Highlights of Performance

Financial Performance:

Advertisement

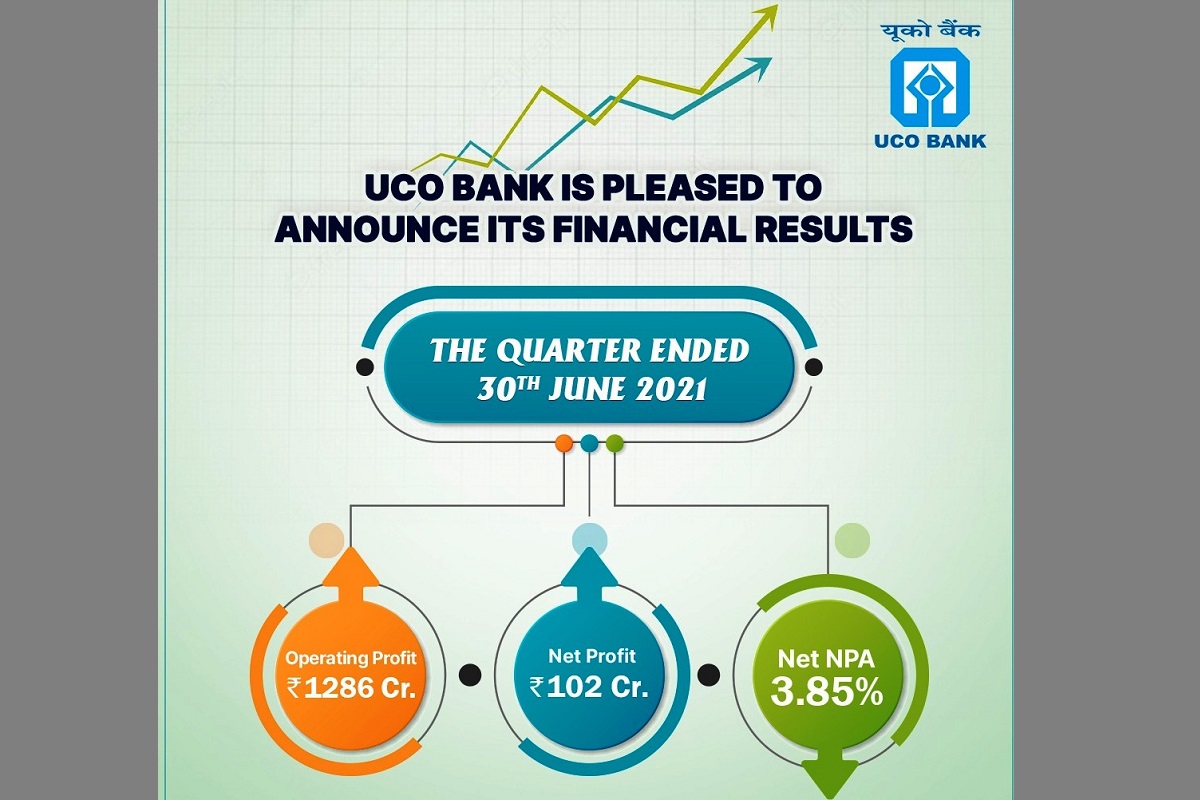

♦ Bank has made Net Profit of 101.81 Crore during the quarter ended June 2021 as against Net Profit of 21.46 Crore in the quarter ended June 2020 registering a growth of 374.42%.

♦ Operating Profit of the Bank for the quarter June 2021 stood at 1286.28 Crore as against 977.08 Crore for the quarter ended June 2020 registering a growth of 31.65%.

♦ Net Interest Income of the Bank for the quarter ended June 2021 has increased to 1460.24 Crore from 1266.78 Crore for the quarter ended June 2020 registering a growth of 15.27%. This is the highest Net Interest Income in the last 23 quarters.

♦ Other Income of the Bank for the quarter ended June 2021 has increased to 969.51 Crore as against 773.93 Crore for the quarter ended June 2020 registering a growth of 25.27%.

♦ Total Business of the Bank has increased to 332946.17 Crore as of 30.06.2021 from 310355.63 Crore as of 30.06.2020 registering a growth of 7.28%.

♦ Total Deposits of the Bank has increased to 212096.82 Crore as of 30.06.2021 from 195119.60 Crore as of 30.06.2020 registering a growth of 8.70%.

♦ CASA of the Bank (Domestic) stood at 38.55% as of 30.06.2021.

♦ Savings Deposits of the Bank has increased to 71377.97 Crore as of 30.06.2021 from 66086.68 Crore as of 30.06.2020 registering a growth of 8.01%.

♦ Total Advances of the Bank stands at 120849.35 Crore as of 30.06.2021 as against 115236.03 Crore as of 30.06.2020 registering a growth of 4.87%.

♦ Gross NPA of the Bank has reduced to 11321.76 Crore (9.37%) as of 30.06.2021 from 16576.43 Crore (14.38%) as on 30.06.2020 and from 11351.97 Crore (9.59%) as on 31.03.2021.

♦ Net NPA of the Bank has reduced to 4387.25 Crore (3.85%) as of 30.06.2021 from 5138.18 Crore (4.95%) as of 30.06.2020 and from 4389.50 Crore (3.94%) as of 31.03.2021.

♦ Provision Coverage Ratio of the Bank has increased to 88.53% as of 30.06.2021 from 86.50% as of 30.06.2020 and from 88.40% as of 31.03.2021.

♦ Capital Adequacy Ratio of the Bank stood at 14.24% and CET-I Ratio at 11.32% as of 30.06.2021.