Modi, Ramgoolam jointly inaugurate Atal Bihari Vajpayee Institute of Public Service and Innovation in Mauritius

Prime Minister Narendra Modi and Mauritius Prime Minister Navinchandra Ramgoolam, on Wednesday, jointly inaugurated the Atal Bihari Vajpayee Institute of Public Service and Innovation in Reduit, Mauritius.

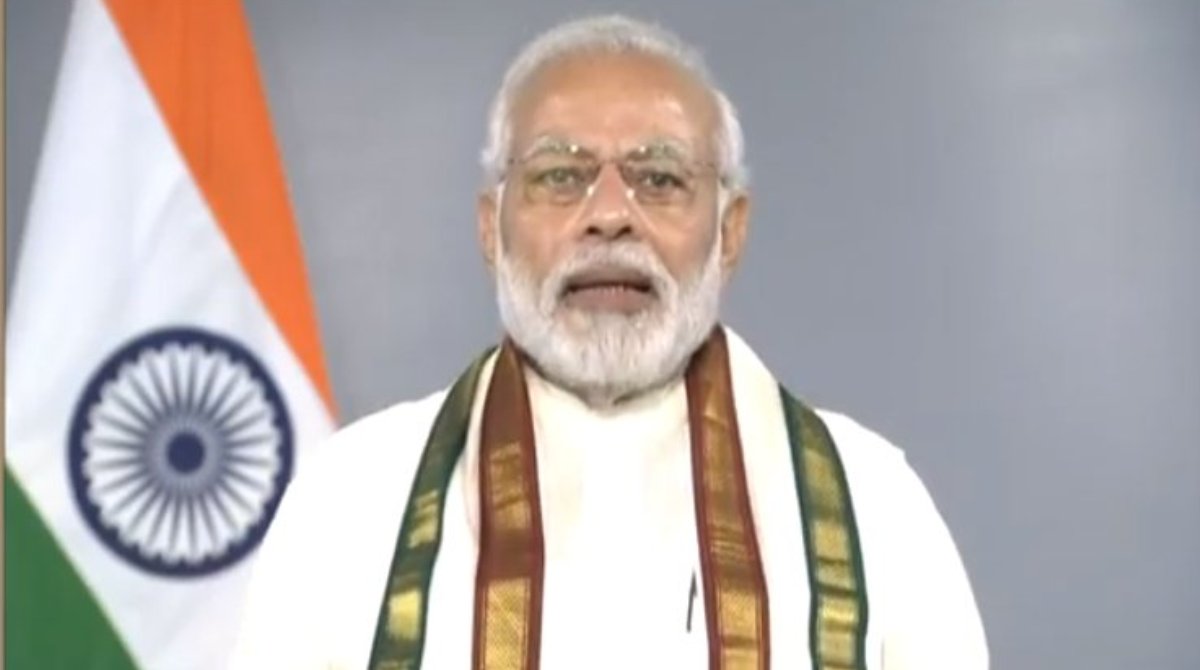

Prime Minister Narendra Modi will tomorrow launch the India Post Payments Bank (IPPB) that seeks to leverage the expansive network of the postal department to ensure financial inclusion for the masses.

The event is scheduled to be held at Talkatora Stadium in New Delhi, along with simultaneous launch events at 650 branches and 3,250 access points that will go live tomorrow, an official statement said.

Advertisement

“IPPB has been envisioned as an accessible, affordable and trusted bank for the common man, to help speedily achieve the financial inclusion objectives of the Union Government,” it added.

Advertisement

The payments bank, where the Indian government holds 100 per cent equity, will leverage the vast network of the Department of Posts (DoP) that has more than three lakh postmen and Grameen Dak Sewaks.

All the 1.55 lakh post offices in the country will be linked to the IPPB system by December 31, 2018.

IPPB will, hence, significantly augment the reach of the banking sector in India, the statement said.

IPPB will offer a range of products such as savings and current accounts, money transfer, direct benefit transfers, bill and utility payments, and enterprise and merchant payments.

These products, and related services, will be offered across multiple channels (counter services, micro-ATM, mobile banking app, SMS and IVR), using the bank’s state-of-the-art technology platform.

Earlier this week, the cabinet had approved 80 per cent increase in spending for IPPB to Rs 1,435 crore, a move that will arm it with additional ammunition to compete aggressively with existing players like Airtel Payments Bank and Paytm Payments Bank.

The revised cost estimate was on account of costs related to technology (Rs 400 crore) and human resource expenses (Rs 235 crore), a statement had said.