Delhi CM meets Amit Shah, seeks his guidance on working for Viksit Delhi

Gupta also sought suggestions from Shah on the execution plan of the BJP government regarding the preparation to deliver the promises made to the people of the city.

Shah in an interaction with NDTV cautioned against linking recent stock market fluctuations with the 2024 Lok Sabha elections.

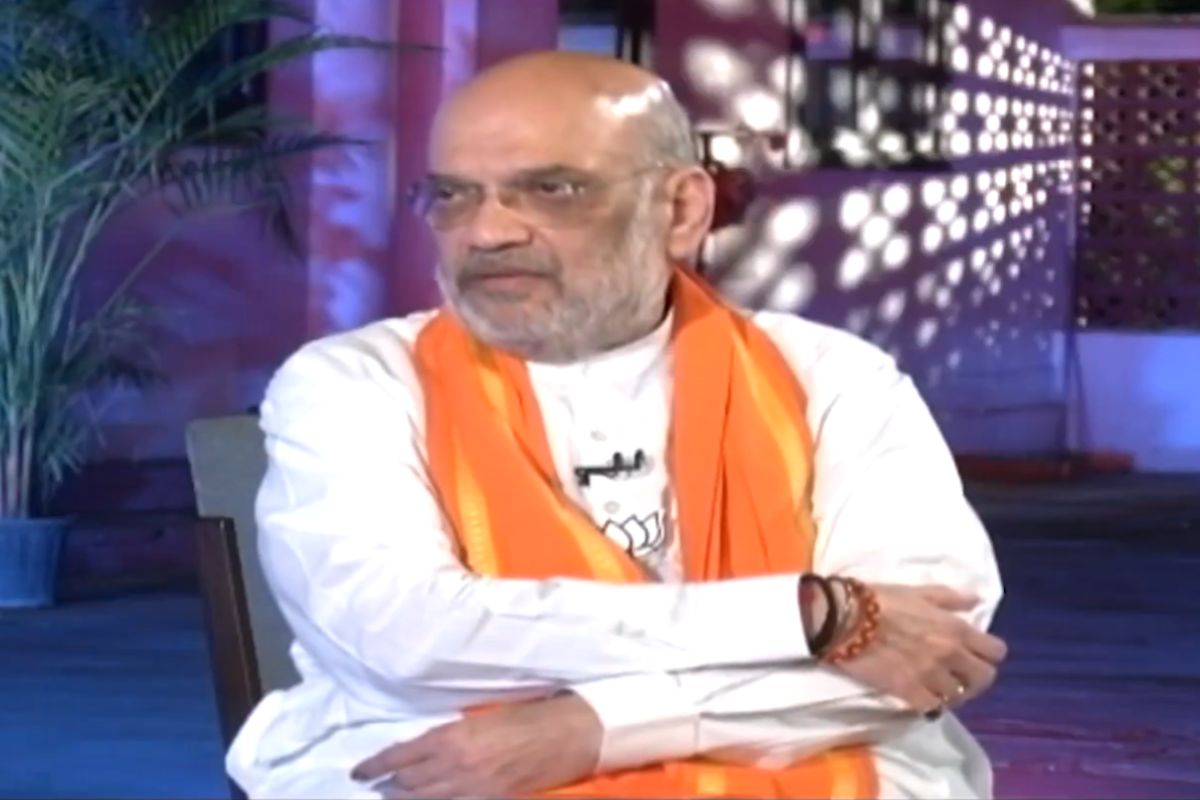

Photo: Amit Shah

In a sensational remark coming amid the stock market continuously trading in the red, Union Home Minister Amit Shah on Monday urged investors to consider purchasing stocks before June 4.

Shah in an interaction with NDTV cautioned against linking recent stock market fluctuations with the 2024 Lok Sabha elections.

Advertisement

The Home Minister expressed optimism, and forecast a surge in the domestic stock market.

Advertisement

“I can’t anticipate stock market moves. But normally whenever a stable government is formed at the Centre, the market sees a rally. I see 400-plus seat wins for the Bharatiya Janata Party, a stable Modi government coming, and thus market rising,” he said.

It is to be noted that over the past few sessions, the share markets have made huge corrections over the past few sessions due to various factors.

On the rumors that the share market crashes indicated a poor performance by the BJP, Minister Shah pointed out that the markets have made bigger corrections several times prior to this.

Notably, the markets tanked on Monday following a heavy selloff by Foreign Institutional Investors (FIIs) in May. Analysts have linked the uncertainty to the poll outcome.

The crack has resulted in investors losing Rs 4.85 lakh crore since the last trading session on May 10. Early trade showed only 910 of the 3,431 stocks trading in green while over 150 stocks hit their lower circuit.

As per HM Shah’s self-sworn affidavit filed with the Election Commission of India (ECI), the minister has a stock portfolio valued at around Rs 17.46 crore while his wife also holds stocks worth around Rs 20 crore.

The market reversed from the day’s low on Monday and ended up with a marginal gain. However, the investors remain concerned over the progressing general election and high valuation.

An absence of major positive triggers and the flight of FIIs from the domestic market will keep the short-term trend weak.

Advertisement