CM lauds tigress rescue

Chief Minister Mamata Banerjee has extended appreciation for the Chief Conservator of Forests for his role in capturing Zeenat, an escapee tigress of Similipal Tiger Reserve of Odhisa.

It might be income tax returns, certificates of the parents or details of the property held by the parents or any other proof of income source of the parents.

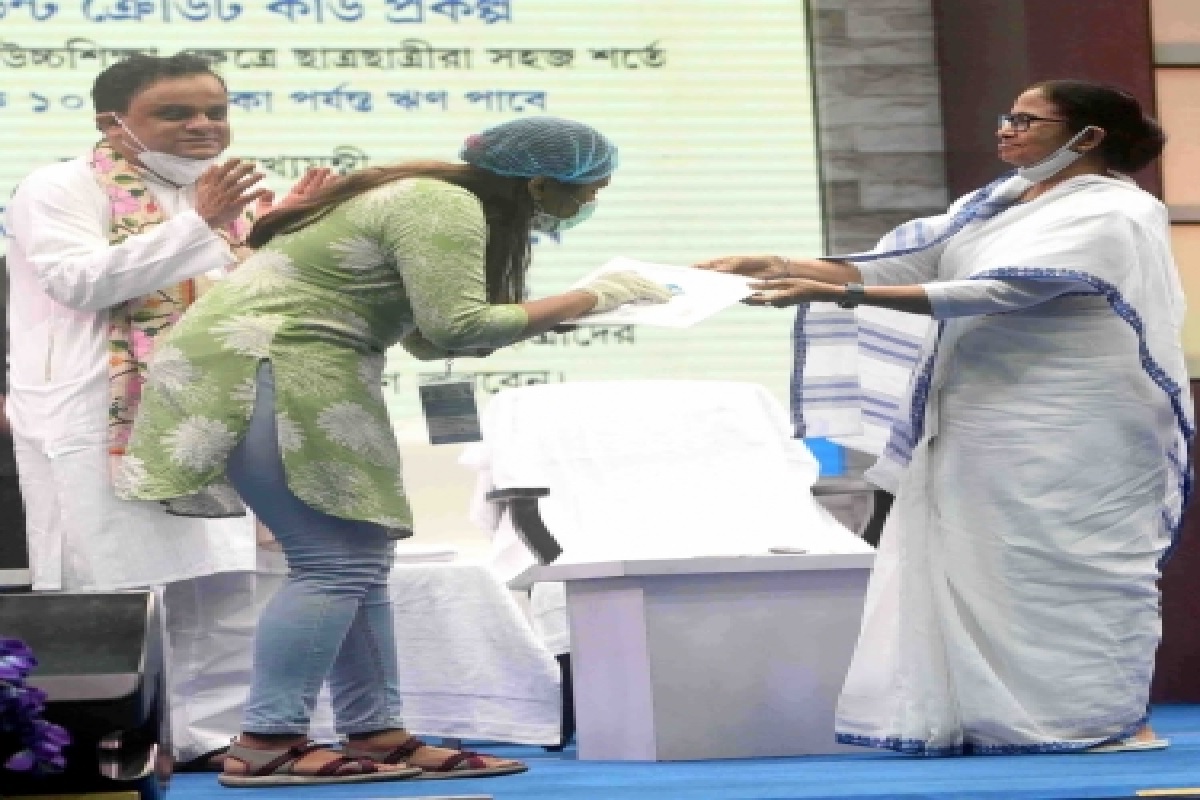

Photo: IANS

West Bengal Chief Minister Mamata Banerjee on Thursday snubbed the banks for insisting on submission of income certificates of the parents of the students applying for loans under the West Bengal Student Credit Card scheme.

“Some banks had been insisting on submission of income certificates of the parents. So, a feeling was being developed that submission of income certificates is mandatory for getting loans under the student credit card scheme. But we have reviewed the situation and said very clearly that submission of parents’ income certificates is not mandatory,” the Chief Minister said at a programme for distribution of students’ credit cards at Netaji Indoor Stadium in central Kolkata on Thursday.

Advertisement

A banking representative in the State Level Bankers’ Committee (SLBC), West Bengal, told IANS on condition of anonymity that whatever the Chief Minister might say, the loan applicant will have to submit some proof to justify the future loan-repayment probabilities.

Advertisement

“It might be income tax returns, certificates of the parents or details of the property held by the parents or any other proof of income source of the parents. The Reserve Bank of India’s guidelines are clear on this matter. On loan matters, individual banks too have some freedom of setting their own guidelines within the prescribed banking format in entertaining loan applications,” he said.

The Chief Minister’s contention is that when the state government is acting as the guarantor for such loans, the banks should not unnecessarily force other supporting documents like parents’ income certificates.

However, this logic has already been nullified by a number of bankers on two grounds. The first logic is that just a state government guarantee cannot be a 100 per cent assurance for sanction of bank loans, since a number of banks earlier have had bitter experiences where loan accounts with state government guarantees have turned into bad loans or non-performing assets.

The second logic is that if the loan amount is beyond a particular amount, then it needs a collateral security besides a guarantee.

As per records, since its launch soon after the state assembly elections last year, there had been around 1.25 lakh loan applications under the West Bengal Students Credit Card scheme. However, till date only around 18,000 such loan applications, which is just 14 per cent of the total, have been sanctioned.

Advertisement