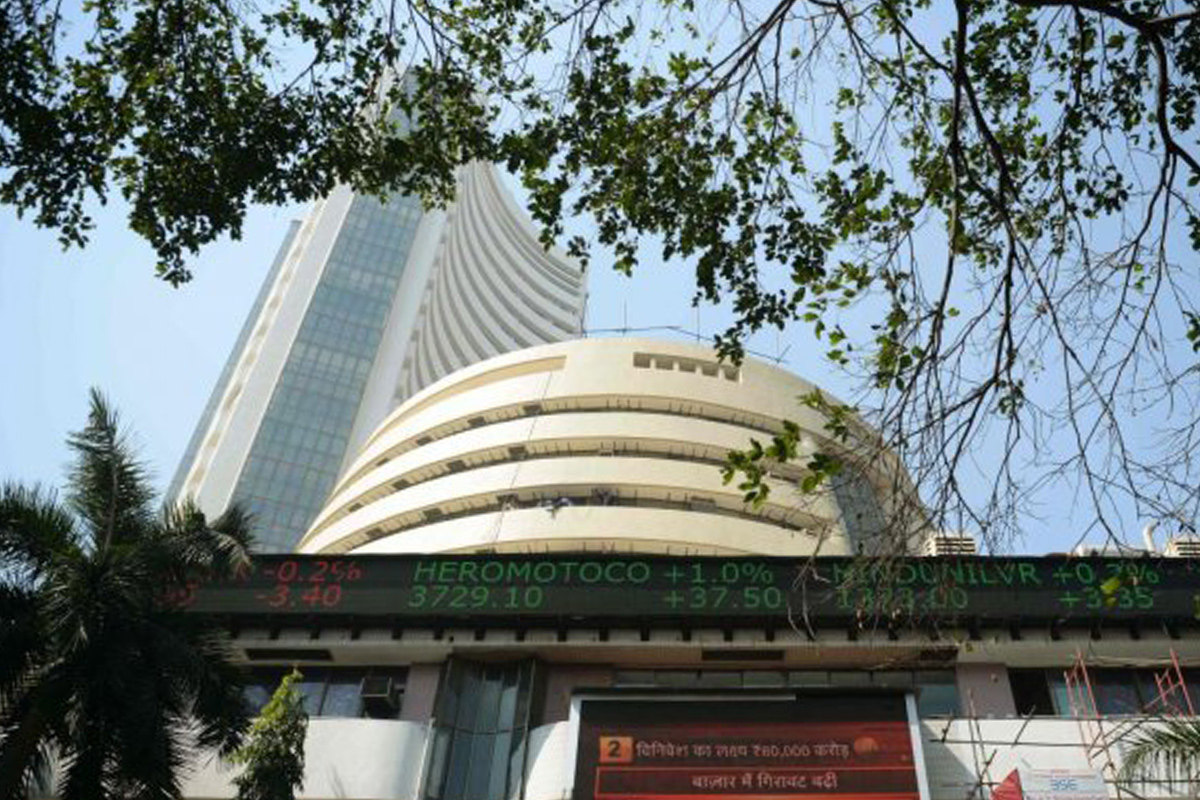

Market ends flat in rangebound session amid tariffs concern

At close, the Sensex was down 7.51 points or 0.01% at 74,332.58, and the Nifty was up 7.80 points or 0.03% at 22,552.50. For the week, BSE Sensex added 1.5% and Nifty jumped 2%.

In the broader market, the S&P BSE MidCap and SmallCap ended with loss at 0.76 per cent and 0.93 per cent respectively.

Consolidated revenue rose 22 per cent to Rs 25,785 crore in the September quarter, while net loss narrowed to Rs 763 crore. (Photo: AFP)

The domestic equity markets plunged nearly 1.5 per cent on Wednesday, tracking heavy losses in index majors Reliance Industries, HDFC Bank and ICICI Bank amid a massive selloff in European markets.

The 30-share BSE index ended 599.64 points or 1.48 per cent lower at 39,922.46 while the broader NSE tanked 159.80 points or 1.34 per cent to close at 11,729.60.

Advertisement

IndusInd Bank was the top loser in the Sensex pack, shedding over 3 per cent, followed by HDFC, ICICI Bank, Tech Mahindra, Bajaj Finance, UltraTech Cement and Tata Steel.

Advertisement

On the other hand, Bharti Airtel was the top gainer, rallying more than 4 per cent, after the country’s second largest telecom operator reported its highest-ever quarterly consolidated revenue, helping it narrow losses in the July-September period.

Consolidated revenue rose 22 per cent to Rs 25,785 crore in the September quarter, while net loss narrowed to Rs 763 crore.

M&M, Maruti and L&T also ended with gains.

In the broader market, the S&P BSE MidCap and SmallCap ended with loss at 0.76 per cent and 0.93 per cent respectively.

According to analysts, Indian equities faced intense selloff after European markets opened with heavy losses amid spiking COVID-19 cases.

Extremely volatility was also witnessed ahead of monthly derivatives expiry and US presidential election, they said.

Benchmarks in Europe plunged up to 3 per cent in early deals.

Bourses in Hong Kong and Tokyo ended on a negative note, while Shanghai and Seoul were in the positive territory.

Meanwhile, international oil benchmark Brent crude was trading 3.20 per cent lower at USD 40.28 per barrel.

Advertisement