The National Scheduled Caste Alliance (NSCA) on Thursday alleged that the private sector banks are ignoring the scheduled caste (SC) entrepreneurs.

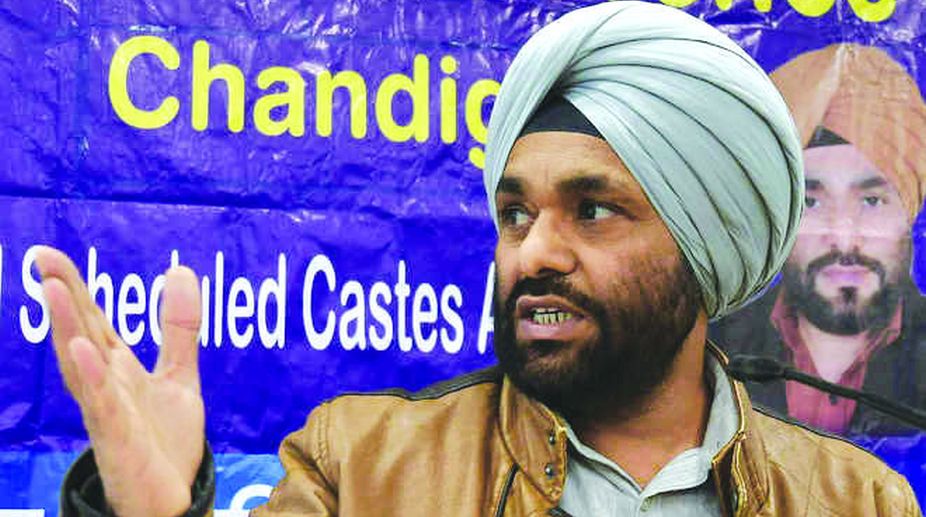

NSCA national president Paramjit Singh Kainth claimed that the private banks and other regional credit banks have mostly ignored the applications of the individuals of SC community seeking loans to start their livelihood under the Stand-Up India scheme, which was launched by Prime Minister (PM) Narendra Modi on 5 April 2016.

Advertisement

He said the main aim of the scheme was to support entrepreneurship among women, SC and Scheduled Tribe (ST) communities.

Kainth further said that Punjab is the state with the largest population of SCs but the attitude of private sector banks and other financial institutions is discouraging and the rate at which this scheme is progressing shows no sign of improvement in the condition of budding SC entrepreneurs.

There are a total of 6,308 bank branches in Punjab and out of them only 886 branches have included Stand up India as their product. In the year 2017, 313 SCs have been approved of Rs 44.19 crore worth of loans and 954 women were approved Rs 193.48 crore of loans. It is surprising to know that seven private banks have completely rejected supporting the initiative of Stand Up India.

Kainth further said that the banks like HDFC, Kotak Mahindra, Axis Bank, Yes Bank, Federal Bank, Capital Small Finance Bank and Satluj Rural Bank are not supporting schemes like Stand up India.

Kainth also said that Chief Minister Amarinder Singh led Congress government should encourage such schemes which foster the sense of self-reliance amongst the scheduled castes community and women.

“The government should take stern action against the banks which are not participating in the scheme and further sanctions should be imposed on those who are not approving or accepting loans applications from both the scheduled castes community and women”, he said.