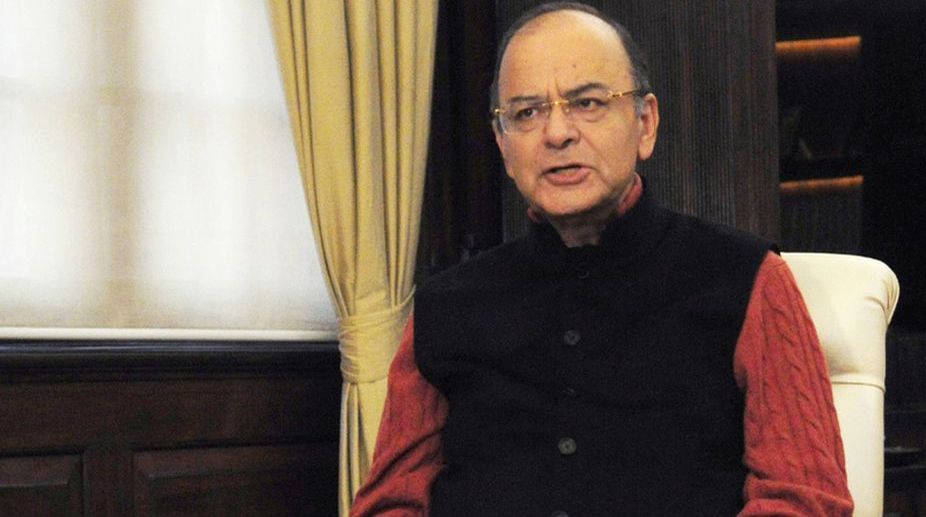

Finance Minister Arun Jaitley Wednesday exuded confidence that Aadhaar law will pass the test of constitutionality, saying the legislation has adequate safeguards for data protection.

Jaitley’s comments at a conclave on financial inclusion organised by United Nations here come amid a legal challenge mounted in the Supreme Court against making the biometric identification number, Aadhaar, mandatory for government schemes, including its linking to income tax PAN. The next date of hearing is in November.

Advertisement

The Finance Minister said Aadhaar was an evolving idea under the previous UPA regime and it did not have legislative backing.

BJP-led NDA gave it a legislative cover with iron wall to ensure data protection and privacy, he said.

“…a legislation was necessary and because of evolving debate the confidentiality of the data and (the need) to build some iron wall around the data itself. The (Aadhaar) legislation has been passed and I am sure it will stand the test of constitutionality,” he said.

Earlier last month, a nine-judge Constitution bench of the apex court had declared the Right to Privacy as a fundamental right saying it is protected as an intrinsic part of the right to life and personal liberty under Article 21 and as a part of the freedom guaranteed by Part III of the Constitution.

Jaitley further said that the Supreme Court in its recent judgement has talked about reasonable restrictions while upholding the idea of privacy as an important constitutional guarantee under the Article 21 of the Constitution.

Citing some of the conditions on privacy, he said: “They have to be by the law, they have to be obviously reasonable and some of illustrative restraints not exhaustive are in the larger interest of national security or for the purposes of detection of crime or for the purpose of dissemination of social benefits.

“I think the third criteria is very consciously inserted because that is the principle purpose for which this was intended to be used and that is where this interplay of over a billion Aadhaar number over a billion bank accounts and mobile phones itself has an important role,” he said.

Pointing out that untargetted subsidies result in wastage of resources, he said once you are able to create identity network then you make sure the social benefits must reach those segments of population for whom it is specifically targeted as resources of states are limited.

Speaking about financial inclusion, Jaitley said as many as 30 crore families have got bank accounts since the launch of India’s biggest ever bank account opening drive, Jan Dhan Yojana three years ago.

About 42 per cent of households were unbanked before the scheme was launched, which aims to give every household access to banking facilities by offering them zero-balance accounts across all commercial banks.

Over the period of three years, he said, the number of zero-balance accounts has reduced from 77 per cent to 20 per cent and even these would become operational once the direct benefit transfer is expanded.

In December 2014, four months after the scheme was launched, 76.81 per cent accounts had zero balance. Now, 99.99 per cent of households have at least one bank account, thanks to the Jan Dhan Yojana.

PMJDY, launched on August 27, 2014 by Prime Minister Narendra Modi, was aimed at providing financial services to the poor. These included opening bank accounts for the poor, giving them electronic means of payment (via RuPay cards), and placing them in a position to avail themselves of credit and insurance.

In addition to financial inclusion, Jaitley said, the government has taken steps to provide security to the poor via life insurance under the Pradhan Mantra Jeevan Jyoti Bima Yojana (PMJJBY) and accident insurance Pradhan Mantra Suraksha Bima Yojana (PMSBY).

Total enrolment was 3.6 crore under the PMJJBY and 10.96 crore under PMSBY with 40 per cent of the policy holders being women in both the schemes.

On Mudra Yojana, he said, 8.77 crore people have been benefited and most of the beneficiaries are women.

Speaking on the results of demonetisation, the Finance Minister said that it has helped in reducing the volume of cash transactions and increase in digitisation, widening the tax base and more formalisation of the economy among others.

Post demonetisation, there is emphasis to reduce overall quantum of cash in the economy, he said.

The government has succeeded in the last three years in bringing financial inclusion at the centre of its political and economic agenda, he said, adding that in times to come, policymakers will have to follow this direction and they will not be able to reverse this trend.