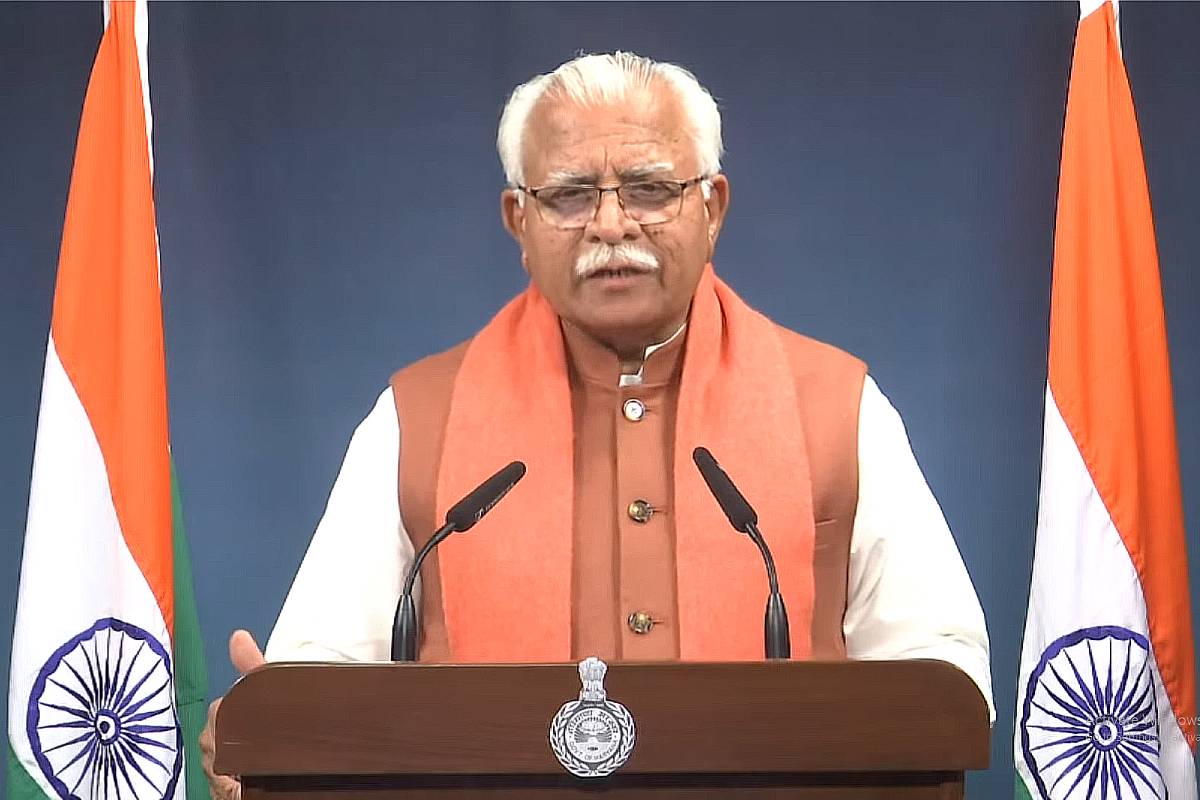

No fresh taxes have been imposed in the state budget presented by the Haryana Chief Minister Manohar Lal Khattar, who also holds the portfolio of finance minister, on Thursday.

Presenting a budget of Rs 1,83,950 crore, the biggest in the state’s history, the Khattar said in this year’s budget, there is an increase of 11.6 per cent over Revised Estimates 2022-23 of Rs 1,64,808 Crore.

Advertisement

The chief minister said with the inclusion of Haryana Parivar Suraksha Nyas, one lakh houses for Antyodaya families, extension of CHIRAYU-Ayushman Bharat Yojana benefits for families with annual income up to Rs 3 lakh, increase in social security pension from Rs 2,500 to Rs 2,750 and eligibility income increased from Rs 2 lakh to Rs 3 lakh, welfare of every section has been ensured.

He said he has aligned the Budget allocation with Sustainable Development Goals (SDGs). An outlay of Rs 1, 20,958 Crore of total expenditure of Rs 1,83,950 Crore being 65.8 per cent has been mapped for the schemes aimed at achievement of SDGs being implemented in the state.

The chief minister said an outlay of Rs 57,879 crore, which is 31.5 per cent, and Rs 1,26,071 crore, which is 68.5 per cent, have been proposed for the creation of capital assets in the budget.

The finance minister said the growth rate of Gross State Domestic Product (GSDP) of the state is estimated to be 7.1 per cent in the year 2022-23. He said the national per capita income at current prices was Rs 86,647 in 2014-15, which is likely to increase to Rs 1,70,620 in 2022-23, whereas for Haryana, it has increased from Rs 1,47,382 in 2014-15 to Rs 2,96,685 in 2022-23.

He informed that in budget estimates 2023-24, revenue receipt at Rs 1,09,122 Crore, comprising tax revenue of Rs 75716 Crore and Rs 12651 Crore as non-tax revenue have been projected. The share of Central tax is Rs 11,164 Crore and grant-in-aid is Rs 9,590 Crore. Besides this, capital receipt of Rs 71173 Crore has been projected.

Khattar said fiscal deficit has been contained at 3.29 per cent of GSDP in Revised Estimates (RE) 2022-23 as against the permissible limit of 3.5 per cent of GSDP. For 2023-24, fiscal deficit of 2.96 per cent of GSDP is projected which is within the allowed limit.