New tax bill is a facelift, not a fix

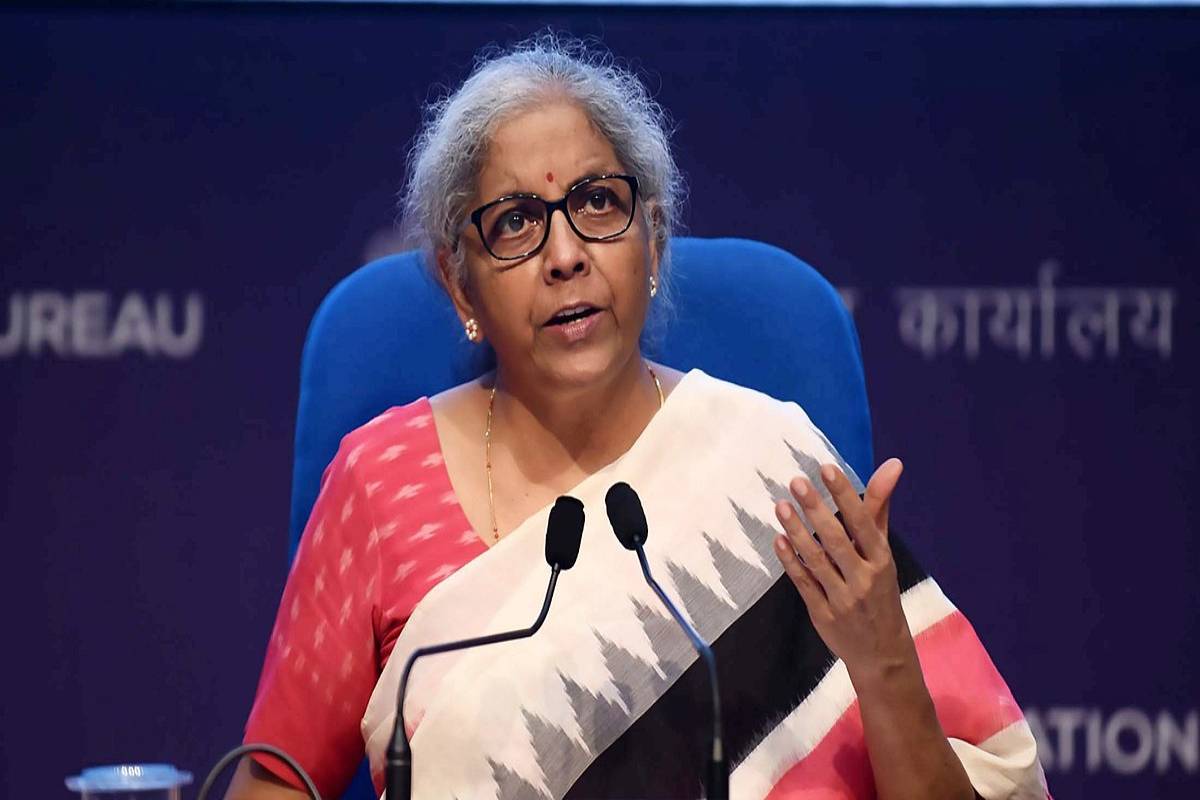

Finance Minister Nirmala Sitharaman’s recent tabling of the Income Tax Bill, 2025, marks a significant shift in India’s tax landscape.

Loans given to persons belonging to the SC community by the banks as well as under various loan schemes, such as Stand up India and Pradhan Mantri Mudra Yojana will be reviewed in the meeting.

Budget 2023-24: Sitharaman chairs first consultation with industry leaders, experts

Finance Minister Nirmala Sitharaman will review the performance of credit and other welfare schemes for Scheduled Castes (SCs) in public sector banks on Tuesday.

Loans given to persons belonging to the SC community by the banks as well as under various loan schemes, such as Stand up India and Pradhan Mantri Mudra Yojana will be reviewed in the meeting. “Credit given to persons belonging to the Scheduled Caste community by the banks as well as under various loan schemes such as Stand up India, Pradhan Mantri Mudra Yojana, National Rural Livelihood Mission (NRLM), National Urban Livelihoods Mission (NULM), Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), Education Loan, Credit Enhancement Guarantee Scheme for Scheduled Castes (CEGSSC), Venture Capital Fund for SCs etc will be reviewed in the meeting,” the ministry said.

Advertisement

According to the Ministry of Finance, the meeting which would take place in New Delhi will be attended by Ministers of State (MoS) for Finance Pankaj Chaudhary and Bhagwat Kisanrao Karad and Department of Financial Services Secretary Sanjay Malhotra.

Advertisement

The Chairman, the National Commission for Scheduled Castes (SCs) and heads of Public Sector Banks and Financial Institutions like Small Industries Development Bank of India (SIDBI) and the National Bank for Agriculture and Rural Development (NABARD) will also participate in the meeting.

The meeting would also review the measures undertaken for the welfare of Scheduled Castes in the banks. The review will focus on the reservation, backlog vacancies and action taken to fill up the same and the functioning of welfare and grievances redressal mechanism, including meetings with welfare associations, the appointment of chief liaison officers (CLOs), and the constitution of grievance redressal cell, among others.

Some of the loan schemes are National Rural Livelihood Mission (NRLM), National Urban Livelihoods Mission (NULM), Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), Education Loan, Credit Enhancement Guarantee Scheme for Scheduled Castes (CEGSSC), and Venture Capital Fund for SCs, among others.

The Government has launched various schemes specifically for Scheduled Castes that includes the Stand-Up India Scheme, Credit Enhancement Guarantee Scheme for Scheduled Castes (CEGSSC) and the Venture Capital Fund for Scheduled Castes.

Besides these schemes, the Government has emphasised on inclusive growth for all segments of society.

Advertisement