BJP govt’s agenda is to transform Delhi into a ‘developed’ national capital: Sachdeva

The BJP leader asserted that the government's focus is on the completion of the long pending works in the city.

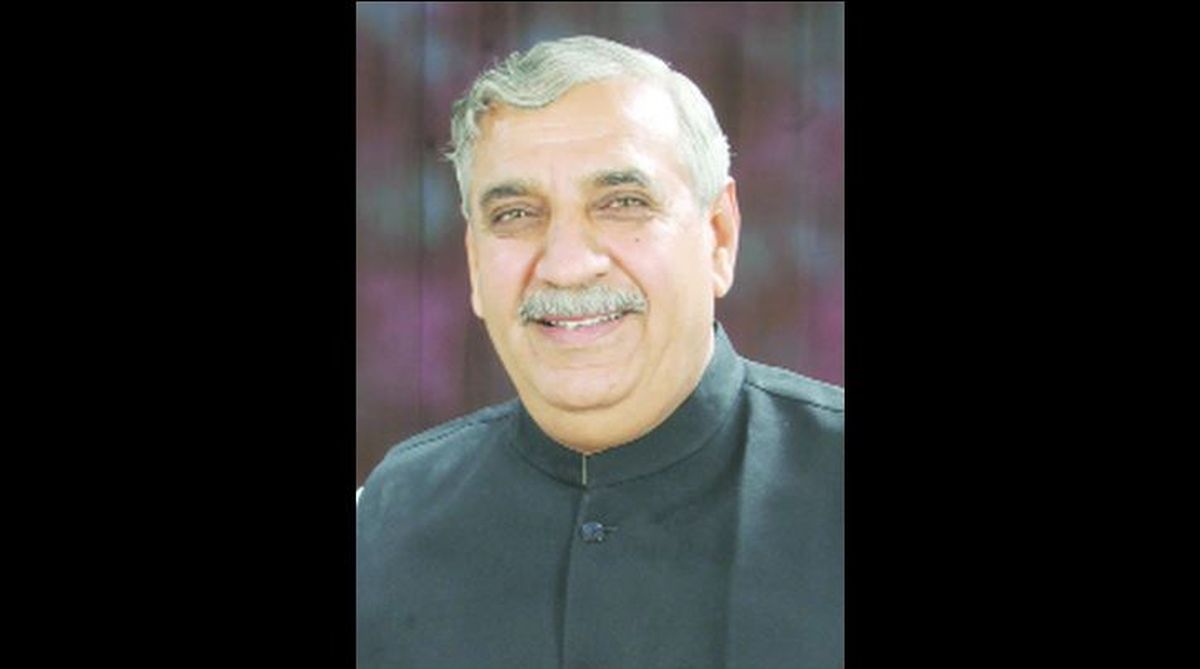

Ashok Arora, State President of Indian National Lok Dal (INLD)

Expressing concern over the ever rising fuel prices, Indian National Lok Dal (INLD) on Thursday urged the Bharatiya Janata Party (BJP) governments at the Centre and the state to reduce taxes on petroleum products.

In a statement, INLD state president Ashok Arora, said while the state government should reduce value added tax (VAT) on petroleum products, the Centre should reduce the central excise duty in order to give relief to the common man.

Advertisement

He reminded the BJP that on 26 May, 2014, the crude oil rate in the international market stood at US$ 106.85 per barrel. As a consequence, the petrol rate was Rs 71.41 per liter and the diesel rate was Rs 55.49 per liter.

Advertisement

But now on 25 August, 2018 while the crude oil rate came down to US$ 73.21 per barrel the petrol rate ironically rose to Rs 77.02 and diesel to Rs 68.89 per liter. Arora said that the BJP was the architect of the paradox by increasing the central excise duty, which was soon followed by the states who unreasonably increased the state VAT on petrol and diesel.

He said as a consequence, whereas in 2014, central excise duty on petrol was Rs 9.48 per liter and state VAT Rs. 14.28 per liter and on diesel it was Rs 3.56 per liter excise duty and Rs 6.69 as VAT.

However, now a consumer pays Rs 19.48 per liter towards central excise and Rs 16.41 towards VAT for petrol and Rs 15.33 per liter for central excise duty and Rs 10.05 towards VAT for diesel. Thus approximately 50 per cent of the cost of fuel goes towards taxes levied by the Union government and the state, the INLD leader said.

He said that there was no justification for these high taxes, particularly on diesel as it has a cascading effect on almost every commodity and activity.

Arora urged the BJP government to curb its urge of mopping up funds from the pocket of the people and spare them from carrying the backbreaking burden of high prices.

Advertisement