RBI asks NBFCs to disclose total charges levied for loan products: Report

The Reserve Bank of India (RBI) has directed large non-banking financial companies (NBFCs) to disclose the total charges levied on customers for each loan product.

The House discussed the Finance (No 2) Bill, 2024, moved by Finance Minister Nirmala Sitharaman, along with the Union Budget, 2024-25.

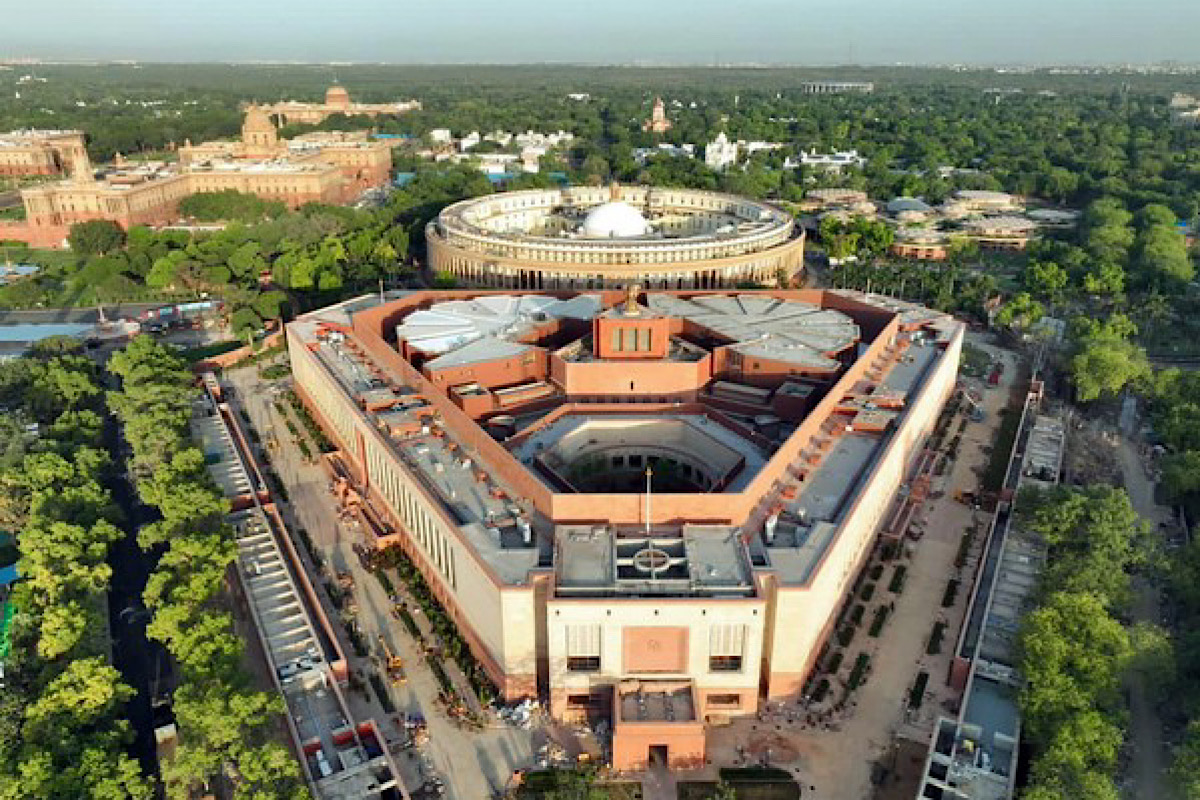

Visuals of Parliament Building (File Photo/ANI)

The Opposition in the Lok Sabha on Tuesday attacked the government’s taxation policy, stating that it had put heavy burdens on the middle and salaried classes, removed indexation benefit on property, placed heavy taxes on life and health insurance policies, while not sparing even equipment used by India’s vast community of farmers.

The House discussed the Finance (No 2) Bill, 2024, moved by Finance Minister Nirmala Sitharaman, along with the Union Budget, 2024-25.

Advertisement

Raising the discussion, Mr Amar Singh (Congress) said the Finance Bill spared the higher income categories, while the relief should have gone to low salaried people. In the new tax regime, the standard deduction was raised from Rs 50,000 to Rs 75,000, but all concessions under the old regime were discontinued.

Advertisement

He said the Budget had increased short and long term capital gains taxes. Salaries up to Rs 5 lakh should have been exempted under the Finance Bill, he said. The member said unemployment was rising and government should consider how many jobs corporates create when they get tax concessions.

The Punjab MP said more than 50 per cent population depended on agriculture but their income was just 18.4 per cent of the gross domestic product (GDP). The agriculture sector’s growth rate was just 1.4 per cent, and the farmers are seeking a law on MSP.

He said his constituency Fatehgarh Sahib included a place where sons of the 10th Sikh Guru were buried alive. Lakhs of people visit the place to pay tributes. The place should be on international tourist circuit and provided all facilities.

Ms Mahua Moitra (Trinamul Congress) said the Budget is a “kursi bachao budget” (saving the government budget). The changes made are regressive. People wanted a course correction but it was not done. The middle classes make up 31 per cent of India and the poor are 65 per cent of the country; both have suffered in the Budget.

She said 65 per cent of the government’s tax collections come from indirect taxes which are imposed on the rich and the poor equally, while just 35 per cent tax collections are made from direct taxes.

For the first time, she said, 55 per cent of the direct tax collections come from the salaried class while just 45 per cent from the corporates. Eighteen per cent taxation on insurance policies would deter people from investing in them.

If inflation was adjusted, there was 25 per cent reduction in the allocation for the social sector, she said. The government’s five top social sector schemes’ allocation was reduced to one-third since 2009-10. The number of people under coverage for ration had not increased for years.

Ms Moitra said Defence been given lowest amount in the Budget, just 1.9 per cent of the GDP. It should be two to three per cent of the GDP.

Ms Supriya Sule (NCP-Sharad Pawar) said if the government believed in cooperative federalism, it should share the cess collections with the States. She said tax on insurance policies should be withdrawn. She said the government had paid no heed to problems of EPS 95 scheme pensioners who lived on meagre pensions.

Advertisement