By Thanksgiving of 1994, Steve Jobs was stuck. Jobs hadn’t had a hit product in years. He’d blown through $50 million investing in Pixar, a maker of high-end graphics computers struggling to reinvent itself as an animation studio. His relationship with the talent there was frayed. Then, with a couple of shrewd financial moves over the next two years, he helped create one of the most remarkable success stories in Hollywood.

Pixar would go on to make a string of hit films, from Finding Nemo to Cars, spawn a renaissance in animated moviemaking, and turn Jobs, the co-founder of Apple, into the largest shareholder of the Walt Disney Co, after Disney bought the studio for 7.4 billion dollars in 2006.

Advertisement

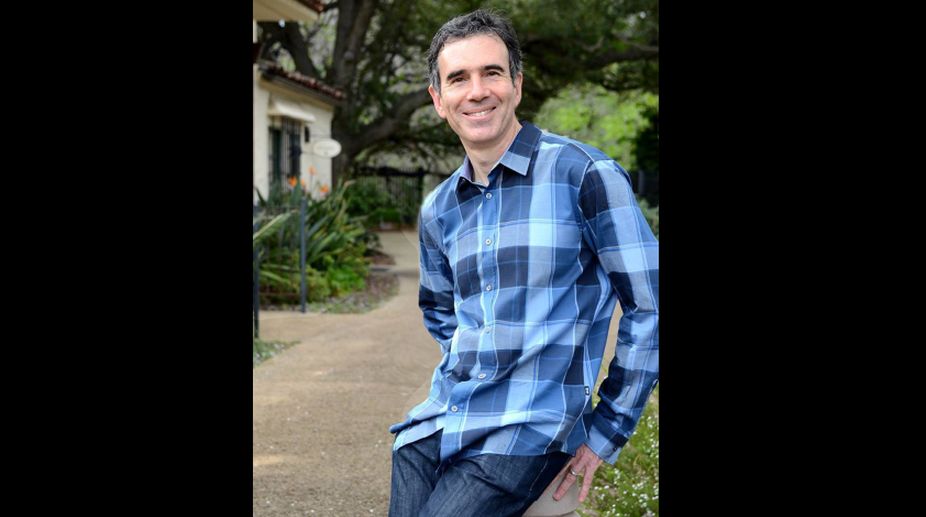

It’s a backstory told for the first time from the perspective of Lawrence Levy, Pixar’s former chief financial officer, in a new book, To Pixar and Beyond. Levy doesn’t take credit for Pixar’s big-screen successes. That goes to executives and filmmakers like John Lasseter, Pixar’s chief creative officer, and Ed Catmull, its president. He argues, though, that companies, like people, need a balance of craft and commerce to succeed.

“Pixar was the classic starving artist, full of talent and creativity but frustrated by a lack of money,” Levy said in an interview. Levy, then a technology executive in Silicon Valley, was cold-called by Jobs that November, 22 years ago. He signed on as finance chief after seeing a short preview of what was to become Pixar’s first feature, Toy Story.

“For 10 minutes I’d been transported somewhere else,” Levy writes. “A world where toys lived. Had feelings. Had problems. I had no idea who was behind it all, but somewhere in this building there were magicians at work.”

After learning more about the movie business and discussing Pixar’s distribution contract with entertainment industry insiders, Levy realised that Jobs, then 39, had signed a lopsided deal with Disney. The Burbank, California-based entertainment company had agreed to put up all of the money to make Pixar’s movies and stood to collect 90 per cent of the profits, even if the films were huge hits.

With that kind of profit-sharing, Pixar would never amount to much more than a contract worker, an animator-for-hire, subservient to the Disney machine, Levy reasoned.

“I don’t think Pixar could have retained or hired the kind of talent it did without building a company financially stable enough to reward them,” he said.

So Jobs and Levy hatched a two-part plan. The first part involved an initial public stock offering. Pixar raised about 150 million dollars in November 1995, shortly after the first Toy Story enjoyed its then-stellar 29 million dollars opening weekend. The success of that first film and the cash in the bank allowed Pixar to take its next step, going to Disney Chief Executive Officer Michael Eisner and asking for a renegotiation of the contract.

Eisner didn’t have to budge, but Pixar’s offer to finance half of the future cost of the films was likely a big incentive in the boom-or-bust business. After months of haggling, Eisner cut a deal, giving Disney the right to additional films and Pixar a 50 per cent share of the profits.

By the time of the Disney purchase, Pixar had won nine Academy Awards, and its first six feature films had grossed more than 3.2 billion dollars at the box office, thanks to such hits as The Incredibles and Monsters, Inc. Jobs, who had pancreatic cancer, died five years later at 56.

For those who can’t get enough of Jobs, Levy offers more insight into his world. A one-time neighbour of Jobs’ in Palo Alto, California, Levy describes a surprisingly laid-back scene where he could simply stroll through the entrepreneur’s back door and go on long weekend walks with him, chatting about the business.

The more controlling side of the future billionaire also comes across, as Levy describes a carefully choreographed Fortune profile in 1995 that rankled Pixar staffers because it focused mostly on Jobs.

Readers looking for more of Pixar’s recent history won’t find it here; Levy’s tale ends, more or less, with the sale in 2006. The company’s creative process, including its “brain trust” of senior executives and directors who review films in progress to keep them on track, has been taken up elsewhere in more detail.

Levy is out of the entertainment business now. He runs the Juniper Foundation, a nonprofit in San Francisco devoted to meditation and Eastern spiritualism. The lesson from Pixar and the key to its success still, he said, is finding that Buddhist “middle way”-part bureaucrat, part free spirit.

“Pixar is thriving,” Levy said. “But it never gets to rest on its laurels. Balancing those things requires constant vigilance.”

Dawn/ANN