Karanvir Bohra undergoes massive transformation for his next project ‘Khadaan’

Prominent television actor Karanvir Bohra has been roped in to play Mahipal, a menacing local thug in the forthcoming web series "Khandaan".

It has indeed proven to be a disruptive year for the entire film industry ecosystem and the end consumer. With major films releasing in 2019, one looks forward to more positive and interesting disruptions to follow next year too.

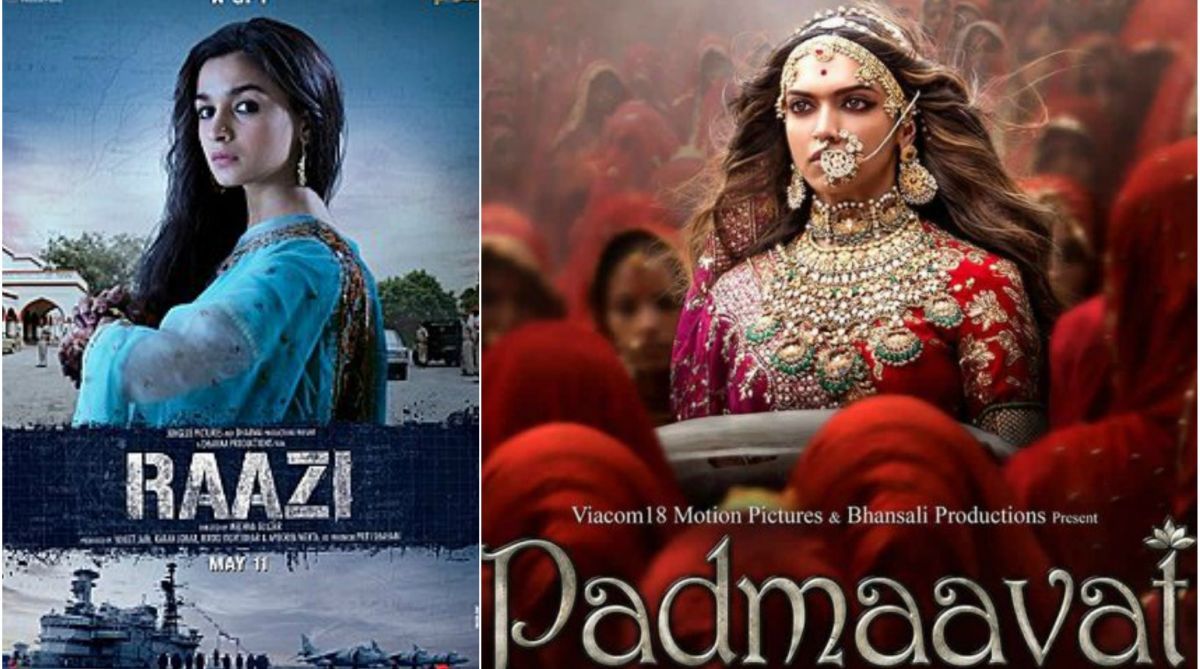

Raazi, Padmaavat posters.

Indeed, 2018 seemed to be a good year for Bollywood compared to the past two years. Not only did some actors bag their first 100 crore film, but many small budget, low star cast and high in content films outperformed the biggies at the box-office. Many films worked unexpectedly and also witnessed many young and debutant filmmakers making their mark.

Ranbir Kapoor’s Sanju ruled the roost with Rs. 300 crore + followed by Padmaavat, Race 3, Badhaai Ho, Stree, Raazi, Sonu Ke Titu Ki Sweety, Raid, Gold, Satyamev Jayate, Padman, Veere Di Wedding, Sui Dhaaga, Dhadak, Parmanu, Andhadun, 2.0 and others following the order. Many content-driven films registered 100 crores at the box office.

Advertisement

Stree turned out to be one of the biggest surprise hit grossing over Rs 100 crores in just 2 weeks. Whereas Sonu Ke Titu Ki Sweety was a smash hit and Ayushmann Khurrana’s Badhaai Ho earned more than Baahubali 2in its sixth weekend. Four South Indian films: Sarkar, Rangasthalam, Bharat Ane Nenu and2.0each grossed more than 150 crores globally.

Advertisement

Apart from China, newer non- traditional, non-Indian diaspora-driven global markets like Russia, Turkey, Taiwan, South Korea, Germany, Poland, Portugal, Latin America and France are opening up to Indian Cinema. Over and above theatrical release, their television and digital platforms also are being explored to make our films get access to their audience.

In this year Indian film content has been customized for their mainstream audiences’ languages & sensibilities. Hichki has so far been released in Russia, Kazakhstan, Taiwan, Hong Kong and China, while Bajirangi Bhaijan was released in China & Turkey this year.

Another interesting trend seen this year was the acute traction OTT platforms garnered. Netflix India became profitable in its first year of operations clocking a net profit of Rs 20.2 lakhs. Engaging series with mainstream actors like Saif Ali Khan, Manisha Koirala, Bhumi Pednekar, Vicky Kaushal, Kiara Advani, Nawazuddin Siddiqui and Pankaj Tripathi were hugely appreciated in original shows like Sacred Games, Lust Stories, Mirzapur etc in Netflix, Amazon Prime and other OTT platforms.

OTT has become the new rival of television as Indian subscribers are increasingly watching content on the move. Films after their theatrical release instead of being streamed in TV channels were directly being streamed in OTT apps. Manmarziyaan and Happy Phirr Bhag Jayegipremiered on Eros Now before their TV debut. Amazon Prime showed Tumbbad within weeks of its theatrical release. ZEE5 had premiered Padman, Veere Di Wedding, Mulk, Parmanu, Batti Gul Meter Chalu.

Other OTT players are also following this route aggressively. The idea behind this strategy is to connect with global audience through digital premières, one of the biggest plus point is that the shelf life of these films on an OTT platform is much more compared to a satellite channel.

There has been a sea change in consumer consumption of content. They want to watch movies at their own convenience and schedule rather than wait for a TV premiere. The mobile phone penetration and the cost-effective data prices has been other contributing factors for the upsurge of this platforms. On the last count there are roughly around 30 OTTs active in India currently.

This year also witnessed a revolution in the acoustics department. For the first time in India, The 4D SLR sound system technology was introduced with the release of the film 2.0. In this technology over and above the speakers placed on both the sides and above the watcher, there would be speakers below the seats to provide the audience with sound from the closest source, hence elevating their film watching experience.

With the recent slash in GST on film tickets from 18 per cent to 12 per cent and from 28 percent to 18 per cent in the exhibition infrastructure and creative development, both will get a strong impetus and attract substantial investments.

Apart from Bollywood, Hollywood also had a great year in 2018. Avengers Infinity War garnered over $43,594,456 followed with Black Panther collecting $10,458,639 & Incredibles 2 over $7,641,308 in India. These films released in English and various other Indian languages. In fact, Incredibles 2collected Rs 22.3 crores within just 5 days of its release here and becoming the highest grossing animation English film ever released in India.

Interestingly The Stolen Princess became the first English animation film from Ukraine to ever release in India, It was released by us in English, Hindi and Tamil and was highly appreciated by the audience. Such that they were challenging the domination of Bollywood’s top producers for control over box office collections.

This dominance, though, has come through not just on the back of content and the constant explosion of CG images, but the sheer increase of the Indian viewers’ appetite for Hollywood films.

In 2018 these films have also become ambitious in terms of number of screens the films released and consistently getting bigger releases for standalone films as well as dubbed versions.

According to a KPMG report over the last 2 to 3 years, nearly 40 per cent of Hollywood releases have been dubbed in at least one regional language. Hollywood production houses have realised that genres like superhero, science fiction, fantasy, hi decibel action and animation are something Bollywood doesn’t offer and there is a huge audience for it.

For a diverse Indian market comprising several regional centres they dubbed English films not just in Hindi but also in other Indian languages like Tamil & Telugu and in some cases with regional subtitles strategically and timely released it in a wider geographical catchment centres.

These studios also increased their marketing budget this year to reach the least common denominator to intimate them that the film is releasing in their preferred language and screens, they did ATL & BTL activities in terms of film trailers in the theatres, ‘Out of Home’ campaign, newspaper advertisements, P R campaigns, brand associations, social & digital media campaigns. The entire marketing mix was strategically implemented to reach the maximum number of audience before the release of the film.

One of the other strong factors that helped is the rising trend of popular Bollywood and film stars lending their voices to important Hollywood film characters. For Incredibles 2, Bollywood actress Kajol lent her voice for Helen (Elastigirl) and also promoted the film personally. Ranveer Singh was the main protagonist’s voice in Deadpool 2’s Hindi version. Rana Dagubatti led his voice for Thanos in both the Tamil and Telugu Versions of Avengers- Infinity War.

This enthusiasm resulted in box-office successes. Incredibles 2 released in India in more than 925 screens in English, Hindi, Tamil and Telugu languages, and of that total collection, 34 per cent came from the film’s dubbed versions.

Avengers – Infinity War was released in 2,000 theatres in 2D, 3D and IMAX 3D formats in India, with half the screens allotted for the dubbed Hindi, Tamil and Telugu versions. Local audiences are keen on watching these films in a language that provide them experiences that their local films cannot deliver.

Indian market is diverse, comprising several powerful regional centres. Dubbing these films and localizing its content into regional languages helps it to penetrate into newer markets and attract bigger audience. Hollywood films which were once considered as in English strictly for the educated, multiplex and family audiences now release in single screens catering to the B and C centres. These films are equally patronized by both the family and the individual audience in a cost-effective and economical way.

This year, 2018, indeed has proven to be a disruptive year for the entire film industry ecosystem and the end consumer. With major films releasing in 2019, one looks forward to more positive and interesting disruptions to follow next year too.

The writer is CEO, Ultra Media & Entertainment Group.

Advertisement