globally recognized platform.

Touching upon the work being done on Central Bank Digital Currency (CBDC), PM said that the transformations of the past 10 years have enabled the creation of a new banking system, economy and currency experience.

The Prime Minister recalled the 80-year celebration of RBI in 2014 and remembered the challenges and problems like NPA and stability faced by the banking system of the country at that time.

Starting from there, today we have reached a point where the Indian banking system is being seen as a strong and sustainable banking system of the world as the near moribund banking system of that time is now in profit and showing record credit, he said.

The Prime Minister credited clarity of policy, intentions and decisions for this transformation.

“Where intentions are right, results too are correct”, said the Prime Minister.

Speaking on the comprehensive nature of reforms, the Prime Minister stated that the government worked on the strategy of recognition, resolution and recapitalization.

A capital infusion of 3.5 lakh crore was undertaken for the helping public sector banks along with many governance-related reforms. Just the Insolvency and Bankruptcy Code has resolved loans amounting to Rs 3.25 lakh, PM Modi pointed out.

He also informed the country that more than 27,000 applications involving underlying defaults of more than Rs 9 lakh crore were resolved even before admission under IBC.

Gross NPAs of banks that stood at 11.25% in 2018 came down to below 3% by September 2023. He said that the problem of twin balance sheets is a problem of the past.

PM also emphasized the importance of clarity for the targets of the next 10 years. He pointed out the importance of keeping an eye on the changes brought about by the cashless economy while promoting digital transactions, and stressed the need for deepening financial inclusion and empowerment processes.

PM Modi also stressed increasing the economic self-reliance of India in the next 10 years so that the impact of global issues is mitigated.

“Today, India is becoming the engine of global growth with 15% share in global GDP growth”, PM Modi remarked.

He emphasized the efforts to make rupee more accessible and acceptable throughout the world.

PM further underlined the importance of a strong banking industry for providing required funding to the projects of the nation.