Market Reality

India's equity markets, long buoyed by strong economic growth and rising corporate earnings, are now facing a sharp and prolonged correction.

The benchmark S&P BSE Sensex closed at 1,921 points or 5.32 per cent to settle at 38,014.62, the Nifty50 index ended at 11,274 levels, up 569 points or 5.32 per cent, with 44 out of 50 constituents advancing and 6 endings in the red.

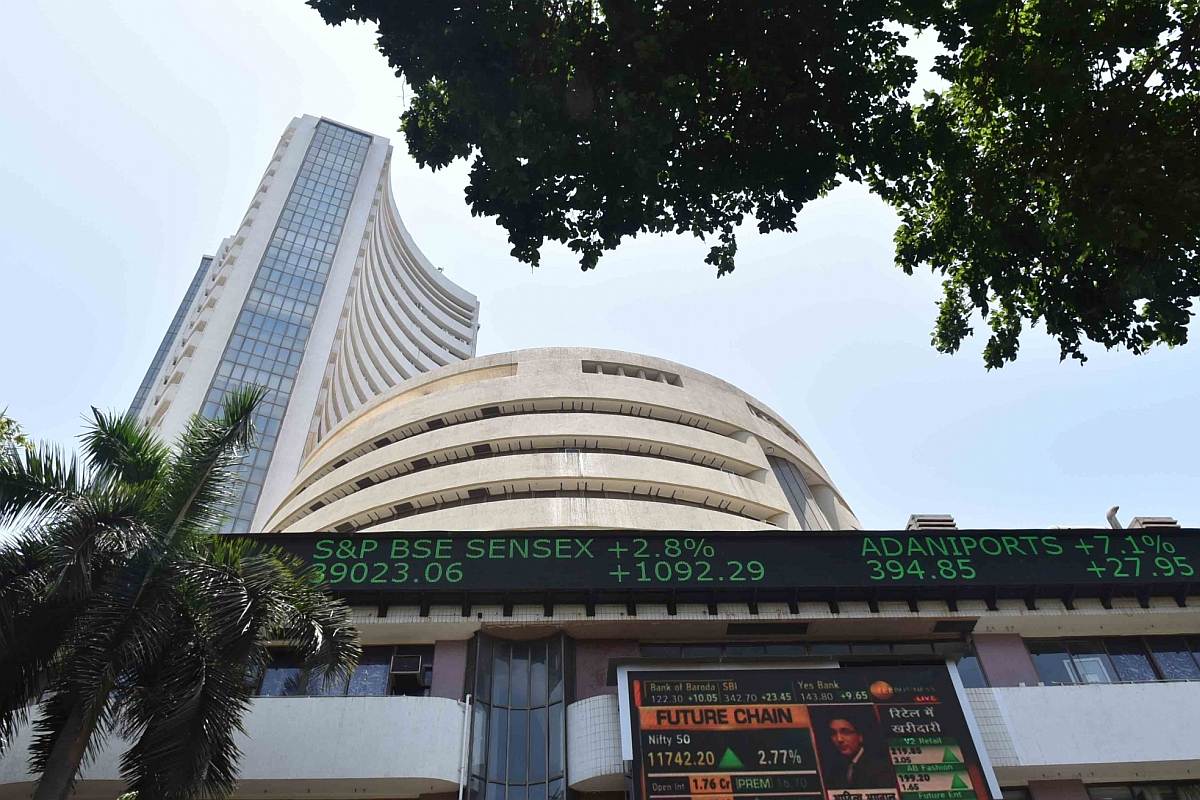

A view of the BSE building in Mumbai. (Photo: IANS)

Equity market skyrocketed on Friday with the Sensex index soaring 2,284.55 points in its biggest intraday gain in more than a decade, after Finance Minister Nirmala Sitharaman announced a cut in the corporate tax rate for companies.

The Sensex zoomed to as high as 38,378.02, hours after the Finance Minister said the effective corporate tax rate for companies will be 25.2 per cent including all additional levies. Experts analyze that this marked the largest single-day jump in the Sensex since May 18, 2009, when it had shot up 2,110.79 points.

Advertisement

The broader Nifty benchmark index climbed to as much as 11,381.90, up 677.1 points from the previous close.

Advertisement

The benchmark S&P BSE Sensex closed at 1,921 points or 5.32 per cent to settle at 38,014.62, with Hero MotoCorp (up 13 per cent) being the top gainer and Power Grid Corporation (down over 2 per cent) the biggest loser.

On NSE, the Nifty50 index ended at 11,274 levels, up 569 points or 5.32 per cent, with 44 out of 50 constituents advancing and 6 endings in the red. Volatility index India VIX dropped over 1 per cent to settle at 15.34 levels.

In the broader market, the S&P BSE MidCap index gained 835 points or over 6 per cent to end at 14,120 and the S&P BSE SmallCap Index settled at 13,204.25, up 501 points or nearly 4 per cent. On the sectoral front, barring IT stocks, all the sectoral indices on the NSE ended in the green. The Nifty IT index settled 0.20 per cent lower at 15,491.05 levels.

Experts say the reduction in corporate tax rate is a big positive for the markets. Governments and central banks around the world have been loosening monetary and fiscal policies to revive economic growth hurt mainly by the ongoing US-China trade war and weak consumer demand.

India’s moves are the latest in a raft of measures from the government to lift the economy after growth hit a six-year low in the April-June period, mainly dragged by a slump in private investment.

“The measures announced by the finance minister this morning can be described as a ‘New Deal’ for the Indian economy,” said VK Vijayakumar, chief investment strategist at Geojit Financial Services. “The psychological stimulus from this … will be higher than the fiscal stimulus.”

Economists believe that the cuts would make India competitive for investment, as it brings corporate tax rates on a par with other Asian economies. Reserve Bank of India Governor Shaktikanta Das said the moves augur “extremely well” for the economy.

(With input from agencies)

Advertisement