NDMC Vice-Chairperson Chahal conducts inspection of Khan Market

New Delhi Municipal Council (NDMC) Vice-Chairperson Kuljeet Singh Chahal conducted an inspection of Khan Market here on Sunday.

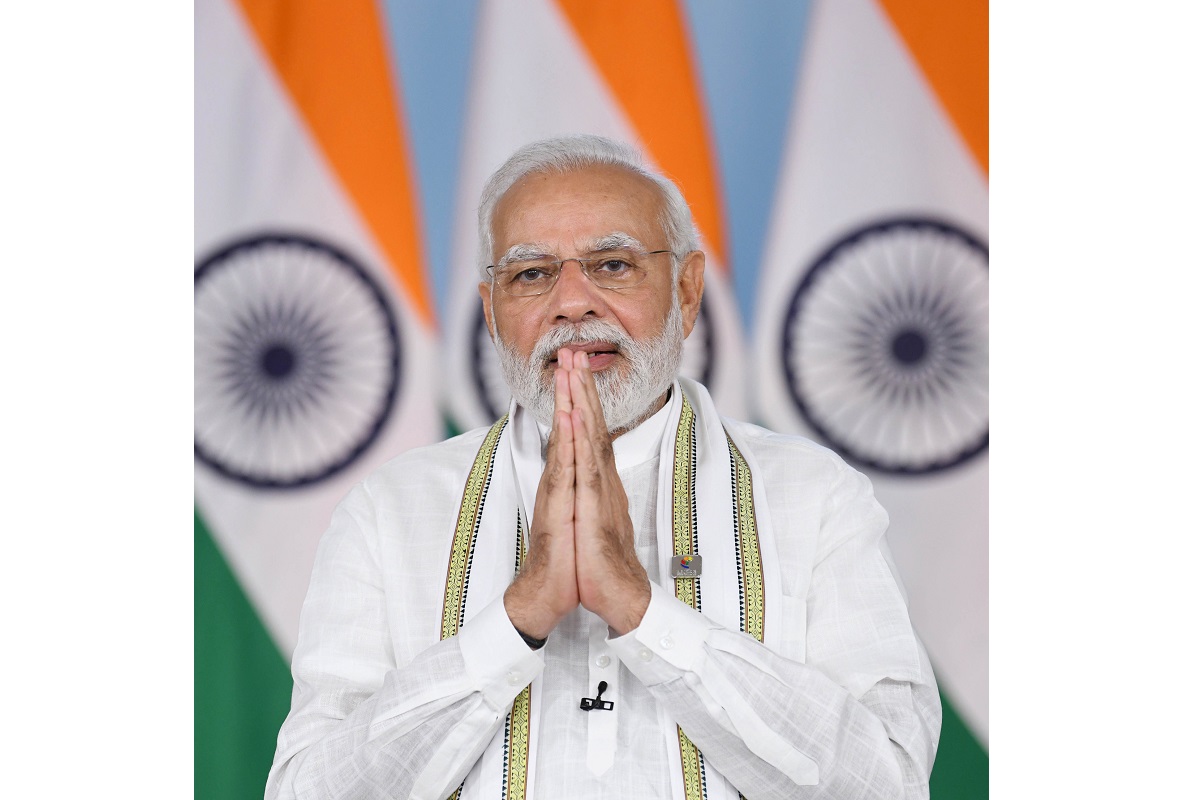

Narendra Modi said that the GST has furthered ‘Ease of Doing Business’ and fulfilled the vision of ‘One Nation, One Tax’.

(ANI Photo/PIB)

Prime Minister Narendra Modi, on Friday, lauded the Goods and Services Tax (GST) on the completion of five years of the tax regime. He said that GST has furthered ‘Ease of Doing Business’ and fulfilled the vision of ‘One Nation, One Tax’.

In response to a tweet by MyGovIndia, the Prime Minister said, “We mark #5YearsofGST, a major tax reform that furthered ‘Ease of Doing Business’ and fulfilled the vision of ‘One Nation, One Tax.’”

Advertisement

“GST has played a key role in defining #NewIndia’s economic structure and empowering citizens!” MyGovIndia had said in a tweet.

Advertisement

The Union Government, through the GST taxation system, intended to introduce uniform taxes across the country, besides transparency, accountability, and a simpler registration process.

The GST was introduced in the country with effect from 1st July, 2017 and states were assured compensation for loss of any revenue arising on account of implementation of GST as per the provisions of the GST (Compensation to States) Act, 2017 for a period of five years.

For providing compensation to the states, a cess is levied on certain goods and the amount of cess collected is credited to the compensation fund. Compensation to states is being paid out of the compensation fund with effect from 1st July 2017.

In the recently concluded GST Council meeting held in Chandigarh, several states have sought an extension of the compensation at least for a few years, if not for five years. Any decision is yet to be taken.

Advertisement