In order to deliver effective core banking services at village level, the Punjab government will install micro ATMs in its all 3,535 primary agricultural co-operative societies (PACS) and district central co-operative banks (DCCBs) under its rural financial inclusion plan.

While disclosing this on Monday, Additional Chief Secretary-cum-Financial Commissioner, Co-operation DP Reddy said co-operatives have played a vital role in improving the economic conditions of farmers and accelerating the pace of development in Punjab.

Advertisement

“In fulfilment of its goals, the department have brought both the services and resources at the doorsteps of villagers thereby covering every nook and corner of the state,” he added.

He further informed the National Bank for Agriculture and Rural Development (NABARD) had sanctioned 4,545 micro ATMs by financing 90 per cent of the cost of the device.

He added that the Punjab State Co-operative Bank (PSCB) along with its 20 DCCBs had become the first state co-operative bank in the country to start ATM, Point of Sale (PoS) or e-commerce services and was awarded for this by the NABARD.

Reddy said the state co-operative bank have already planned to extend digital banking solutions to unbanked areas of the state. This unique initiative would increase, footfalls at co-operative institutions and provide an additional revenue stream to banks and societies, he said.

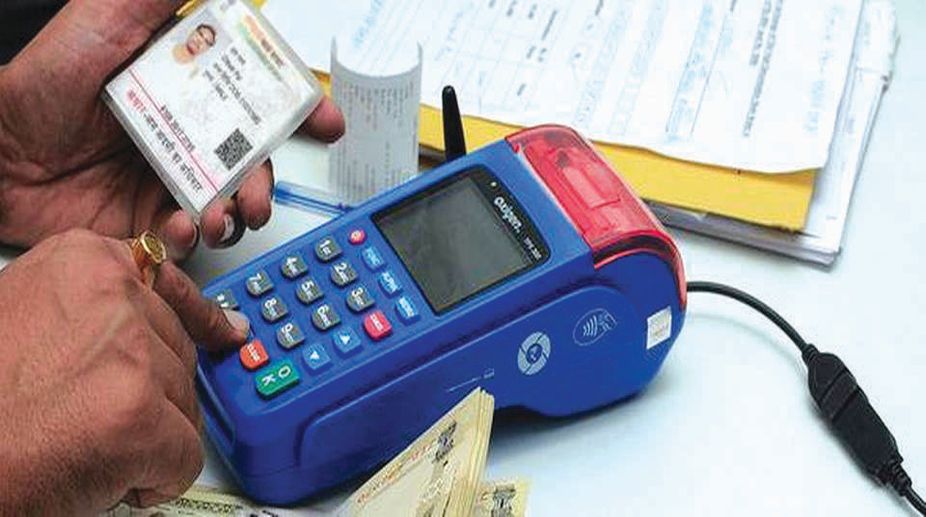

Outlining the benefits of micro ATMs, Reddy said all transaction facilities like balance enquiry checking, cash deposit or withdrawal, fund transfer and remittance could be made through these handheld devices.

The farmers, who were using other banks ATMs for Kisan Credit Card (KCC) purpose, could use these micro-ATMs at PACSs thereby save inter-bank transactional costs to be paid to other banks. In addition to this, customers could use any other bank’s debit card at these locations and no longer have to search for ATMs or travel longer distances, he added.

Reddy further said after implementation of these core banking facilities, farmers would be able to get the kind component fertilizers and seeds from nearest PACS by swiping of the KCC card at micro ATMs. These ATMs allows the PACSs and branches to connect to the bank’s core banking solution to authenticate the customer via biometric or PIN at real-time basis.

In branches, this device could be used to authenticate the AADHAR number, e-KYC account opening, AADHAAR based transactions through biometric authentication from Unique Identification Authority of India (UIDAI) database, he added.

Reddy also informed that the PSCB had signed an agreement with National Informatics Centre (NIC) to implement co-operative core banking solution application in all its branches to provide basic banking facilities to the customers.