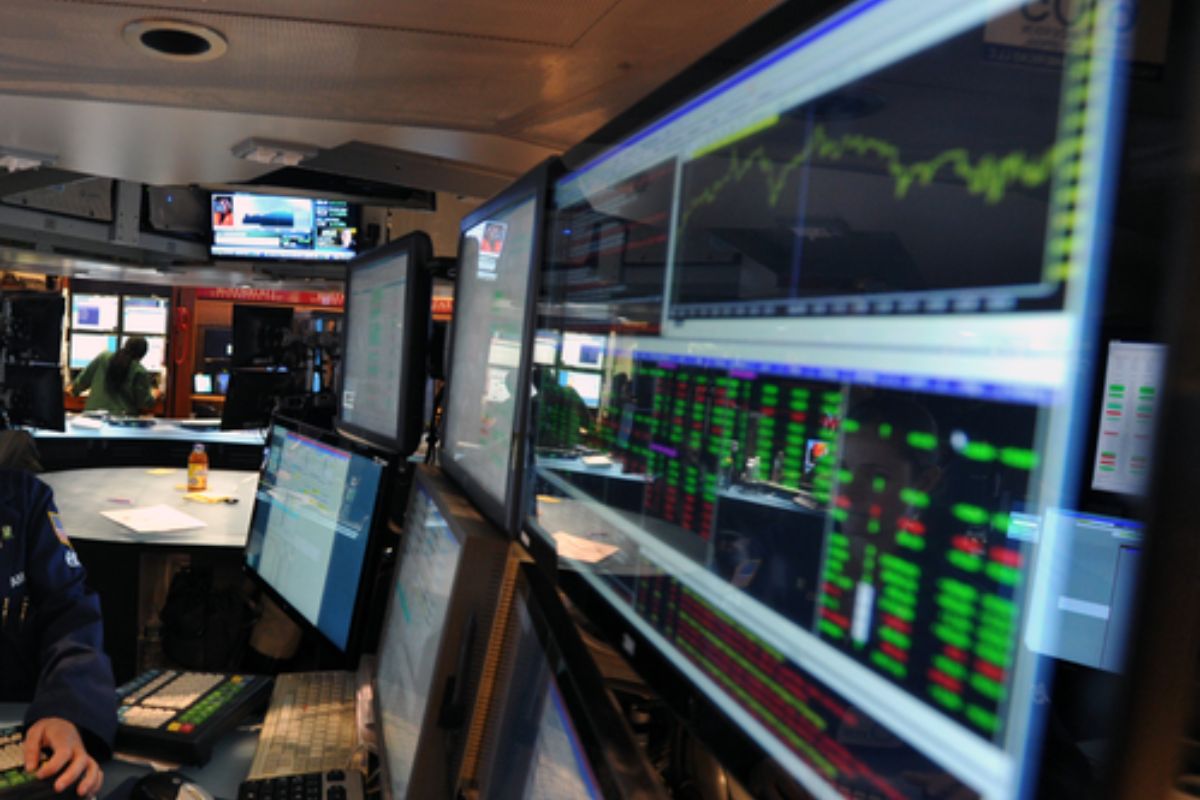

US stocks tumble on inflation data

US stocks tumbled on Tuesday after fresh data revealed that inflation eased somewhat, but stayed stubborn in January.

A spike in yields can put pressure on stocks, since it increases the amount companies spend to cover the interest on their debt, in turn hurting their profit.

The allure of owning US stocks over less risky investments is at its lowest level in decades, according to one measure, despite the equity market’s race upward this year, the media reported.

The benchmark S&P 500 index has gained 16 per cent this year, pushed higher by Wall Street’s obsession with artificial intelligence that has propelled mega-cap technology stocks to dizzying heights, CNN reported.

Advertisement

At the same time, hot economic data has helped push Treasury yields higher in recent months. Bonds have become coveted additions to investors’ portfolios thanks to the Federal Reserve’s historic pace of interest rate hikes it began last March to tame runaway inflation.

Advertisement

A spike in yields can put pressure on stocks, since it increases the amount companies spend to cover the interest on their debt, in turn hurting their profit.

The recent surge in bond yields has also pushed down the anticipated advantage of owning equities over less risky investments – known as the equity risk premium – to a two-decade low, CNN reported.

Treasury bonds are generally seen as safer investments than stocks, since they’re issued by the US government, which has never defaulted on its debt. Treasuries also provide a steady source of income for investors.

Investors are rarely getting adequate compensation in the equity market,” said Seema Shah, chief global strategist at Principal Asset Management, CNN reported.

Stocks cooled off somewhat in August, a historically tough month for markets since there’s a lack of economic data to spur a rally and people tend to go on vacations before summer’s end, leading to lower trading volumes and more volatility.

Yields have remained elevated, though off their highs from last month, as investors debated whether the Federal Reserve could keep interest rates higher for longer as surging oil prices and robust economic data signal that the central bank has more room to tighten monetary policy.

Shah says she recommends that investors weigh increasing their positions in high-quality bonds, considering that the economic outlook remains foggy despite Wall Street rolling back its bets on a downturn in recent months, CNN reported.

Advertisement