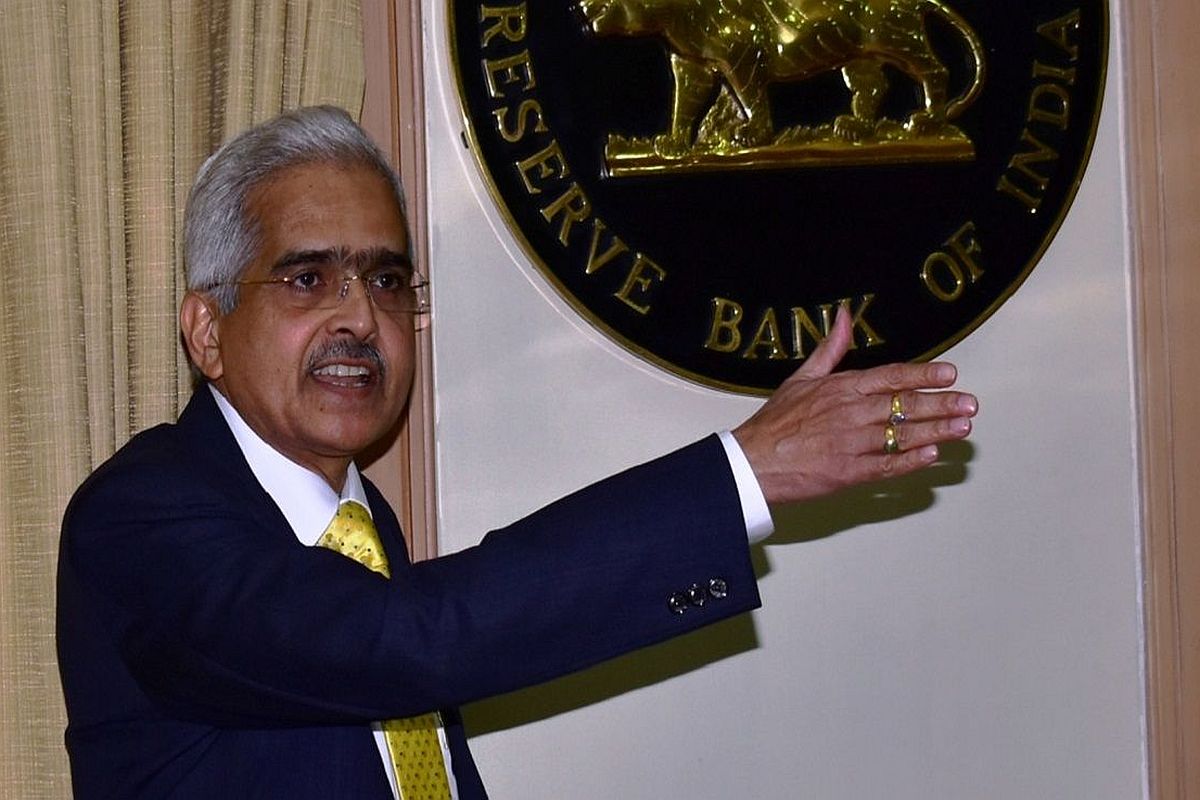

The Reserve Bank of India on Friday slashed the repo rate by 25 basis points from 5.40 per cent to 5.15 per cent. The reverse repo rate has been adjusted at 4.90 per cent and the marginal standing facility (MSF) rate and the bank rate to 5.40 per, accordingly.

This will make home and auto loans even cheaper.

Advertisement

With today’s rate cut, RBI lowered its repo rate for the fifth consecutive time this calendar year. The RBI has in total reduced the repo rate by 135 basis points or 1.35 percentage points.

A lower repo rate, or short-term lending rate for commercial banks, will reduce the interest cost on automobile and home loans, thereby ushering in growth.

The RBI’s monetary policy committee (MPC) in its fourth policy review of the current fiscal also revised the GDP outlook for FY2019-20 to 6.1 per cent from the previous 6.9 per cent.

For FY2020-21, the growth rate has been revised to 7.2 per cent.

The GDP growth for the first quarter of FY2020-21 was earlier projected at 7.4 per cent.

Further, the Reserve Bank’s Monetary Policy Committee continued its accommodative stance.

“The MPC also decided to continue with an accommodative stance as long as it is necessary to revive growth while ensuring that inflation remains within the target,” the policy statement said.

Earlier in August, the central bank had cut the repo rate by 35 basis points to 5.4 per cent to boost growth.